GM

Gabriela Monserrat

Answers (8)

GM

Answered

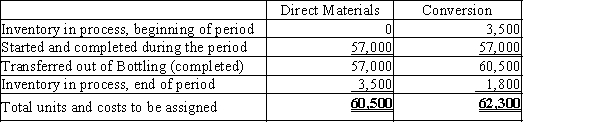

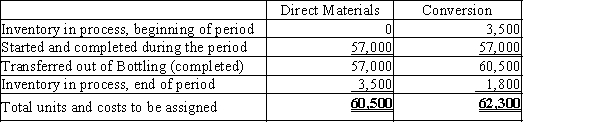

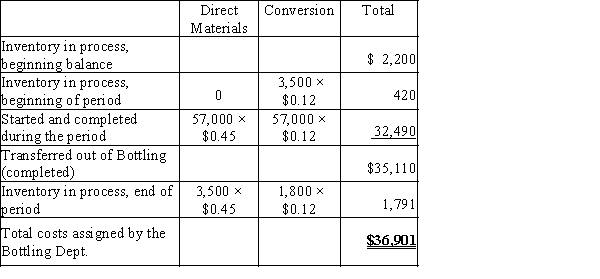

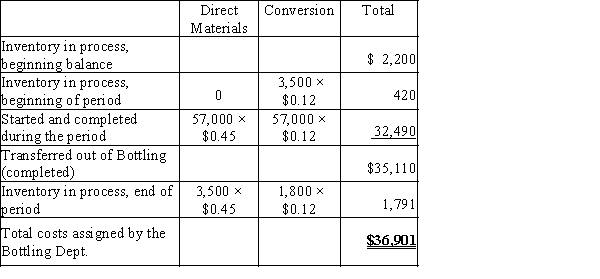

The cost per equivalent unit of direct materials and conversion in the Bottling Department of Mountain Springs Water Company is $0.45 and $0.12, respectively. The equivalent units to be assigned costs are as follows:  The beginning work in process inventory had a cost of $2,200. Determine the cost of completed and transferred out production and the ending work in process inventory.

The beginning work in process inventory had a cost of $2,200. Determine the cost of completed and transferred out production and the ending work in process inventory.

The beginning work in process inventory had a cost of $2,200. Determine the cost of completed and transferred out production and the ending work in process inventory.

The beginning work in process inventory had a cost of $2,200. Determine the cost of completed and transferred out production and the ending work in process inventory.On Aug 01, 2024

Completed and transferred out production$35,110Inventory in process, ending$1,791

Completed and transferred out production$35,110Inventory in process, ending$1,791

Completed and transferred out production$35,110Inventory in process, ending$1,791

Completed and transferred out production$35,110Inventory in process, ending$1,791GM

Answered

The dictator of a small country restricts the price of cars to an amount less than or equal to $1,200 (a price below the equilibrium price for cars) .Such a policy would set a:

A) price floor.

B) price ceiling.

C) quota.

D) tariff.

A) price floor.

B) price ceiling.

C) quota.

D) tariff.

On Jul 02, 2024

B

GM

Answered

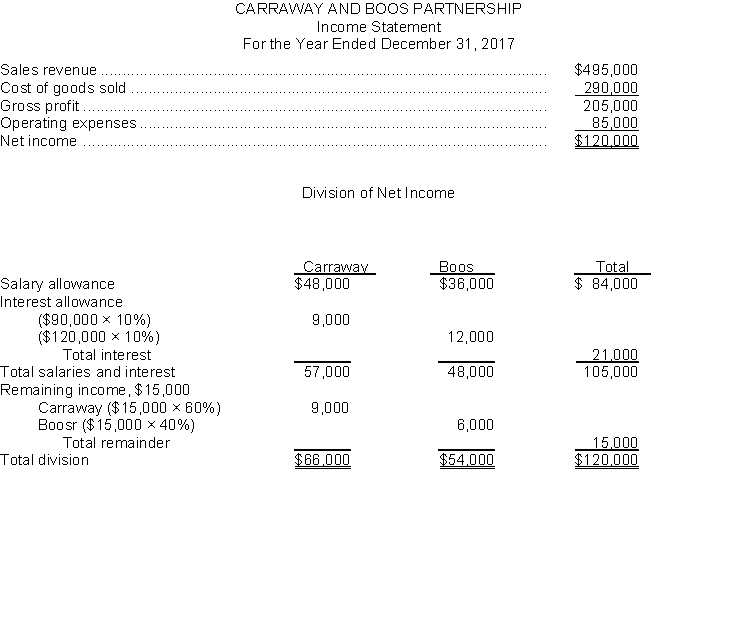

Carraway and Boos have a partnership agreement which includes the following provisions regarding sharing net income or net loss:

1. A salary allowance of $48000 to Carraway and $36000 to Boos.

2. An interest allowance of 10% on capital balances at the beginning of the year.

3. The remainder to be divided 60% to Carraway and 40% to Boos.

The capital balance on January 1 2017 for Carraway and Boos was $90000 and $120000 respectively. During 2017 the Carraway and Boos Partnership had sales of $495000 cost of goods sold of $290000 and operating expenses of $85000.

