Asked by Dangerously Loved on Apr 28, 2024

Verified

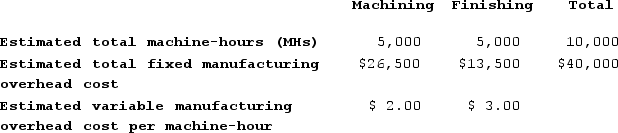

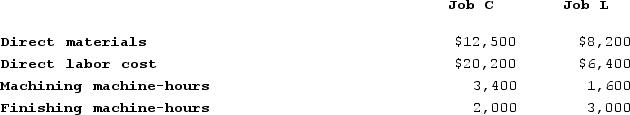

Sanderlin Corporation has two manufacturing departments--Machining and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job C and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job C and Job L. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job L is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job L is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $29,900

B) $11,680

C) $28,780

D) $17,100

Machining Department

A division within a manufacturing facility where machines are used to process materials into finished products.

Finishing Department

The section in a manufacturing process where products receive final modifications and packaging before being released for sale.

- Compute the allocation of overhead costs to specified jobs in accordance with departmental pricing.

Verified Answer

ZK

Zybrea KnightMay 04, 2024

Final Answer :

C

Explanation :

First, we need to calculate the predetermined overhead rate for each department:

Machining department: $1,180,000 / 140,000 machine-hours = $8.43 per machine-hour

Finishing department: $720,000 / 90,000 machine-hours = $8.00 per machine-hour

Using these rates, we can calculate the manufacturing overhead applied to each job:

Job C:

Machining department: 1,800 machine-hours x $8.43 = $15,174

Finishing department: 1,500 machine-hours x $8.00 = $12,000

Total manufacturing overhead applied: $27,174

Job L:

Machining department: 1,500 machine-hours x $8.43 = $12,645

Finishing department: 1,200 machine-hours x $8.00 = $9,600

Total manufacturing overhead applied: $22,245

Therefore, the manufacturing overhead applied to Job L is closest to $28,780 (Option C).

Machining department: $1,180,000 / 140,000 machine-hours = $8.43 per machine-hour

Finishing department: $720,000 / 90,000 machine-hours = $8.00 per machine-hour

Using these rates, we can calculate the manufacturing overhead applied to each job:

Job C:

Machining department: 1,800 machine-hours x $8.43 = $15,174

Finishing department: 1,500 machine-hours x $8.00 = $12,000

Total manufacturing overhead applied: $27,174

Job L:

Machining department: 1,500 machine-hours x $8.43 = $12,645

Finishing department: 1,200 machine-hours x $8.00 = $9,600

Total manufacturing overhead applied: $22,245

Therefore, the manufacturing overhead applied to Job L is closest to $28,780 (Option C).

Learning Objectives

- Compute the allocation of overhead costs to specified jobs in accordance with departmental pricing.