CB

Camille Black

Answers (6)

CB

Answered

Why are the actions of firms interdependent in an oligopoly market but not in a monopolistically competitive market?

On Jul 15, 2024

Because there are only a few firms in an oligopoly market, their actions are interdependent. There are so many firms in a monopolistically competitive market that each firm it too small for its actions to affect other firms.

CB

Answered

________ remedies, as applied in the U.S., developed from the English court's authority to fashion remedies when existing laws did not provide any adequate ones.

A) Positive

B) Remedial

C) Consequential

D) Equitable

E) Equalized

A) Positive

B) Remedial

C) Consequential

D) Equitable

E) Equalized

On Jul 12, 2024

D

CB

Answered

It is better not to replace old equipment if it is not fully depreciated.

On Jun 15, 2024

False

CB

Answered

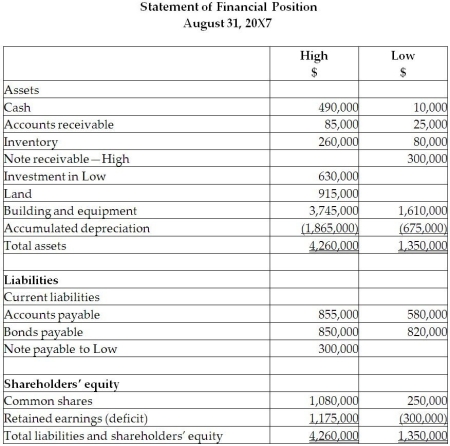

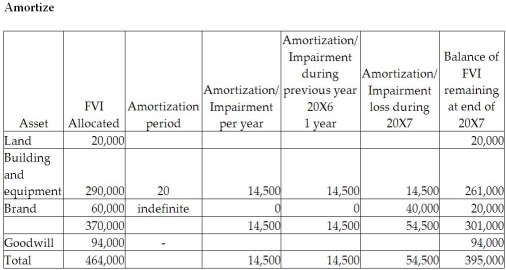

On September 1, 20X5, High Limited decided to buy 80% of the shares outstanding of Low Inc. for $630,000. High will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows: High Low $$ Cash 525,00040,000 Accounts receivable 65,00035,000 Inventory supplies 50,00050,000 Land 525,000275,000 Buildings and equipment 3,450,000925,000 Accumulated depreciation 865,000‾)125,000‾ Total assets 3,750,000‾1,200,000‾ Liabilities Current liabilities Accounts payable 665,000280,000 Bonds payable 1,350,000620,000 Shareholders’ equity Common shares 950,000250,000 Retained earnings 785,000‾50,00‾ Total liabilities and shareholders’ equity 3,750,000‾1,200,000‾\begin{array}{|l|r|r}\hline &\text { High } & \text { Low } \\&\$ & \$\\\hline\\\hline\text { Cash } & 525,000 & 40,000 \\\hline \text { Accounts receivable } & 65,000 & 35,000 \\\hline \text { Inventory supplies } & 50,000 & 50,000 \\\hline \text { Land } & 525,000 & 275,000 \\\hline \text { Buildings and equipment } & 3,450,000 & 925,000 \\\hline \text { Accumulated depreciation } & \underline{865,000}) & \underline{125,000} \\\hline \text { Total assets } & \underline{3,750,000} & \underline{1,200,000} \\\hline\\\hline \text { Liabilities } & & \\\hline \text { Current liabilities } & & \\\hline \text { Accounts payable } & 665,000 & 280,000 \\\hline \text { Bonds payable } & 1,350,000 & 620,000 \\\hline\\\hline \text { Shareholders' equity } & & \\\hline \text { Common shares } & 950,000 & 250,000 \\\hline \text { Retained earnings } & \underline{785,000} & \underline{50,00} \\\hline \text { Total liabilities and shareholders' equity } & \underline{3,750,000} & \underline{1,200,000} \\\hline\end{array} Cash Accounts receivable Inventory supplies Land Buildings and equipment Accumulated depreciation Total assets Liabilities Current liabilities Accounts payable Bonds payable Shareholders’ equity Common shares Retained earnings Total liabilities and shareholders’ equity High $525,00065,00050,000525,0003,450,000865,000)3,750,000665,0001,350,000950,000785,0003,750,000 Low $40,00035,00050,000275,000925,000125,0001,200,000280,000620,000250,00050,001,200,000

After a review of the assets and liabilities, High determines that some of the assets of Low have fair values different from their carrying values. These items are listed below:

• Land has a fair value of $295,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• Brand value is $60,000. The brand has an indefinite life.

