EA

Emily Ashby

Answers (4)

EA

Answered

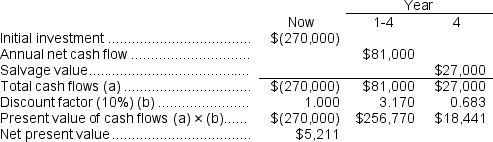

(Ignore income taxes in this problem.)Strausberg Inc.is considering investing in a project that would require an initial investment of $270,000.The life of the project would be 4 years.The annual net cash inflows from the project would be $81,000.The salvage value of the assets at the end of the project would be $27,000.The company uses a discount rate of 10%.

Required:

Compute the net present value of the project.

Required:

Compute the net present value of the project.

On May 08, 2024

EA

Answered

In the long run the perfect competitor's firm's most efficient output

A) is identical to its most profitable output.

B) is less than its most profitable output.

C) is more than its most profitable output.

A) is identical to its most profitable output.

B) is less than its most profitable output.

C) is more than its most profitable output.

On May 08, 2024

A

EA

Answered

Prior to changes in 2011,what was the main perceived attraction of income trusts?

A) reducing double taxation

B) unregulated business environment

C) fewer layers in the organizational structure

D) maintenance-free business assets

A) reducing double taxation

B) unregulated business environment

C) fewer layers in the organizational structure

D) maintenance-free business assets

On May 02, 2024

A

EA

Answered

Which of the following is not a breach of an agent's duty of obedience?

A) Entering into an unauthorized contract for which his or her principal is then liable.

B) Committing a tort for which the principal is now liable.

C) Improperly delegating her authority.

D) Not following a principal's instruction to misrepresent the quality of a competitor's goods to a potential customer.

A) Entering into an unauthorized contract for which his or her principal is then liable.

B) Committing a tort for which the principal is now liable.

C) Improperly delegating her authority.

D) Not following a principal's instruction to misrepresent the quality of a competitor's goods to a potential customer.

On Apr 29, 2024

D