CM

Collin Meier

Answers (4)

CM

Answered

The classification and normal balance of the accounts payable account are

A) asset, credit balance

B) liability, credit balance

C) owner's equity, credit balance

D) revenue, credit balance

A) asset, credit balance

B) liability, credit balance

C) owner's equity, credit balance

D) revenue, credit balance

On Jun 21, 2024

B

CM

Answered

A study of 356 decisions in medium to large organizations found that ________ of them failed.

On Jun 18, 2024

half

CM

Answered

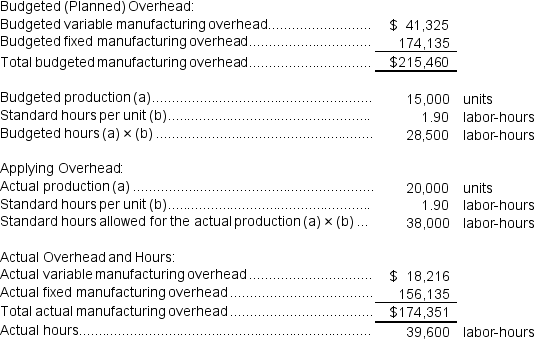

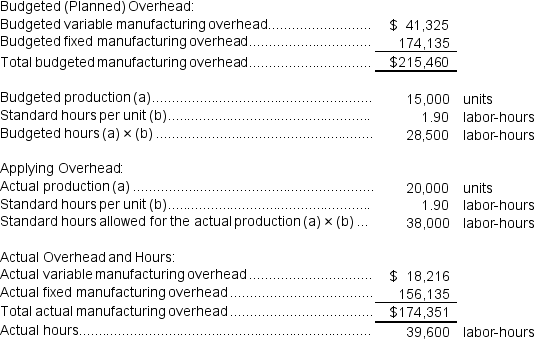

Edlow Incorporated makes a single product--a critical part used in commercial airline seats.The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period.Data concerning the most recent year appear below:  Required:

Required:

a.Determine the variable overhead rate variance for the year.

b.Determine the variable overhead efficiency variance for the year.

c.Determine the fixed overhead budget variance for the year.

d.Determine the fixed overhead volume variance for the year.

Required:

Required:a.Determine the variable overhead rate variance for the year.

b.Determine the variable overhead efficiency variance for the year.

c.Determine the fixed overhead budget variance for the year.

d.Determine the fixed overhead volume variance for the year.

On May 21, 2024

a.Variable component of the predetermined overhead rate (SR)= $41,325/28,500 labor-hours

= $1.45 per labor-hour

Variable overhead rate variance = (AH × AR)- (AH × SR)

= ($18,216)- (39,600 labor-hours × $1.45 per labor-hour)

= ($18,216)- ($57,420)

= $39,204 F

b.Labor efficiency variance = (AH - SH)× SR

= (39,600 labor-hours - 38,000 labor-hours)× $1.45 per labor-hour

= (1,600 labor-hours)× $1.45 per labor-hour

= $2,320 U

c.Budget variance = Actual fixed overhead - Budgeted fixed overhead

= $156,135 - $174,135 = $18,000 F

d.Fixed component of the predetermined overhead rate = $174,135/28,500 labor-hours

= $6.11 per labor-hour

Volume variance = Budgeted fixed overhead - Fixed overhead applied to work in process

= $174,135 - ($6.11 per labor-hour × 38,000 labor-hours)

= $174,135 - ($232,180)

= $58,045 F

or

Volume variance = Fixed component of the predetermined overhead rate x (Denominator hours - Standard hours allowed for the actual output)

= $6.11 per labor-hour x (28,500 labor-hours - 38,000 labor-hours)

= $6.11 per labor-hour x (28,500 labor-hours - 38,000 labor-hours)

= $6.11 per labor-hour x (-9,500 hours)

= $58,045 F

= $1.45 per labor-hour

Variable overhead rate variance = (AH × AR)- (AH × SR)

= ($18,216)- (39,600 labor-hours × $1.45 per labor-hour)

= ($18,216)- ($57,420)

= $39,204 F

b.Labor efficiency variance = (AH - SH)× SR

= (39,600 labor-hours - 38,000 labor-hours)× $1.45 per labor-hour

= (1,600 labor-hours)× $1.45 per labor-hour

= $2,320 U

c.Budget variance = Actual fixed overhead - Budgeted fixed overhead

= $156,135 - $174,135 = $18,000 F

d.Fixed component of the predetermined overhead rate = $174,135/28,500 labor-hours

= $6.11 per labor-hour

Volume variance = Budgeted fixed overhead - Fixed overhead applied to work in process

= $174,135 - ($6.11 per labor-hour × 38,000 labor-hours)

= $174,135 - ($232,180)

= $58,045 F

or

Volume variance = Fixed component of the predetermined overhead rate x (Denominator hours - Standard hours allowed for the actual output)

= $6.11 per labor-hour x (28,500 labor-hours - 38,000 labor-hours)

= $6.11 per labor-hour x (28,500 labor-hours - 38,000 labor-hours)

= $6.11 per labor-hour x (-9,500 hours)

= $58,045 F

CM

Answered

The inventory method where items in the ending inventory will be valued at the costs shown on the most recent invoices is:

A) LIFO.

B) specific invoice.

C) FIFO.

D) weighted-average.

A) LIFO.

B) specific invoice.

C) FIFO.

D) weighted-average.

On May 18, 2024

C