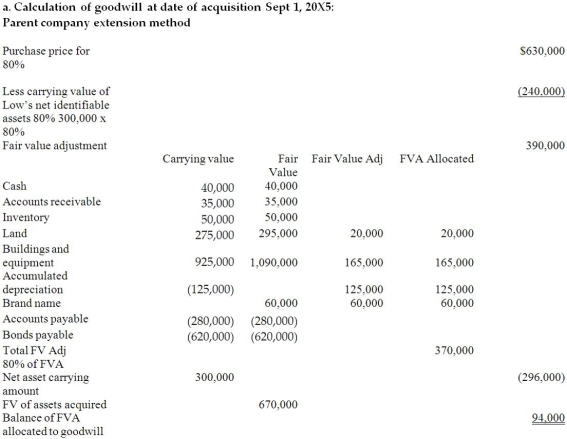

During the 20X7 fiscal year, the following events occurred:

1. On March 1, 20X7, Low sold land to High for $390,000, which had a carrying value of $275,000. High paid for this with $90,000 cash and a note payable for the difference. This note pays interest at 10%, which is paid monthly.

2. High sold inventory (included in High sales)to Low for $200,000. Profit margin on these sales is 25%. Low still has supplies on hand of $75,000.

3. In 20X6, Low had provided seat space on flights to High for a value of $500,000. This amount was included in sales for Low. Profit margin on these sales is 40%. At the end of August, 20X6, High still had an amount of $200,000 in these prepaid seats that had not yet been used. (High includes this in inventory.)

4. The brand name was found to be impaired and an impairment loss of $40,000 was recognized. Statement of Comprehensive Income Year Ended August 31, 20X7 High Low $$ Sales 6,560,0001,540,000 Gain on sale of land 0115,000 Interest income 015,0006,560,0001,670,000 Cost of sales 4,980,0001,030,000 Depreciation and amortization expenses 250,000125,000 Interest expense 15,000 Management fees Other expenses 565,000‾1,040,000‾5,810,0002,195,000 Net income ( loss) 750,000(525,000)‾\begin{array}{c}\text {Statement of Comprehensive Income }\\\text {Year Ended August 31, 20X7}\\\\\begin{array}{|l|r|r|}\hline &\text { High } & \text { Low } \\&\$ & \$\\\hline \text { Sales } & 6,560,000 & 1,540,000 \\\hline \text { Gain on sale of land } & 0 & 115,000 \\\hline \text { Interest income } & 0 & 15,000 \\\hline & 6,560,000 & 1,670,000 \\\hline \text { Cost of sales } & 4,980,000 & 1,030,000 \\\hline \text { Depreciation and amortization expenses } & 250,000 & 125,000 \\\hline \text { Interest expense } & 15,000 & \\\hline \text { Management fees } & & \\\hline \text { Other expenses } & \underline{565,000} & \underline{1,040,000} \\\hline & 5,810,000 & 2,195,000 \\\hline \text { Net income }(\text { loss) } & 750,000 & \underline{(525,000)} \\\hline\end{array}\end{array}Statement of Comprehensive Income Year Ended August 31, 20X7 Sales Gain on sale of land Interest income Cost of sales Depreciation and amortization expenses Interest expense Management fees Other expenses Net income ( loss) High $6,560,000006,560,0004,980,000250,00015,000565,0005,810,000750,000 Low $1,540,000115,00015,0001,670,0001,030,000125,0001,040,0002,195,000(525,000) Required:

