AB

Andrea Black

Answers (6)

AB

Answered

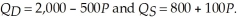

The market demand and supply functions for pork are:  To help pork producers, the U.S. Congress is considering legislation that would put a price floor at $2.25 per unit. If this price floor is implemented, how many units of pork will the government be forced to buy to keep the price at $2.25? How much will the government spend in total? How much does producer surplus increase?

To help pork producers, the U.S. Congress is considering legislation that would put a price floor at $2.25 per unit. If this price floor is implemented, how many units of pork will the government be forced to buy to keep the price at $2.25? How much will the government spend in total? How much does producer surplus increase?

To help pork producers, the U.S. Congress is considering legislation that would put a price floor at $2.25 per unit. If this price floor is implemented, how many units of pork will the government be forced to buy to keep the price at $2.25? How much will the government spend in total? How much does producer surplus increase?

To help pork producers, the U.S. Congress is considering legislation that would put a price floor at $2.25 per unit. If this price floor is implemented, how many units of pork will the government be forced to buy to keep the price at $2.25? How much will the government spend in total? How much does producer surplus increase?On Jul 20, 2024

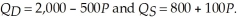

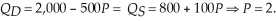

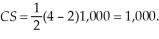

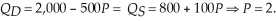

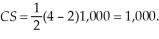

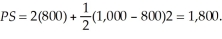

First we must determine the market equilibrium quantity and price. To do this, we set quantity demanded equal to quantity supplied and solve for equilibrium price.  At a price of $2, the quantity exchanged will be: 1,000. The choke price (lowest price such that no units are transacted) is $4. The consumer surplus is

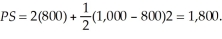

At a price of $2, the quantity exchanged will be: 1,000. The choke price (lowest price such that no units are transacted) is $4. The consumer surplus is  Producer surplus is

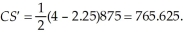

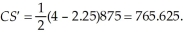

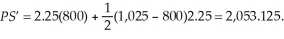

Producer surplus is  If a price floor of $2.25 per unit is implemented, consumers will purchase 875 units. However, producers will bring 1,025 units to the market. The government will be forced to buy up the surplus 150 units at $2.25 per unit. Consumer surplus is:

If a price floor of $2.25 per unit is implemented, consumers will purchase 875 units. However, producers will bring 1,025 units to the market. The government will be forced to buy up the surplus 150 units at $2.25 per unit. Consumer surplus is:  Producer surplus is

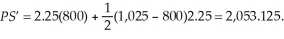

Producer surplus is  Government spending is $337.50. Producer surplus increases by $253.125 or 14.1%. Consumer surplus falls by over 23%.

Government spending is $337.50. Producer surplus increases by $253.125 or 14.1%. Consumer surplus falls by over 23%.

At a price of $2, the quantity exchanged will be: 1,000. The choke price (lowest price such that no units are transacted) is $4. The consumer surplus is

At a price of $2, the quantity exchanged will be: 1,000. The choke price (lowest price such that no units are transacted) is $4. The consumer surplus is  Producer surplus is

Producer surplus is  If a price floor of $2.25 per unit is implemented, consumers will purchase 875 units. However, producers will bring 1,025 units to the market. The government will be forced to buy up the surplus 150 units at $2.25 per unit. Consumer surplus is:

If a price floor of $2.25 per unit is implemented, consumers will purchase 875 units. However, producers will bring 1,025 units to the market. The government will be forced to buy up the surplus 150 units at $2.25 per unit. Consumer surplus is:  Producer surplus is

Producer surplus is  Government spending is $337.50. Producer surplus increases by $253.125 or 14.1%. Consumer surplus falls by over 23%.

Government spending is $337.50. Producer surplus increases by $253.125 or 14.1%. Consumer surplus falls by over 23%.AB

Answered

Office Supplies (not used for resale) bought on account were returned for credit and recorded with a debit to Accounts Payable and a credit to Merchandise Inventory. This error will cause:

A) net income to be overstated.

B) net income to be understated.

C) no effect on net income or total assets.

D) total assets to be understated.

A) net income to be overstated.

B) net income to be understated.

C) no effect on net income or total assets.

D) total assets to be understated.

On Jul 19, 2024

C

AB

Answered

The average-fixed-cost curve is always declining. How does this affect the relationship between the AVC and ATC curves?

On Jun 19, 2024

ATC = AVC + AFC, so the vertical distance between the AVC and ATC curves is the value of AFC for that level of output. Both AVC and ATC are typically U-shaped. The vertical distance between the two curves is steadily declining as output increases because AFC is steadily declining. Said another way, the two curves move closer together as output increases.

AB

Answered

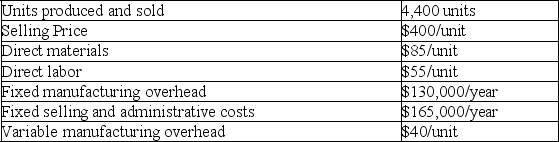

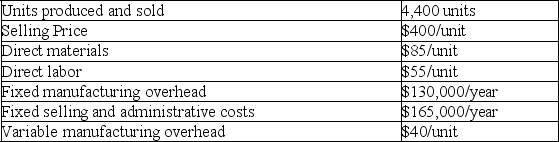

Maloney Co.provided the following information for the year 20X1:

There are no beginning inventories.Prepare an income statement using the variable costing format.

There are no beginning inventories.Prepare an income statement using the variable costing format.

There are no beginning inventories.Prepare an income statement using the variable costing format.

There are no beginning inventories.Prepare an income statement using the variable costing format.On Jun 18, 2024

Variable costs = 4,400 units × ($85 + $55 + $40)= $792,000

Variable costs = 4,400 units × ($85 + $55 + $40)= $792,000Fixed costs = $130,000 + $165,000 = $295,000

AB

Answered

Which of the following items would not affect the cost of inventory purchased during the period?

A) quantity discounts

B) sales discounts

C) freight in

D) sales commissions

A) quantity discounts

B) sales discounts

C) freight in

D) sales commissions

On May 20, 2024

D

AB

Answered

A preferred stock will pay a dividend of $1.25 in the upcoming year and every year thereafter; i.e., dividends are not expected to grow. You require a return of 12% on this stock. Use the constant growth DDM to calculate the intrinsic value of this preferred stock.

A) $11.56

B) $9.65

C) $11.82

D) $10.42

A) $11.56

B) $9.65

C) $11.82

D) $10.42

On May 19, 2024

D