DC

Destiny Cavins

Answers (7)

DC

Answered

A performance appraisal evaluator who was using the anniversary model would perform evaluations:

A) at the end of every fiscal year

B) when specific projects were concluded

C) according to when employees joined the organization

D) according to the hierarchical levels of the organization

E) every time the employee needed reinforcement

A) at the end of every fiscal year

B) when specific projects were concluded

C) according to when employees joined the organization

D) according to the hierarchical levels of the organization

E) every time the employee needed reinforcement

On Jul 24, 2024

C

DC

Answered

Granting discounts for cash sales will tend to decrease the accounts receivable period.

On Jul 24, 2024

True

DC

Answered

Section 16(b) of the 1934 Act differs from Rule 10b-5 in that the latter:

A) applies to transfers within 6 months of each other.

B) only applies to officers, and directors.

C) requires material inside information.

D) only applies to 10% shareholders.

A) applies to transfers within 6 months of each other.

B) only applies to officers, and directors.

C) requires material inside information.

D) only applies to 10% shareholders.

On Jul 23, 2024

C

DC

Answered

Jack is severely injured in an accident at work and believes he is going to die. He tells his friend and co-worker, Diane, that she can have his car after he is dead. However, Jack makes a full recovery. Because he did not die, his gift of the car to Diane will be automatically revoked.

On Jun 24, 2024

True

DC

Answered

The free cash flow to the firm is reported as $198 million. The interest expense to the firm is $15 million. If the tax rate is 35% and the net debt of the firm increased by $20 million, what is the approximate market value of the firm if the FCFE grows at 3% and the cost of equity is 14%?

A) $1,950 billion

B) $2,497 billion

C) $2,585 billion

D) $3,098 billion

A) $1,950 billion

B) $2,497 billion

C) $2,585 billion

D) $3,098 billion

On Jun 23, 2024

A

DC

Answered

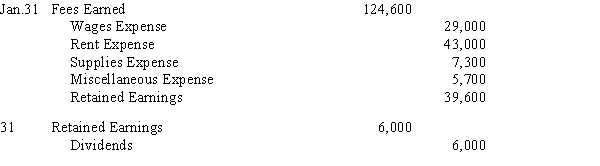

After the accounts have been adjusted on January 31, the end of the fiscal year, the following balances are taken from the ledger of Harrison's Dog Walking Service Company:  Journalize the two entries required to close the accounts

Journalize the two entries required to close the accounts

Journalize the two entries required to close the accounts

Journalize the two entries required to close the accountsOn May 25, 2024

DC

Answered

Under the sales revenue approach,no bad debt expense is recorded when a specific account (known to be uncollectible)is written off.

On May 24, 2024

True