AJ

Anish Joshi

Answers (2)

AJ

Answered

Which of these is a wise way to respond to criticism posted on social media?

A) Have others post more positive feedback

B) Ignore it

C) Use it as valuable feedback

D) Assume the person posting will retract the message after the issue has been solved

E) Respectfully explain why you can't offer an immediate solution to the issue

A) Have others post more positive feedback

B) Ignore it

C) Use it as valuable feedback

D) Assume the person posting will retract the message after the issue has been solved

E) Respectfully explain why you can't offer an immediate solution to the issue

On Sep 26, 2024

C

AJ

Answered

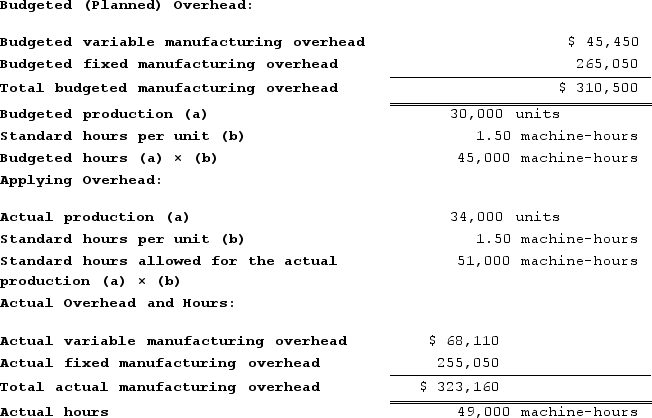

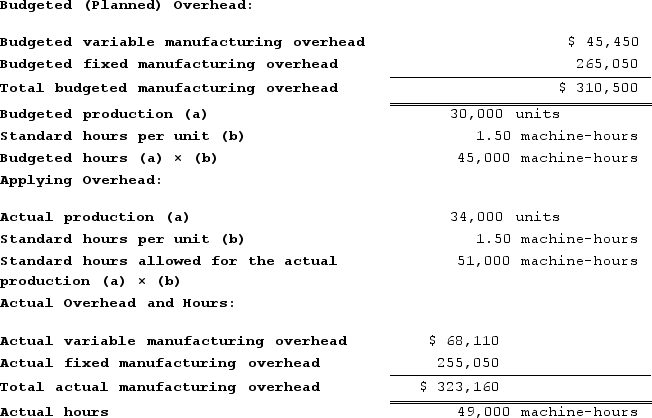

Hargett Incorporated makes a single product--an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

a.Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

e. Determine whether overhead was underapplied or overapplied for the year and by how much.

Required:

Required:a.Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

e. Determine whether overhead was underapplied or overapplied for the year and by how much.

On Sep 22, 2024

a. Variable component of the predetermined overhead rate (Standard rate) = $45,450/45,000 machine-hours

= $1.01 per machine-hour

Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= ($68,110) − (49,000 machine-hours × $1.01 per machine-hour)

= ($68,110) − ($49,490)

= $18,620 Unfavorable

b. Labor efficiency variance = (Actual hours − Standard hours) × Standard rate

= (49,000 machine-hours − 51,000 machine-hours) × $1.01 per machine-hour

= (−2,000 machine-hours) − $1.01 per machine-hour

= $2,020 Favorable

c. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $255,050 − $265,050 = $10,000 Favorable

d. Fixed component of the predetermined overhead rate = $265,050/45,000 machine-hours

= $5.89 per machine-hour

Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $265,050 − ($5.89 per machine-hour × 51,000 machine-hours)

= $265,050 − ($300,390)

= $35,340 Favorable

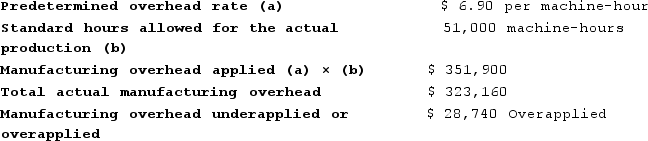

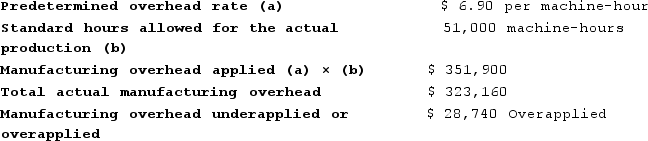

e. Predetermined overhead rate = $310,500/45,000 machine-hours = $6.90 per machine-hour

= $1.01 per machine-hour

Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= ($68,110) − (49,000 machine-hours × $1.01 per machine-hour)

= ($68,110) − ($49,490)

= $18,620 Unfavorable

b. Labor efficiency variance = (Actual hours − Standard hours) × Standard rate

= (49,000 machine-hours − 51,000 machine-hours) × $1.01 per machine-hour

= (−2,000 machine-hours) − $1.01 per machine-hour

= $2,020 Favorable

c. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $255,050 − $265,050 = $10,000 Favorable

d. Fixed component of the predetermined overhead rate = $265,050/45,000 machine-hours

= $5.89 per machine-hour

Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $265,050 − ($5.89 per machine-hour × 51,000 machine-hours)

= $265,050 − ($300,390)

= $35,340 Favorable

e. Predetermined overhead rate = $310,500/45,000 machine-hours = $6.90 per machine-hour