Statement of Comprehensive Income Year Ended August 31, 20X7 High Low $$ Sales 6,560,0001,540,000 Gain on sale of land 0115,000 Interest income 015,0006,560,0001,670,000 Cost of sales 4,980,0001,030,000 Depreciation and amortization expenses 250,000125,000 Interest expense 15,000 Management fees Other expenses 565,000‾1,040,000‾5,810,0002,195,000 Net income ( loss) 750,000(525,000)‾\begin{array}{c}\text {Statement of Comprehensive Income }\\\text {Year Ended August 31, 20X7}\\\\\begin{array}{|l|r|r|}\hline &\text { High } & \text { Low } \\&\$ & \$\\\hline \text { Sales } & 6,560,000 & 1,540,000 \\\hline \text { Gain on sale of land } & 0 & 115,000 \\\hline \text { Interest income } & 0 & 15,000 \\\hline & 6,560,000 & 1,670,000 \\\hline \text { Cost of sales } & 4,980,000 & 1,030,000 \\\hline \text { Depreciation and amortization expenses } & 250,000 & 125,000 \\\hline \text { Interest expense } & 15,000 & \\\hline \text { Management fees } & & \\\hline \text { Other expenses } & \underline{565,000} & \underline{1,040,000} \\\hline & 5,810,000 & 2,195,000 \\\hline \text { Net income }(\text { loss) } & 750,000 & \underline{(525,000)} \\\hline\end{array}\end{array}Statement of Comprehensive Income Year Ended August 31, 20X7 Sales Gain on sale of land Interest income Cost of sales Depreciation and amortization expenses Interest expense Management fees Other expenses Net income ( loss) High $6,560,000006,560,0004,980,000250,00015,000565,0005,810,000750,000 Low $1,540,000115,00015,0001,670,0001,030,000125,0001,040,0002,195,000(525,000) Required:

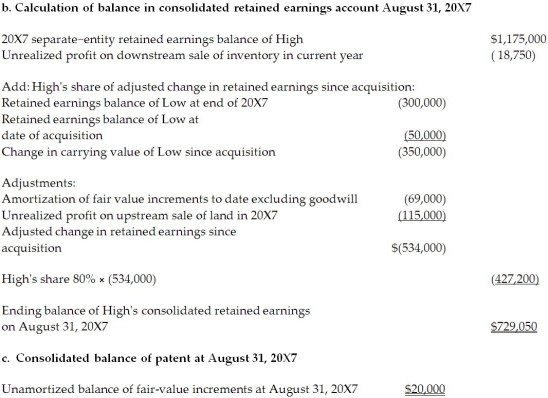

Calculate the balances for the following consolidated balances of High assuming High uses the parent-company extension method approach:

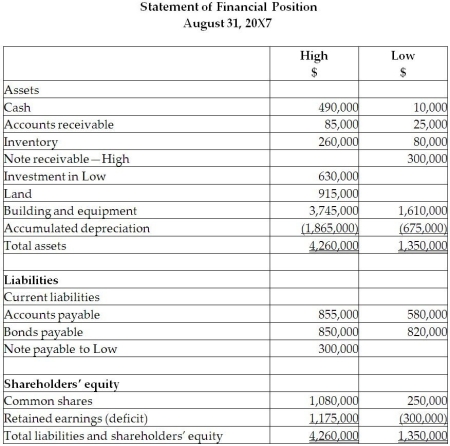

a. Goodwill at August 31, 20X5

b. Retained earnings at August 31, 20X7

c. Brand name, net, at August 31, 20X7.

After a review of the assets and liabilities, High determines that some of the assets of Low have fair values different from their carrying values. These items are listed below:

• Land has a fair value of $295,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• Brand value is $60,000. The brand has an indefinite life.

During the 20X7 fiscal year, the following events occurred:

1. On March 1, 20X7, Low sold land to High for $390,000, which had a carrying value of $275,000. High paid for this with $90,000 cash and a note payable for the difference. This note pays interest at 10%, which is paid monthly.

