CL

Caroline Livingston

Answers (6)

CL

Answered

At the end of a period (before adjustment), Allowance for Doubtful Accounts has a credit balance of $250. The credit sales for the period total $500,000. If the company estimates uncollectible accounts expense at 1% of credit sales, the amount of bad debt expense to be recorded in an adjusting entry is $4,750.

On Jul 12, 2024

False

CL

Answered

Mean charts and range charts complement one another, one detecting shifts in process average, the other detecting shifts in process dispersion.

On Jul 10, 2024

True

CL

Answered

Mike,Randy,and Steve are partners of a partnership.Mike and Steve loan the partnership $10,000 each.Which of the following statements is true?

A) Randy is a debtor of the partnership.

B) Mike and Steve are the sole owners of the partnership.

C) Mike and Steve are both owners and creditors of the partnership.

D) Mike,Randy,and Steve are all owners and creditors of the partnership.

A) Randy is a debtor of the partnership.

B) Mike and Steve are the sole owners of the partnership.

C) Mike and Steve are both owners and creditors of the partnership.

D) Mike,Randy,and Steve are all owners and creditors of the partnership.

On Jun 12, 2024

C

CL

Answered

The Naples Police Dept.(NPD) has 55 officers and 30 support personnel.NPD has just adopted new hiring standards for new police officers.These include a minimum height of 5'8" and a minimum weight of 160 pounds.Susan is a recent graduate with a Bachelor's Degree in Police Science.She wants to get a job as a police officer in Naples.However Susan is only 5'5" and weighs 130 pounds.If Susan brings a legal challenge to NPD's new hiring standards,what legal basis might she have?

A) Disparate treatment

B) Disparate impact

C) Irrational standards

D) Irrational policy

A) Disparate treatment

B) Disparate impact

C) Irrational standards

D) Irrational policy

On Jun 10, 2024

B

CL

Answered

In using the net present value approach a project is acceptable if the project's net present value is ____________ or _______________.

On May 13, 2024

zero positive

CL

Answered

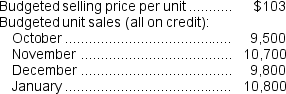

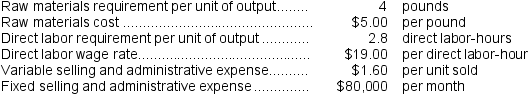

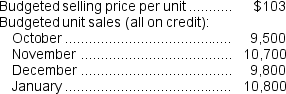

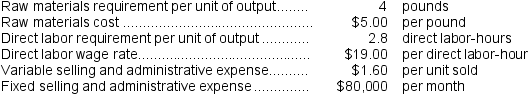

Mumbower Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

Credit sales are collected:

Credit sales are collected:

40% in the month of the sale

60% in the following month

Raw materials purchases are paid:

40% in the month of purchase

60% in the following month

The ending finished goods inventory should equal 20% of the following month's sales.The ending raw materials inventory should equal 40% of the following month's raw materials production needs.

Required:

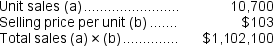

a.What are the budgeted sales for November?

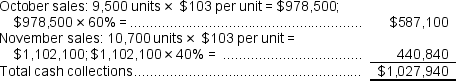

b.What are the expected cash collections for November?

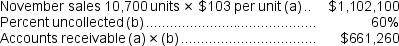

c.What is the budgeted accounts receivable balance at the end of November?

d.According to the production budget, how many units should be produced in November?

e.If 40,000 pounds of raw materials are needed for production in December, how many pounds of raw materials should be purchased in November?

f.What is the estimated cost of raw materials purchases for November?

g.If the cost of raw material purchases in October is $201,040, then in November what are the total estimated cash disbursements for raw materials purchases?

h.What is the estimated accounts payable balance at the end of November?

i.What is the estimated raw materials inventory balance at the end of November?

j.What is the total estimated direct labor cost for November assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?

k.For simplicity, we will assume that there is no fixed manufacturing overhead and that the variable manufacturing overhead is $7.00 per direct labor-hour.What is the estimated unit product cost?

l.What is the estimated finished goods inventory balance at the end of November?

m.What is the estimated cost of goods sold and gross margin for November?

n.What is the estimated total selling and administrative expense for November?

o.What is the estimated net operating income for November?

