AM

Alexandria Mosley

Answers (6)

AM

Answered

Which of the following is an important cause of inflation in an economy?

A) Increases in productivity in the economy

B) The influence of positive externalities on the economy

C) Lack of property rights in the economy

D) Growth in the quantity of money in the economy

A) Increases in productivity in the economy

B) The influence of positive externalities on the economy

C) Lack of property rights in the economy

D) Growth in the quantity of money in the economy

On Jul 14, 2024

D

AM

Answered

As part of her compensation package, Mariana was granted the rights to purchase shares of her organization's stock at an established price for a fixed period of time. What type of compensation is this?

A) Executive perks

B) Share appreciation rights

C) Stock options

D) Phantom stock

A) Executive perks

B) Share appreciation rights

C) Stock options

D) Phantom stock

On Jul 13, 2024

C

AM

Answered

Many economists agree that government should deal with monopolists on a case-by-case basis. Which of the following is not a government policy option?

A) If the monopoly is attained and maintained through anticompetitive behavior, the government can file a suit based on antitrust laws.

B) If the firm is a natural monopoly, the government may decide to regulate its prices and operations.

C) If the monopoly is maximizing economic profits, the government can subsidize new firms to enter the industry.

D) If the monopoly is subject, and vulnerable, to potential competition, the government can decide to leave it alone.

A) If the monopoly is attained and maintained through anticompetitive behavior, the government can file a suit based on antitrust laws.

B) If the firm is a natural monopoly, the government may decide to regulate its prices and operations.

C) If the monopoly is maximizing economic profits, the government can subsidize new firms to enter the industry.

D) If the monopoly is subject, and vulnerable, to potential competition, the government can decide to leave it alone.

On Jun 14, 2024

C

AM

Answered

For each of the following scenarios, indicate the amount of the adjusting journal entry for Bad Debt Expense to be recorded, the balance in Allowance for Doubtful Accounts after adjustment at December 31, and the net realizable value of accounts receivable at December 31.

(a) Based on an analysis of Simmons Company's $380,000 balance in Accounts Receivable at December 31, it was estimated that $15,500 will be uncollectible. There is a credit balance of $1,200 in Allowance for Doubtful Accounts before adjustment.

(b) Blake Company had credit sales of $900,000 at year-end, an Accounts Receivable balance of $425,000 at December 31, and an Allowance for Doubtful Accounts credit balance of $11,000 before adjustment. Blake estimates bad debt expense as ¾ of 1% of credit sales.

(c) Hidgon Inc. has a balance of $812,000 in Accounts Receivable at December 31. An analysis of those receivables shows $24,000 will probably not be collected. Before adjusting entries are prepared, Allowance for Doubtful Accounts has a debit balance of $750.

(a) Based on an analysis of Simmons Company's $380,000 balance in Accounts Receivable at December 31, it was estimated that $15,500 will be uncollectible. There is a credit balance of $1,200 in Allowance for Doubtful Accounts before adjustment.

(b) Blake Company had credit sales of $900,000 at year-end, an Accounts Receivable balance of $425,000 at December 31, and an Allowance for Doubtful Accounts credit balance of $11,000 before adjustment. Blake estimates bad debt expense as ¾ of 1% of credit sales.

(c) Hidgon Inc. has a balance of $812,000 in Accounts Receivable at December 31. An analysis of those receivables shows $24,000 will probably not be collected. Before adjusting entries are prepared, Allowance for Doubtful Accounts has a debit balance of $750.

On Jun 13, 2024

0 (a) Bad debt expense $14,300 Allowance for doubtful accounts at Dec. 3115,500\begin{array} { l r } \text { (a) Bad debt expense } & \$ 14,300 \\ \text { Allowance for doubtful accounts at Dec. } 31 & 15,500 \end{array} (a) Bad debt expense Allowance for doubtful accounts at Dec. 31$14,30015,500

Net realizable value of accounts receivable at

Dec. 31 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 364,500

(b) Bad debt expense $6,750 Allowance for doubtful accounts at Dec. 3117,750\begin{array} { l r r } \text { (b) Bad debt expense } & \$ & 6,750 \\ \text { Allowance for doubtful accounts at Dec. } 31 & 17,750 \end{array} (b) Bad debt expense Allowance for doubtful accounts at Dec. 31$17,7506,750

