CC

Courtney Callahan

Answers (4)

CC

Answered

Activity-based costing is a method of accumulating and allocating costs by department.

On Jun 21, 2024

False

CC

Answered

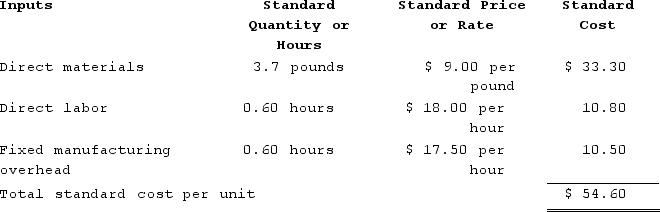

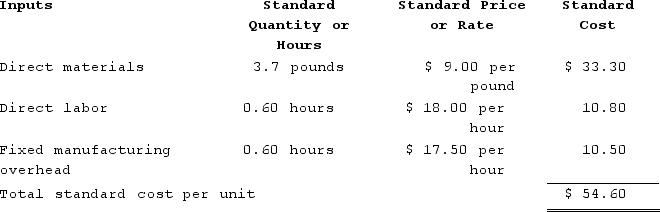

Scogin Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. The standard cost card for the company's only product is as follows:  During the year, the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text. On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and Property, Plant, and Equipment (net) . All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.When recording the raw materials used in production, the Work in Process inventory account will increase (decrease) by:

During the year, the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text. On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and Property, Plant, and Equipment (net) . All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.When recording the raw materials used in production, the Work in Process inventory account will increase (decrease) by:

A) ($646,020)

B) $646,020

C) ($646,920)

D) $646,920

During the year, the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text. On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and Property, Plant, and Equipment (net) . All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.When recording the raw materials used in production, the Work in Process inventory account will increase (decrease) by:

During the year, the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text. On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and Property, Plant, and Equipment (net) . All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.When recording the raw materials used in production, the Work in Process inventory account will increase (decrease) by:A) ($646,020)

B) $646,020

C) ($646,920)

D) $646,920

On Jun 20, 2024

B

CC

Answered

Suppose a recent increase in federal gasoline taxes is estimated to cause a $150 million reduction in the total surplus (consumer plus producer surplus) in the gasoline market. If tax revenues increased by $100 million, what is the deadweight loss associated with the tax? As a result of the tax, 10,000 people sold their cars and started riding their bicycles to work. How much of the burden of the deadweight loss is incurred by the bicycle riders?

On May 22, 2024

The direct deadweight loss is $50 million. It is impossible to determine how much of the loss is borne by bicycle riders without more information. For example, some of the deadweight loss may be attributable to walkers or people who switched to public transportation.

CC

Answered

__________ focuses on the strategic question: In what industries and markets should we compete?

A) Competitive strategy

B) Environmental strategy

C) Corporate strategy

D) Capital strategy

E) Business strategy

A) Competitive strategy

B) Environmental strategy

C) Corporate strategy

D) Capital strategy

E) Business strategy

On May 21, 2024

C