2. High sold inventory (included in High sales)to Low for $200,000. Profit margin on these sales is 25%. Low still has supplies on hand of $75,000.

3. In 20X6, Low had provided seat space on flights to High for a value of $500,000. This amount was included in sales for Low. Profit margin on these sales is 40%. At the end of August, 20X6, High still had an amount of $200,000 in these prepaid seats that had not yet been used. (High includes this in inventory.)

4. The brand name was found to be impaired and an impairment loss of $40,000 was recognized.

Statement of Comprehensive Income Year Ended August 31, 20X7 High Low $$ Sales 6,560,0001,540,000 Gain on sale of land 0115,000 Interest income 015,0006,560,0001,670,000 Cost of sales 4,980,0001,030,000 Depreciation and amortization expenses 250,000125,000 Interest expense 15,000 Management fees Other expenses 565,000‾1,040,000‾5,810,0002,195,000 Net income ( loss) 750,000(525,000)‾\begin{array}{c}\text {Statement of Comprehensive Income }\\\text {Year Ended August 31, 20X7}\\\\\begin{array}{|l|r|r|}\hline &\text { High } & \text { Low } \\&\$ & \$\\\hline \text { Sales } & 6,560,000 & 1,540,000 \\\hline \text { Gain on sale of land } & 0 & 115,000 \\\hline \text { Interest income } & 0 & 15,000 \\\hline & 6,560,000 & 1,670,000 \\\hline \text { Cost of sales } & 4,980,000 & 1,030,000 \\\hline \text { Depreciation and amortization expenses } & 250,000 & 125,000 \\\hline \text { Interest expense } & 15,000 & \\\hline \text { Management fees } & & \\\hline \text { Other expenses } & \underline{565,000} & \underline{1,040,000} \\\hline & 5,810,000 & 2,195,000 \\\hline \text { Net income }(\text { loss) } & 750,000 & \underline{(525,000)} \\\hline\end{array}\end{array}Statement of Comprehensive Income Year Ended August 31, 20X7 Sales Gain on sale of land Interest income Cost of sales Depreciation and amortization expenses Interest expense Management fees Other expenses Net income ( loss) High $6,560,000006,560,0004,980,000250,00015,000565,0005,810,000750,000 Low $1,540,000115,00015,0001,670,0001,030,000125,0001,040,0002,195,000(525,000) Required:

Statement of Comprehensive Income Year Ended August 31, 20X7 High Low $$ Sales 6,560,0001,540,000 Gain on sale of land 0115,000 Interest income 015,0006,560,0001,670,000 Cost of sales 4,980,0001,030,000 Depreciation and amortization expenses 250,000125,000 Interest expense 15,000 Management fees Other expenses 565,000‾1,040,000‾5,810,0002,195,000 Net income ( loss) 750,000(525,000)‾\begin{array}{c}\text {Statement of Comprehensive Income }\\\text {Year Ended August 31, 20X7}\\\\\begin{array}{|l|r|r|}\hline &\text { High } & \text { Low } \\&\$ & \$\\\hline \text { Sales } & 6,560,000 & 1,540,000 \\\hline \text { Gain on sale of land } & 0 & 115,000 \\\hline \text { Interest income } & 0 & 15,000 \\\hline & 6,560,000 & 1,670,000 \\\hline \text { Cost of sales } & 4,980,000 & 1,030,000 \\\hline \text { Depreciation and amortization expenses } & 250,000 & 125,000 \\\hline \text { Interest expense } & 15,000 & \\\hline \text { Management fees } & & \\\hline \text { Other expenses } & \underline{565,000} & \underline{1,040,000} \\\hline & 5,810,000 & 2,195,000 \\\hline \text { Net income }(\text { loss) } & 750,000 & \underline{(525,000)} \\\hline\end{array}\end{array}Statement of Comprehensive Income Year Ended August 31, 20X7 Sales Gain on sale of land Interest income Cost of sales Depreciation and amortization expenses Interest expense Management fees Other expenses Net income ( loss) High $6,560,000006,560,0004,980,000250,00015,000565,0005,810,000750,000 Low $1,540,000115,00015,0001,670,0001,030,000125,0001,040,0002,195,000(525,000) Required:Calculate the balances for the following consolidated balances of High assuming High uses the parent-company extension method approach:

a. Goodwill at August 31, 20X5

b. Retained earnings at August 31, 20X7

c. Brand name, net, at August 31, 20X7.