Net realizable value of accounts receivable at

Dec. 31 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 407,250

(c) Bad debt expense $24,750\quad \$ 24,750$24,750

Allowance for doubtful accounts at Dec. 3124,00031 \quad 24,0003124,000

Net realizable value of accounts receivable at

Dec. 31 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 788,00

Net realizable value of accounts receivable at

Dec. 31 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 364,500

(b) Bad debt expense $6,750 Allowance for doubtful accounts at Dec. 3117,750\begin{array} { l r r } \text { (b) Bad debt expense } & \$ & 6,750 \\ \text { Allowance for doubtful accounts at Dec. } 31 & 17,750 \end{array} (b) Bad debt expense Allowance for doubtful accounts at Dec. 31$17,7506,750

Net realizable value of accounts receivable at

Dec. 31 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 407,250

(c) Bad debt expense $24,750\quad \$ 24,750$24,750

Allowance for doubtful accounts at Dec. 3124,00031 \quad 24,0003124,000

Net realizable value of accounts receivable at

Dec. 31 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 788,00

AM

Answered

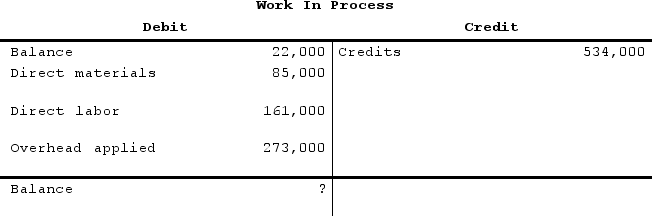

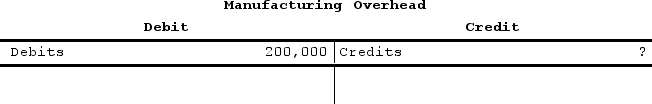

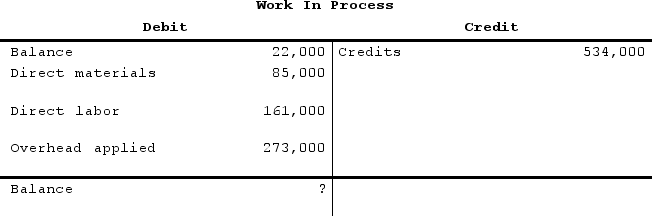

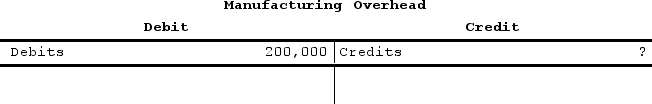

Saint Johns Corporation uses a job-order costing system and has provided the following partially completed summary T-accounts for the just completed period:

Manufacturing overhead for the period was:

Manufacturing overhead for the period was:

A) $7,000 Underapplied

B) $73,000 Underapplied

C) $73,000 Overapplied

D) $7,000 Overapplied

Manufacturing overhead for the period was:

Manufacturing overhead for the period was:A) $7,000 Underapplied

B) $73,000 Underapplied

C) $73,000 Overapplied

D) $7,000 Overapplied

On May 15, 2024

C

AM

Answered

Risk compartmentalization occurs when

A) companies place their most problematic employees into separate profit centers so that they cannot influence one another to act unethically.

B) all profit centers within a corporation are aware of the code of ethics.

C) all profit centers within an organization become aware of the consequences of competitors' actions.

D) various profit centers within an organization become unaware of the consequences of their actions on the firm as a whole.

E) ethics and compliance programs reduce the risk of misconduct.

A) companies place their most problematic employees into separate profit centers so that they cannot influence one another to act unethically.

B) all profit centers within a corporation are aware of the code of ethics.

C) all profit centers within an organization become aware of the consequences of competitors' actions.

D) various profit centers within an organization become unaware of the consequences of their actions on the firm as a whole.

E) ethics and compliance programs reduce the risk of misconduct.

On May 14, 2024

D