DS

Dorreen San Pedro

Answers (6)

DS

Answered

Which of the following is not an example of a cost that varies in total as the number of units produced changes?

A) electricity per KWH to operate factory equipment

B) direct materials cost

C) insurance premiums on factory building

D) wages of assembly worker

A) electricity per KWH to operate factory equipment

B) direct materials cost

C) insurance premiums on factory building

D) wages of assembly worker

On Jul 21, 2024

C

DS

Answered

Compared to traditional bank loans, microfinance loans

A) are much larger.

B) require collateral.

C) are made more frequently to women than to men.

D) have repayments that begin at a much later date.

A) are much larger.

B) require collateral.

C) are made more frequently to women than to men.

D) have repayments that begin at a much later date.

On Jul 20, 2024

C

DS

Answered

A manager directs,controls,and plans the work of others and is responsible for results.

On Jun 21, 2024

True

DS

Answered

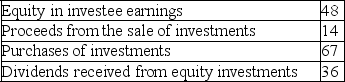

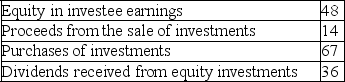

During 2019,the following items were reported on The Mickey Company's statement of cash flows in millions of dollars.

For each item,identify the type of activity it is (operating,investing,financing)and the effect it would have on the statement of cash flows.The operating activities section is prepared using the indirect method.Enter "+" if the item is added or "-" if the item is subtracted.Do not enter dollar amounts.

For each item,identify the type of activity it is (operating,investing,financing)and the effect it would have on the statement of cash flows.The operating activities section is prepared using the indirect method.Enter "+" if the item is added or "-" if the item is subtracted.Do not enter dollar amounts.

On Jun 20, 2024

DS

Answered

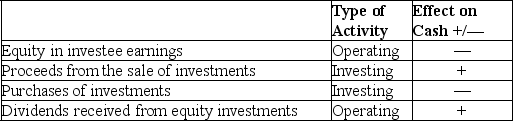

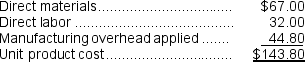

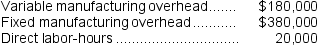

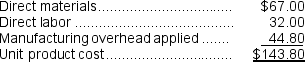

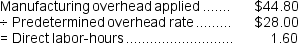

Mcniff Corporation makes a range of products.The company's predetermined overhead rate is $28 per direct labor-hour, which was calculated using the following budgeted data:  Management is considering a special order for 200 units of product O96S at $122 each.The normal selling price of product O96S is $149 and the unit product cost is determined as follows:

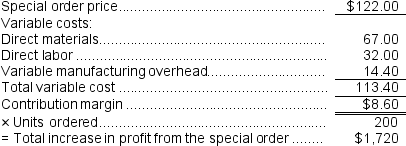

Management is considering a special order for 200 units of product O96S at $122 each.The normal selling price of product O96S is $149 and the unit product cost is determined as follows:  If the special order were accepted, normal sales of this and other products would not be affected.The company has ample excess capacity to produce the additional units.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.

If the special order were accepted, normal sales of this and other products would not be affected.The company has ample excess capacity to produce the additional units.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.

Required:

The financial advantage (disadvantage)for the company as a result of accepting this special order would be:

Management is considering a special order for 200 units of product O96S at $122 each.The normal selling price of product O96S is $149 and the unit product cost is determined as follows:

Management is considering a special order for 200 units of product O96S at $122 each.The normal selling price of product O96S is $149 and the unit product cost is determined as follows:  If the special order were accepted, normal sales of this and other products would not be affected.The company has ample excess capacity to produce the additional units.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.

If the special order were accepted, normal sales of this and other products would not be affected.The company has ample excess capacity to produce the additional units.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:

The financial advantage (disadvantage)for the company as a result of accepting this special order would be:

On May 22, 2024

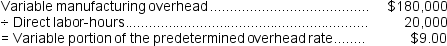

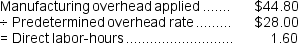

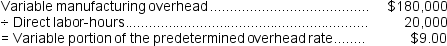

Direct materials, direct labor, and variable manufacturing overhead are relevant in this decision.Fixed manufacturing overhead is not relevant because it would not be affected by the decision.The variable portion of the manufacturing overhead rate is computed as follows:  The direct-labor hours per unit for the special order can be determined as follows:

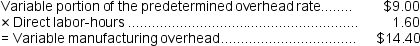

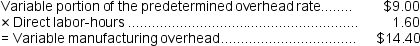

The direct-labor hours per unit for the special order can be determined as follows:  Consequently, the variable manufacturing overhead for the special order would be:

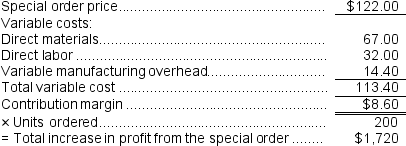

Consequently, the variable manufacturing overhead for the special order would be:  Putting this all together:

Putting this all together:

The direct-labor hours per unit for the special order can be determined as follows:

The direct-labor hours per unit for the special order can be determined as follows:  Consequently, the variable manufacturing overhead for the special order would be:

Consequently, the variable manufacturing overhead for the special order would be:  Putting this all together:

Putting this all together:

DS

Answered

Companies that believe in __________, realise that businesses around the world have much to share with and learn from one another.

A) transnational knowledge positioning

B) international trade

C) global organisational learning

D) cross-cultural management of intellectual property

E) expatriate knowledge sharing

A) transnational knowledge positioning

B) international trade

C) global organisational learning

D) cross-cultural management of intellectual property

E) expatriate knowledge sharing

On May 21, 2024

C