AK

Abhishek Kharga

Answers (2)

AK

Answered

A mediator:

A) is a neutral third party that helps the union and management negotiators reach a voluntary agreement

B) must have the trust and respect of both parties if he or she is to have any success

C) must have sufficient expertise to convince the union and employer he or she will be fair and equitable

D) has no power to impose a solution, he or she can only facilitate

E) is accurately described by all of the above

A) is a neutral third party that helps the union and management negotiators reach a voluntary agreement

B) must have the trust and respect of both parties if he or she is to have any success

C) must have sufficient expertise to convince the union and employer he or she will be fair and equitable

D) has no power to impose a solution, he or she can only facilitate

E) is accurately described by all of the above

On Sep 25, 2024

E

AK

Answered

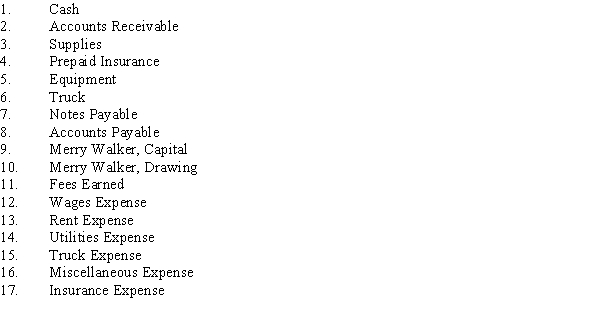

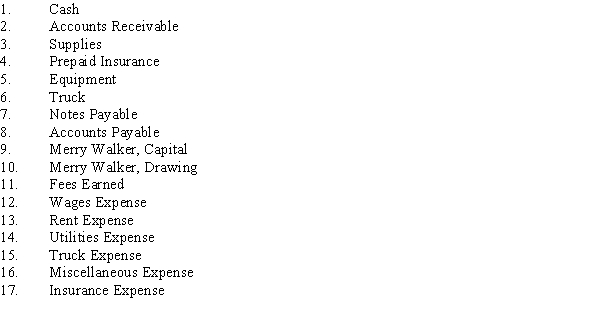

On January 1, Merry Walker established a catering service. Listed below are accounts to use for transactions

(a) through

(f), each identified by a number. Following this list are the transactions that occurred in Walker's first month of operations. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number

(s) in the appropriate box. Transactions Account(s) Debited Account(s) Credited a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. \begin{array} { | l | l | l | } \hline \text { Transactions } & \text { Account(s) Debited } & \text { Account(s) Credited } \\\hline \text { a. Recorded jobs completed on } & & \\\text { account and sent invoices to } & & \\\text { customers. } & & \\\hline \text { b. Received an invoice for truck } & & \\\text { expenses to be paid in February. } & & \\\hline \text { c. Paid utilities expense } & & \\\hline \begin{array} { l } \text { ac Received cash from customers on } \\\text { account. }\end{array} & & \\\hline \text { e. Paid employee wages. } & & \\\hline \text { f. Withdrew cash for personal use. } & & \\\hline\end{array} Transactions a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. Account(s) Debited Account(s) Credited

Transactions Account(s) Debited Account(s) Credited a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. \begin{array} { | l | l | l | } \hline \text { Transactions } & \text { Account(s) Debited } & \text { Account(s) Credited } \\\hline \text { a. Recorded jobs completed on } & & \\\text { account and sent invoices to } & & \\\text { customers. } & & \\\hline \text { b. Received an invoice for truck } & & \\\text { expenses to be paid in February. } & & \\\hline \text { c. Paid utilities expense } & & \\\hline \begin{array} { l } \text { ac Received cash from customers on } \\\text { account. }\end{array} & & \\\hline \text { e. Paid employee wages. } & & \\\hline \text { f. Withdrew cash for personal use. } & & \\\hline\end{array} Transactions a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. Account(s) Debited Account(s) Credited

(a) through

(f), each identified by a number. Following this list are the transactions that occurred in Walker's first month of operations. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number

(s) in the appropriate box.

Transactions Account(s) Debited Account(s) Credited a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. \begin{array} { | l | l | l | } \hline \text { Transactions } & \text { Account(s) Debited } & \text { Account(s) Credited } \\\hline \text { a. Recorded jobs completed on } & & \\\text { account and sent invoices to } & & \\\text { customers. } & & \\\hline \text { b. Received an invoice for truck } & & \\\text { expenses to be paid in February. } & & \\\hline \text { c. Paid utilities expense } & & \\\hline \begin{array} { l } \text { ac Received cash from customers on } \\\text { account. }\end{array} & & \\\hline \text { e. Paid employee wages. } & & \\\hline \text { f. Withdrew cash for personal use. } & & \\\hline\end{array} Transactions a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. Account(s) Debited Account(s) Credited

Transactions Account(s) Debited Account(s) Credited a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. \begin{array} { | l | l | l | } \hline \text { Transactions } & \text { Account(s) Debited } & \text { Account(s) Credited } \\\hline \text { a. Recorded jobs completed on } & & \\\text { account and sent invoices to } & & \\\text { customers. } & & \\\hline \text { b. Received an invoice for truck } & & \\\text { expenses to be paid in February. } & & \\\hline \text { c. Paid utilities expense } & & \\\hline \begin{array} { l } \text { ac Received cash from customers on } \\\text { account. }\end{array} & & \\\hline \text { e. Paid employee wages. } & & \\\hline \text { f. Withdrew cash for personal use. } & & \\\hline\end{array} Transactions a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense ac Received cash from customers on account. e. Paid employee wages. f. Withdrew cash for personal use. Account(s) Debited Account(s) Credited On Sep 22, 2024

Transactions Account(s) Debited Account(s) Credited a. 211 b. 158 c. 141 d. 12 e. 121 f. 101\begin{array} { | l | c | c | } \hline \text { Transactions } & \text { Account(s) Debited } & \text { Account(s) Credited } \\\hline \text { a. } & 2 & 11 \\\hline \text { b. } & 15 & 8 \\\hline \text { c. } & 14 & 1 \\\hline \text { d. } & 1 & 2 \\\hline \text { e. } & 12 & 1 \\\hline \text { f. } & 10 & 1 \\\hline\end{array} Transactions a. b. c. d. e. f. Account(s) Debited 2151411210 Account(s) Credited 1181211