Credit sales are collected:

Credit sales are collected:40% in the month of the sale

60% in the following month

Raw materials purchases are paid:

40% in the month of purchase

60% in the following month

The ending finished goods inventory should equal 20% of the following month's sales.The ending raw materials inventory should equal 40% of the following month's raw materials production needs.

Required:

a.What are the budgeted sales for November?

b.What are the expected cash collections for November?

c.What is the budgeted accounts receivable balance at the end of November?

d.According to the production budget, how many units should be produced in November?

e.If 40,000 pounds of raw materials are needed for production in December, how many pounds of raw materials should be purchased in November?

f.What is the estimated cost of raw materials purchases for November?

g.If the cost of raw material purchases in October is $201,040, then in November what are the total estimated cash disbursements for raw materials purchases?

h.What is the estimated accounts payable balance at the end of November?

i.What is the estimated raw materials inventory balance at the end of November?

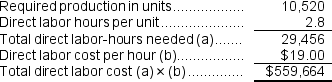

j.What is the total estimated direct labor cost for November assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?

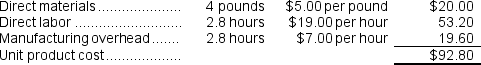

k.For simplicity, we will assume that there is no fixed manufacturing overhead and that the variable manufacturing overhead is $7.00 per direct labor-hour.What is the estimated unit product cost?

l.What is the estimated finished goods inventory balance at the end of November?

m.What is the estimated cost of goods sold and gross margin for November?

n.What is the estimated total selling and administrative expense for November?

o.What is the estimated net operating income for November?

On May 11, 2024

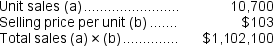

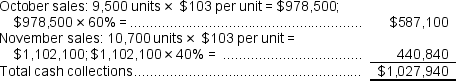

a.The budgeted sales for November are computed as follows:  b.The expected cash collections for November are computed as follows:

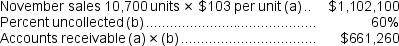

b.The expected cash collections for November are computed as follows:  c.The budgeted accounts receivable balance at the end of November is:

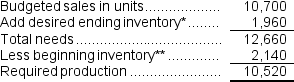

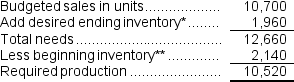

c.The budgeted accounts receivable balance at the end of November is:  d.The budgeted required production for November is computed as follows:

d.The budgeted required production for November is computed as follows:  *December sales of 9,800 units × 20% = 1,960 units

*December sales of 9,800 units × 20% = 1,960 units

** November sales of 10,700 units × 20%= 2,140 units

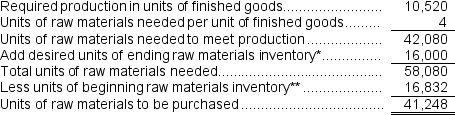

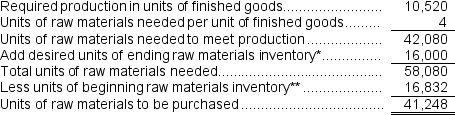

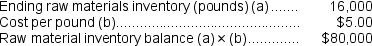

e.The budgeted raw material purchases for November are computed as follows: * 40,000 pounds × 40% = 16,000 pounds.

* 40,000 pounds × 40% = 16,000 pounds.

** 42,080 pounds × 40% = 16,832 pounds.

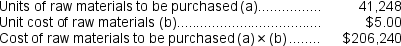

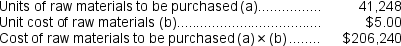

f.The budgeted cost of raw material purchases for November is computed as follows: g.The estimated cash disbursements for materials purchases in November is computed as follows:

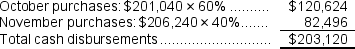

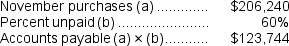

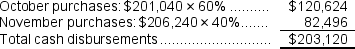

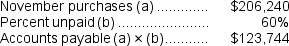

g.The estimated cash disbursements for materials purchases in November is computed as follows:  h.The budgeted accounts payable balance at the end of November is:

h.The budgeted accounts payable balance at the end of November is:  i.The estimated raw materials inventory balance at the end of November is computed as follows:

