AA

Ayisha Ateek

Answers (6)

AA

Answered

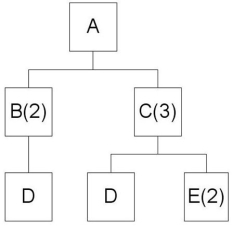

Consider the following bill of material. Fifty units of Product A are needed. Assuming no on-hand inventory, and no scheduled receipts, explode the bill of material.

On Jul 26, 2024

Item A: 50 units; Item B: 50 × 2 = 100 units; Item C: (50 × 3) = 150 units; Item D: (50 × 2 × 1) + (50 × 3 × 1) = 250 units; Item E: (50 × 3 × 2) = 300 units.

Item A: 50 units; Item B: 50 × 2 = 100 units; Item C: (50 × 3) = 150 units; Item D: (50 × 2 × 1) + (50 × 3 × 1) = 250 units; Item E: (50 × 3 × 2) = 300 units.AA

Answered

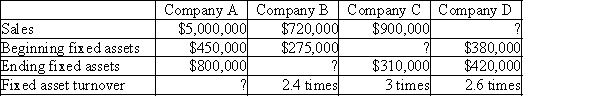

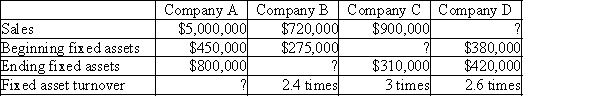

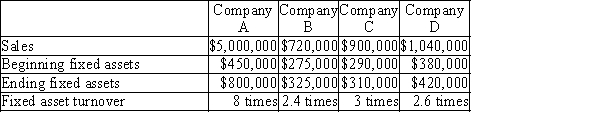

Fill in the missing numbers using the formula for fixed asset turnover:

On Jul 25, 2024

AA

Answered

In "drum, buffer, rope," what provides the schedule, i.e. the pace of production?

A) drum

B) buffer

C) rope

D) drum, buffer, and rope combined

E) both buffer and rope

A) drum

B) buffer

C) rope

D) drum, buffer, and rope combined

E) both buffer and rope

On Jun 26, 2024

A

AA

Answered

A problem in hiring for person-organization fit is that:

A) the corporate culture might be weakened.

B) candidates whose values fit the organization might be excluded.

C) it might inadvertently discriminate against protected classes of workers.

D) group characteristics may receive too little attention.

A) the corporate culture might be weakened.

B) candidates whose values fit the organization might be excluded.

C) it might inadvertently discriminate against protected classes of workers.

D) group characteristics may receive too little attention.

On Jun 24, 2024

C

AA

Answered

A country's currency that is not convertible meaning that it cannot be exchanged for other currencies at market determined rates:

A) Can be exchanged by that country's government at its official exchange rate

B) Does not pose any barriers to international trade

C) Does not create any difficulties to repatriate profits back into the company's home country

D) All of the above

A) Can be exchanged by that country's government at its official exchange rate

B) Does not pose any barriers to international trade

C) Does not create any difficulties to repatriate profits back into the company's home country

D) All of the above

On May 26, 2024

A

AA

Answered

Which of the following would be an argument for using the gross cost of plant and equipment as part of operating assets in return on investment computations?

A) It is consistent with the computation of net operating income, which includes depreciation as an operating expense.

B) It is consistent with the balance sheet presentation of plant and equipment.

C) It eliminates the age of equipment as a factor in ROI computations.

D) It discourages the replacement of old, worn-out equipment because of the dramatic, adverse effect on ROI.

A) It is consistent with the computation of net operating income, which includes depreciation as an operating expense.

B) It is consistent with the balance sheet presentation of plant and equipment.

C) It eliminates the age of equipment as a factor in ROI computations.

D) It discourages the replacement of old, worn-out equipment because of the dramatic, adverse effect on ROI.

On May 25, 2024

C