Asked by Mikaela Forcum on Jun 14, 2024

Verified

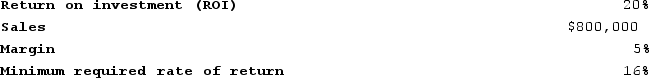

The following data pertains to Timmins Company's operations last year:

Required:

Required:

a. Compute the company's average operating assets.

b. Compute the company's residual income for the year.

Operating Assets

Assets used by an organization in its day-to-day operations to generate revenue, excluding investments and inventory.

Residual Income

The amount of net income an entity has after deducting all necessary expenses and required returns on investments, representing leftover earnings.

Operations

The activities involved in the day-to-day functions of a business related to producing and delivering its products or services.

- Analyze financial data to compute margin, turnover, and ROI for performance evaluation.

Verified Answer

20% = 5% × Turnover

Turnover = 20% ÷ 5% = 4

Turnover = Sales ÷ Average operating assets

4 = $800,000 ÷ Average operating assets

Average operating assets = $800,000 ÷ 4 = $200,000

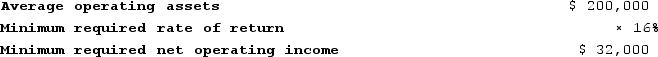

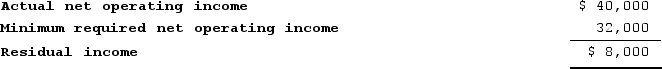

b. Before the residual income can be computed, we must first compute the company's net operating income for the year:

Margin = Net operating income ÷ Sales

5% = Net operating income ÷ $800,000

Net operating income = 5% × $800,000 = $40,000

Learning Objectives

- Analyze financial data to compute margin, turnover, and ROI for performance evaluation.

Related questions

Craycraft Incorporated Reported the Following Results from Last Year's Operations ...

Eady Wares Is a Division of a Major Corporation ...

Fabbri Wares Is a Division of a Major Corporation ...

Gabbe Industries Is a Division of a Major Corporation ...

Haney Fabrication Is a Division of a Major Corporation ...