BL

Brooke Liber

Answers (2)

BL

Answered

Wealth creating transactions are more likely to occur

A) With private property rights

B) With contract enforcement

C) Both a and b

D) None of the above

A) With private property rights

B) With contract enforcement

C) Both a and b

D) None of the above

On Sep 27, 2024

C

BL

Answered

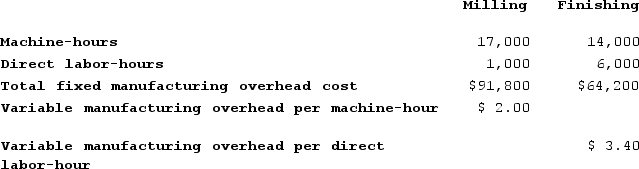

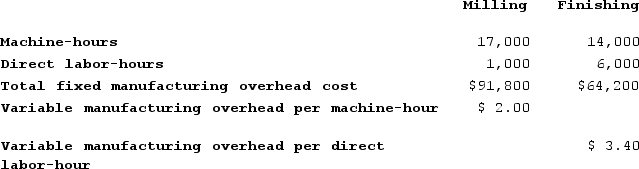

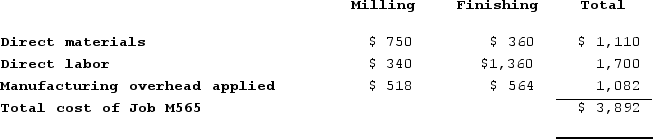

Dancel Corporation has two production departments, Milling and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

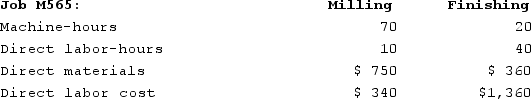

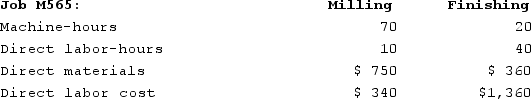

During the current month the company started and finished Job M565. The following data were recorded for this job:

During the current month the company started and finished Job M565. The following data were recorded for this job:

Required:a. Calculate the total amount of overhead applied to Job M565 in both departments.b. Calculate the total job cost for Job M565.c. Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.

Required:a. Calculate the total amount of overhead applied to Job M565 in both departments.b. Calculate the total job cost for Job M565.c. Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.

During the current month the company started and finished Job M565. The following data were recorded for this job:

During the current month the company started and finished Job M565. The following data were recorded for this job: Required:a. Calculate the total amount of overhead applied to Job M565 in both departments.b. Calculate the total job cost for Job M565.c. Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.

Required:a. Calculate the total amount of overhead applied to Job M565 in both departments.b. Calculate the total job cost for Job M565.c. Calculate the selling price for Job M565 if the company marks up its unit product costs by 20% to determine selling prices.On Sep 23, 2024

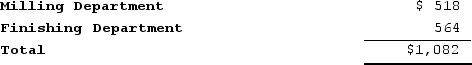

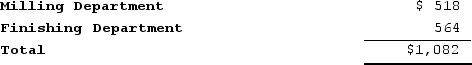

a. Milling Department:

Milling Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per machine-hour × Total machine-hours in the department)

= $91,800 + ($2.00 per machine-hour × 17,000 machine-hours)

= $91,800 +$34,000 = $125,800

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $125,800 ÷ 17,000 machine-hours = $7.40 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $7.40 per machine-hour × 70 machine-hours = $518

Finishing Department:

Finishing Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)

= $64,200 + ($3.40 per direct labor-hour × 6,000 direct labor-hours)

= $64,200 + $20,400 = $84,600

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $84,600 ÷6,000 direct labor-hours = $14.10 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $14.10 per direct labor-hour × 40 direct labor-hours = $564

Overhead applied to Job M565

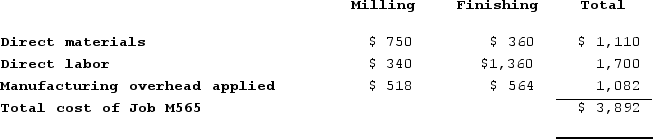

b.

b.

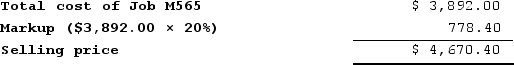

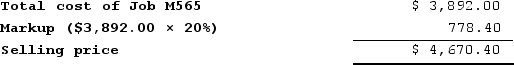

c.

c.

Milling Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per machine-hour × Total machine-hours in the department)

= $91,800 + ($2.00 per machine-hour × 17,000 machine-hours)

= $91,800 +$34,000 = $125,800

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $125,800 ÷ 17,000 machine-hours = $7.40 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $7.40 per machine-hour × 70 machine-hours = $518

Finishing Department:

Finishing Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)

= $64,200 + ($3.40 per direct labor-hour × 6,000 direct labor-hours)

= $64,200 + $20,400 = $84,600

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $84,600 ÷6,000 direct labor-hours = $14.10 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $14.10 per direct labor-hour × 40 direct labor-hours = $564

Overhead applied to Job M565

b.

b. c.

c.