AZ

Aleah Zainul

Answers (8)

AZ

Answered

The most common form of business organization in the United States is the partnership.

On Jul 29, 2024

False

AZ

Answered

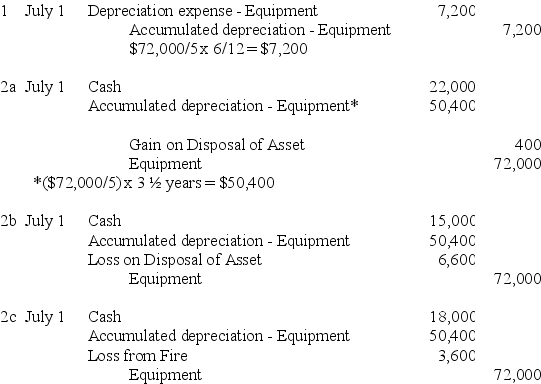

A company purchased and installed equipment on January 1 at a total cost of $72,000.Straight-line depreciation was calculated based on the assumption of a five-year life and no salvage value.The equipment was disposed of on July 1 of the fourth year.The company uses the calendar year.

1.Prepare the general journal entry to update depreciation to July 1 in the fourth year.

2.Prepare the general journal entry to record the disposal of the equipment under each of these three independent situations:

a.The equipment was sold for $22,000 cash.

b.The equipment was sold for $15,000 cash.

c.The equipment was totally destroyed in a fire and the insurance company settled the claim for $18,000 cash.

1.Prepare the general journal entry to update depreciation to July 1 in the fourth year.

2.Prepare the general journal entry to record the disposal of the equipment under each of these three independent situations:

a.The equipment was sold for $22,000 cash.

b.The equipment was sold for $15,000 cash.

c.The equipment was totally destroyed in a fire and the insurance company settled the claim for $18,000 cash.

On Jul 20, 2024

AZ

Answered

Gain on sale of equipment and interest expense are reported under other revenues and gains in a multiple-step income statement.

On Jun 29, 2024

False

AZ

Answered

A multilevel systems model of organizational learning assumes learning occurs at three distinct yet interconnected levels. Which of the following is NOT one of those levels?

A) human capital level

B) organizational level

C) group level

D) individual level

A) human capital level

B) organizational level

C) group level

D) individual level

On Jun 20, 2024

A

AZ

Answered

Only debt investments can be accounted for using the fair value through other comprehensive income model.

On Jun 19, 2024

False

AZ

Answered

A firm's total output times the price at which it sells that output is _____ revenue.

A) net

B) total

C) average

D) marginal

A) net

B) total

C) average

D) marginal

On May 21, 2024

B

AZ

Answered

Under the general law of contracts,a signed,written offer made by a merchant that allows acceptance at any time within a 90-day time period is not binding unless the offeree signs the offer.

On May 20, 2024

False

AZ

Answered

A regressive tax takes a:

A) fixed percentage of income.

B) lower percentage of income as income rises.

C) higher percentage of income as income rises.

D) lower percentage of income as income falls.

A) fixed percentage of income.

B) lower percentage of income as income rises.

C) higher percentage of income as income rises.

D) lower percentage of income as income falls.

On May 19, 2024

B