CJ

Charlotte Jerome

Answers (6)

CJ

Answered

A maximum wage law,as opposed to a minimum wage law,would be considered a

A) price ceiling.

B) price floor.

C) tax on businesses.

D) sales tax.

A) price ceiling.

B) price floor.

C) tax on businesses.

D) sales tax.

On Jul 24, 2024

A

CJ

Answered

______ is when one positive or negative characteristic dominants the way that person is viewed by others.

A) Perceptual defense

B) Stereotyping

C) Halo effect

D) Projection

A) Perceptual defense

B) Stereotyping

C) Halo effect

D) Projection

On Jul 21, 2024

C

CJ

Answered

The two-way flow of communication between a salesperson and a customer that is paid for by the firm and seeks to influence the customer's purchase decision is referred to as

A) public relations.

B) advertising.

C) personal selling.

D) sales promotion.

E) publicity.

A) public relations.

B) advertising.

C) personal selling.

D) sales promotion.

E) publicity.

On Jun 24, 2024

C

CJ

Answered

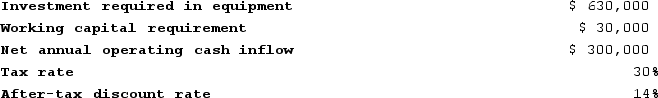

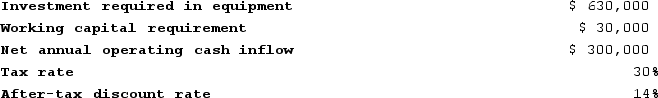

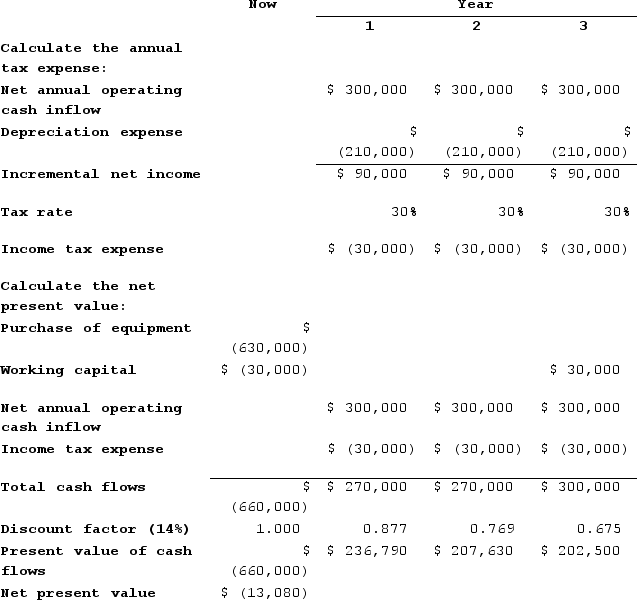

Ariel Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!On Jun 21, 2024

CJ

Answered

________ is the actual or implied receipt and retention of that which is tendered or offered.

A) Consideration

B) Capacity

C) Acceptance

D) Quasi-contract

A) Consideration

B) Capacity

C) Acceptance

D) Quasi-contract

On May 25, 2024

C

CJ

Answered

One problem with the transformational leadership perspective is that specific elements within it are culture-bound.

On May 22, 2024

True