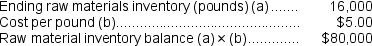

i.The estimated raw materials inventory balance at the end of November is computed as follows:  j.The estimated direct labor cost for November is computed as follows:

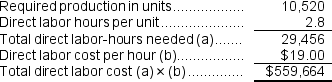

j.The estimated direct labor cost for November is computed as follows:  k.The estimated unit product cost is computed as follows:

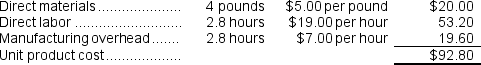

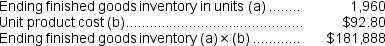

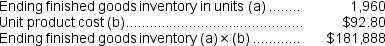

k.The estimated unit product cost is computed as follows:  l.The estimated finished goods inventory balance at the end of November is computed as follows:

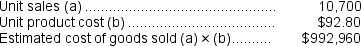

l.The estimated finished goods inventory balance at the end of November is computed as follows:  m.The estimated cost of goods sold for November is computed as follows:

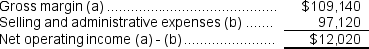

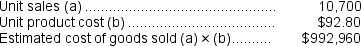

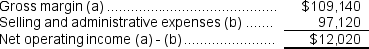

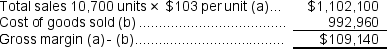

m.The estimated cost of goods sold for November is computed as follows:  The estimated gross margin for November is computed as follows:

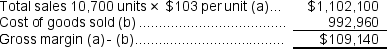

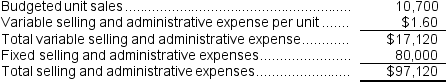

The estimated gross margin for November is computed as follows:  n.The estimated selling and administrative expense for November is computed as follows:

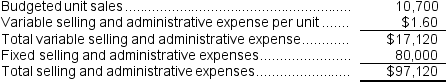

n.The estimated selling and administrative expense for November is computed as follows:  o.The estimated net operating income for November is computed as follows:

o.The estimated net operating income for November is computed as follows:

b.The expected cash collections for November are computed as follows:

b.The expected cash collections for November are computed as follows:  c.The budgeted accounts receivable balance at the end of November is:

c.The budgeted accounts receivable balance at the end of November is:  d.The budgeted required production for November is computed as follows:

d.The budgeted required production for November is computed as follows:  *December sales of 9,800 units × 20% = 1,960 units

*December sales of 9,800 units × 20% = 1,960 units** November sales of 10,700 units × 20%= 2,140 units

e.The budgeted raw material purchases for November are computed as follows:

* 40,000 pounds × 40% = 16,000 pounds.

* 40,000 pounds × 40% = 16,000 pounds.** 42,080 pounds × 40% = 16,832 pounds.

f.The budgeted cost of raw material purchases for November is computed as follows:

g.The estimated cash disbursements for materials purchases in November is computed as follows:

g.The estimated cash disbursements for materials purchases in November is computed as follows:  h.The budgeted accounts payable balance at the end of November is:

h.The budgeted accounts payable balance at the end of November is:  i.The estimated raw materials inventory balance at the end of November is computed as follows:

i.The estimated raw materials inventory balance at the end of November is computed as follows:  j.The estimated direct labor cost for November is computed as follows:

j.The estimated direct labor cost for November is computed as follows:  k.The estimated unit product cost is computed as follows:

k.The estimated unit product cost is computed as follows:  l.The estimated finished goods inventory balance at the end of November is computed as follows:

l.The estimated finished goods inventory balance at the end of November is computed as follows:  m.The estimated cost of goods sold for November is computed as follows:

m.The estimated cost of goods sold for November is computed as follows:  The estimated gross margin for November is computed as follows:

The estimated gross margin for November is computed as follows:  n.The estimated selling and administrative expense for November is computed as follows:

n.The estimated selling and administrative expense for November is computed as follows:  o.The estimated net operating income for November is computed as follows:

o.The estimated net operating income for November is computed as follows: