DA

Dylan Allmen

Answers (5)

DA

Answered

In recent decades, a number of countries with similar economic goals have formed transnational trade groups or signed trade agreements for the purpose of promoting free trade. Describe the two discussed in the text.

On Jun 07, 2024

(1) In 2018 the European Union (EU) consisted of 27 countries with more than 510 million consumers. The EU has eliminated most barriers to the free flow of products, services, capital, and labor across its borders. In addition, 16 countries have adopted the euro, eliminating the need to continually monitor the currency exchange rate.

(2) The North American Free Trade Agreement (NAFTA) lifted many trade barriers between Canada, Mexico, and the United States and created a marketplace with more than 485 million consumers.

(2) The North American Free Trade Agreement (NAFTA) lifted many trade barriers between Canada, Mexico, and the United States and created a marketplace with more than 485 million consumers.

DA

Answered

Anarchy is the fourth level of behavior on the violence continuum of the harm model of aggression.

On Jun 06, 2024

False

DA

Answered

Decision by lack of response occurs when one idea after another is suggested without discussing it, and then the team finally accepts an idea without any critical evaluation.

On May 07, 2024

True

DA

Answered

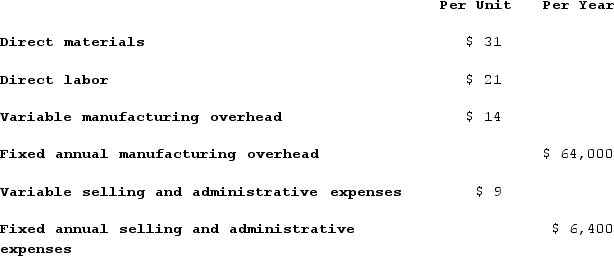

The management of Landstrom Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $560,000 and has a required return on investment of 10%.Required:a. Determine the unit product cost for the new product.b. Determine the markup percentage on absorption cost for the new product.c. Determine the selling price for the new product using the absorption costing approach. (Round your intermediate and final answer to 2 decimal places.)

Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $560,000 and has a required return on investment of 10%.Required:a. Determine the unit product cost for the new product.b. Determine the markup percentage on absorption cost for the new product.c. Determine the selling price for the new product using the absorption costing approach. (Round your intermediate and final answer to 2 decimal places.)

Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $560,000 and has a required return on investment of 10%.Required:a. Determine the unit product cost for the new product.b. Determine the markup percentage on absorption cost for the new product.c. Determine the selling price for the new product using the absorption costing approach. (Round your intermediate and final answer to 2 decimal places.)

Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $560,000 and has a required return on investment of 10%.Required:a. Determine the unit product cost for the new product.b. Determine the markup percentage on absorption cost for the new product.c. Determine the selling price for the new product using the absorption costing approach. (Round your intermediate and final answer to 2 decimal places.)On May 06, 2024

a. The unit product cost is:

![a. The unit product cost is: b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}% c. The selling price is determined as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62fc_017b_bf83_994e7b0d5906_TB8314_00.jpg) b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}%

b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}%

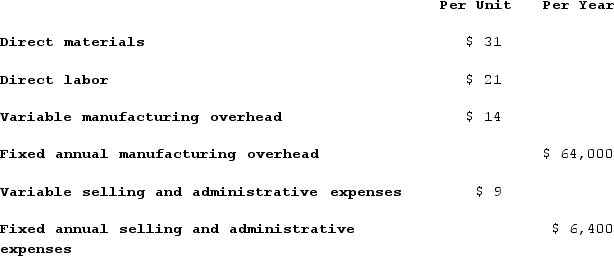

c. The selling price is determined as follows:

![a. The unit product cost is: b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}% c. The selling price is determined as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62fc_017c_bf83_77965db3b8ae_TB8314_00.jpg)

![a. The unit product cost is: b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}% c. The selling price is determined as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62fc_017b_bf83_994e7b0d5906_TB8314_00.jpg) b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}%

b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}%c. The selling price is determined as follows:

![a. The unit product cost is: b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}% c. The selling price is determined as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62fc_017c_bf83_77965db3b8ae_TB8314_00.jpg)