Asked by Kennedy Bulman on Jun 08, 2024

Verified

You would like to hold a protective put position on the stock of Avalon Corporation to lock in a guaranteed minimum value of $50 at year-end. Avalon currently sells for $50. Over the next year, the stock price will increase by 10% or decrease by 10%. The T-bill rate is 5%. Unfortunately, no put options are traded on Avalon Co.

What portfolio position in stock and T-bills will ensure you a payoff equal to the payoff that would be provided by a protective put with X = $50?

A) ½ share of stock and $25 in bills

B) 1 share of stock and $50 in bills

C) ½ share of stock and $26.19 in bills

D) 1 share of stock and $25 in bills

Protective Put

An investment strategy where an investor buys a put option for an asset they own to limit potential losses if the asset's price falls.

T-bill Rate

The interest rate earned by investors in U.S. Treasury bills, which are short-term government securities.

- Comprehend the principle of protective puts and the methodology for replicating them using stocks and Treasury bills.

Verified Answer

AP

Antonina PennisiJun 13, 2024

Final Answer :

C

Explanation :

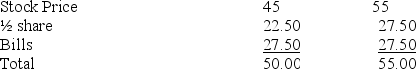

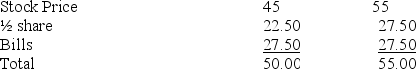

The hedge ratio is −0.5. A portfolio comprising one share and two puts would provide a guaranteed payoff of 55, with present value of 55/1.05 = 52.38. Therefore,

S + 2P = 52.38

50 + 2P = 52.38

P = 1.19

The protective put strategy = 1 share + 1 put = 50 + 1.19 = 51.19

The goal is a portfolio with the same exposure to the stock as the protective put portfolio. Since the hedge ratio is −0.5, you hold 1 − 0.5 = 0.5 shares of stock. The cost is $25 for the ½ share of stock. You place your remaining funds, $26.19, in bills earning 5%.

The stock plus bills strategy duplicates the cost and payoff of the protective put strategy.

The stock plus bills strategy duplicates the cost and payoff of the protective put strategy.

S + 2P = 52.38

50 + 2P = 52.38

P = 1.19

The protective put strategy = 1 share + 1 put = 50 + 1.19 = 51.19

The goal is a portfolio with the same exposure to the stock as the protective put portfolio. Since the hedge ratio is −0.5, you hold 1 − 0.5 = 0.5 shares of stock. The cost is $25 for the ½ share of stock. You place your remaining funds, $26.19, in bills earning 5%.

The stock plus bills strategy duplicates the cost and payoff of the protective put strategy.

The stock plus bills strategy duplicates the cost and payoff of the protective put strategy.

Learning Objectives

- Comprehend the principle of protective puts and the methodology for replicating them using stocks and Treasury bills.