On Jun 12, 2024

CB

Answered

A ______ is a nondepository financial institution that has the ability to provide higher returns,albeit with greater risk.

A) yearling

B) blue chip

C) hedge fund

D) mutual fund

A) yearling

B) blue chip

C) hedge fund

D) mutual fund

On May 16, 2024

C

CB

Answered

Design a methodologically sound study that you could use to validate,experimentally,the effectiveness of group therapy.

On May 13, 2024

To validate the effectiveness of group therapy experimentally, a methodologically sound study could be designed as follows:

1. Randomized Controlled Trial (RCT): The study would involve randomly assigning participants to either a group therapy intervention or a control group that receives no therapy or an alternative form of therapy. Randomization helps to ensure that any observed differences in outcomes between the groups can be attributed to the group therapy intervention.

2. Inclusion and Exclusion Criteria: Clear inclusion and exclusion criteria would be established to ensure that the participants in the study have similar characteristics and are suitable for group therapy. This would help to control for potential confounding variables.

3. Outcome Measures: Objective and validated outcome measures would be used to assess the effectiveness of group therapy. These measures could include changes in symptoms, quality of life, functioning, and satisfaction with the therapy.

4. Blinding: To minimize bias, researchers and participants could be blinded to the group assignment. This could be achieved by using independent assessors who are unaware of the participants' group assignment to collect outcome data.

5. Sample Size Calculation: A sample size calculation would be conducted to determine the number of participants needed to detect a meaningful difference in outcomes between the group therapy and control groups.

6. Statistical Analysis: Appropriate statistical analyses, such as t-tests or ANOVA, would be used to compare the outcomes of the group therapy and control groups. Additionally, intention-to-treat analysis would be employed to account for potential dropouts and non-compliance.

7. Ethical Considerations: The study would adhere to ethical guidelines, including obtaining informed consent from participants, ensuring confidentiality, and minimizing any potential harm.

By following these methodological principles, the study would provide robust evidence regarding the effectiveness of group therapy, which could inform clinical practice and policy decisions.

1. Randomized Controlled Trial (RCT): The study would involve randomly assigning participants to either a group therapy intervention or a control group that receives no therapy or an alternative form of therapy. Randomization helps to ensure that any observed differences in outcomes between the groups can be attributed to the group therapy intervention.

2. Inclusion and Exclusion Criteria: Clear inclusion and exclusion criteria would be established to ensure that the participants in the study have similar characteristics and are suitable for group therapy. This would help to control for potential confounding variables.

3. Outcome Measures: Objective and validated outcome measures would be used to assess the effectiveness of group therapy. These measures could include changes in symptoms, quality of life, functioning, and satisfaction with the therapy.

4. Blinding: To minimize bias, researchers and participants could be blinded to the group assignment. This could be achieved by using independent assessors who are unaware of the participants' group assignment to collect outcome data.

5. Sample Size Calculation: A sample size calculation would be conducted to determine the number of participants needed to detect a meaningful difference in outcomes between the group therapy and control groups.

6. Statistical Analysis: Appropriate statistical analyses, such as t-tests or ANOVA, would be used to compare the outcomes of the group therapy and control groups. Additionally, intention-to-treat analysis would be employed to account for potential dropouts and non-compliance.

7. Ethical Considerations: The study would adhere to ethical guidelines, including obtaining informed consent from participants, ensuring confidentiality, and minimizing any potential harm.

By following these methodological principles, the study would provide robust evidence regarding the effectiveness of group therapy, which could inform clinical practice and policy decisions.