AG

Artur Gertih

Answers (6)

AG

Answered

A new machine tool is expected to generate receipts as follows: $5,000 in year one; $3,000 in year two, nothing in the next year, and $2,000 in the fourth year. At an interest rate of 6%, what is the present value of these receipts? Is this a better present value than $2,500 each year over four years? Explain.

On Jul 13, 2024

5,000 × .943 + 3,000 × .890 + 2,000 × .792 = $8,969 using Table S7.1 in the text ($8,971.16 using Excel). The steady stream generates NPV of 2,500 × 3.465 = $8,662.5 ($8,662.76 using Excel). The irregular stream has the higher present value because the larger receipts are early.

AG

Answered

The respect we give to the law as a source of authority is in part a recognition of the fact that in the absence of law,we would rely solely on the goodwill and dependability of one another.

On Jul 10, 2024

True

AG

Answered

Private international borrowing and lending is freely allowed by governments of developing countries.

On Jun 13, 2024

False

AG

Answered

Molly focuses her leadership behaviors on helping followers reach their full potential as human beings.She is using ______.

A) situational leadership

B) path-goal leadership

C) contingent reward leadership

D) transformational leadership

A) situational leadership

B) path-goal leadership

C) contingent reward leadership

D) transformational leadership

On Jun 10, 2024

D

AG

Answered

A company reports the following:

Net income$270,000

Preferred dividends$10,000

Shares of common stock outstanding20,000

Market price per share of common stock$36.40

?Calculate the company's price-earnings ratio. Round your answer to one decimal place.

Net income$270,000

Preferred dividends$10,000

Shares of common stock outstanding20,000

Market price per share of common stock$36.40

?Calculate the company's price-earnings ratio. Round your answer to one decimal place.

On May 14, 2024

Price-Earnings Ratio = Market Price per Share of Common Stock/Earnings per Share on Common Stock?

Earnings per Share on Common Stock = (Net Income - Preferred Dividends)/Shares of

Common Stock Outstanding

Earnings per Share = ($270,000 - $10,000)/20,000

Earnings per Share = $13.00

?Price-Earnings Ratio = $36.40/$13.00

Price-Earnings Ratio = 2.8

Earnings per Share on Common Stock = (Net Income - Preferred Dividends)/Shares of

Common Stock Outstanding

Earnings per Share = ($270,000 - $10,000)/20,000

Earnings per Share = $13.00

?Price-Earnings Ratio = $36.40/$13.00

Price-Earnings Ratio = 2.8

AG

Answered

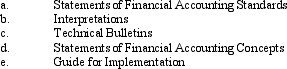

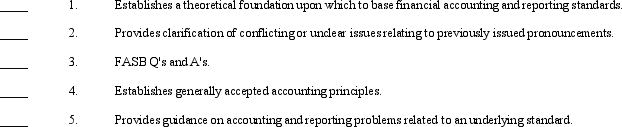

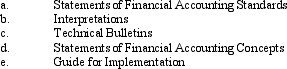

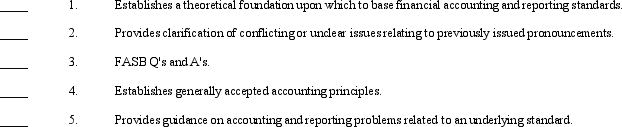

Listed below are several types of pronouncements that the FASB issues.Following the list is a series of descriptive statements.

Required:

Required:

Match each pronouncement with its descriptive statement by placing the appropriate letter in the space provided.

Required:

Required:Match each pronouncement with its descriptive statement by placing the appropriate letter in the space provided.

On May 11, 2024

1. \quad d

2. \quad b

4. \quad e

4. \quad a

5 \quad c

2. \quad b

4. \quad e

4. \quad a

5 \quad c