Instructions

Prepare an income statement for the Carraway and Boos Partnership for the year ended December 31 2017. As a part of the income statement include a Division of Net Income to each of the partners.

1. A salary allowance of $48000 to Carraway and $36000 to Boos.

2. An interest allowance of 10% on capital balances at the beginning of the year.

3. The remainder to be divided 60% to Carraway and 40% to Boos.

The capital balance on January 1 2017 for Carraway and Boos was $90000 and $120000 respectively. During 2017 the Carraway and Boos Partnership had sales of $495000 cost of goods sold of $290000 and operating expenses of $85000.

Instructions

Prepare an income statement for the Carraway and Boos Partnership for the year ended December 31 2017. As a part of the income statement include a Division of Net Income to each of the partners.

On Jul 01, 2024

GM

Answered

Donna is considering the option of becoming a co-owner in a business. Her investment choices are to hold a risk free asset that has a return of  and co-ownership of the business, which has a rate of return of

and co-ownership of the business, which has a rate of return of  and a level of risk of

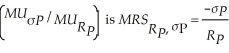

and a level of risk of  . Donna's marginal rate of substitution of return for risk

. Donna's marginal rate of substitution of return for risk  where

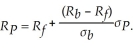

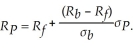

where  is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by

is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by  Solve for Donna's optimal portfolio rate of return and risk as a function of

Solve for Donna's optimal portfolio rate of return and risk as a function of  ,

,  and

and  . Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

. Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

Investment Rate of Return Risk

Risk Free 0.06 0

Business 0.25 0.39

and co-ownership of the business, which has a rate of return of

and co-ownership of the business, which has a rate of return of  and a level of risk of

and a level of risk of  . Donna's marginal rate of substitution of return for risk

. Donna's marginal rate of substitution of return for risk  where

where  is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by

is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by  Solve for Donna's optimal portfolio rate of return and risk as a function of

Solve for Donna's optimal portfolio rate of return and risk as a function of  ,

,  and

and  . Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

. Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.Investment Rate of Return Risk

Risk Free 0.06 0

Business 0.25 0.39

On Jun 02, 2024

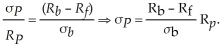

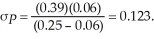

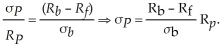

To find Donna's optimal portfolio return and portfolio risk, we need to first equate the slope of her indifference curve to the slope of her budget constraint. This implies  We may then substitute this level of portfolio risk into her budget constraint to find her optimal rate of return

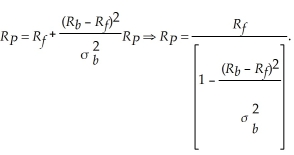

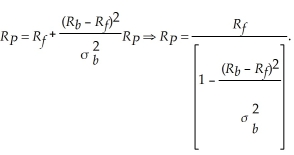

We may then substitute this level of portfolio risk into her budget constraint to find her optimal rate of return  We can plug this optimal portfolio return into the expression for portfolio risk above and get:

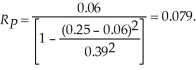

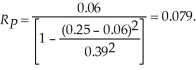

We can plug this optimal portfolio return into the expression for portfolio risk above and get:  Using the values from the table, we see that Donna's optimal portfolio return is

Using the values from the table, we see that Donna's optimal portfolio return is  Donna's optimal portfolio risk is

Donna's optimal portfolio risk is

We may then substitute this level of portfolio risk into her budget constraint to find her optimal rate of return

We may then substitute this level of portfolio risk into her budget constraint to find her optimal rate of return  We can plug this optimal portfolio return into the expression for portfolio risk above and get:

We can plug this optimal portfolio return into the expression for portfolio risk above and get:  Using the values from the table, we see that Donna's optimal portfolio return is

Using the values from the table, we see that Donna's optimal portfolio return is  Donna's optimal portfolio risk is

Donna's optimal portfolio risk is

GM

Answered

Which of the following is true regarding the rights of a trustee in a Chapter 7 bankruptcy?

A) The trustee may take possession of the debtor's property and have it appraised.

B) If someone else holds the debtor's property,the trustee has the power to require the person to return that property.

C) The trustee may temporarily take over the debtor's business.

D) The trustee may take possession of the debtor's property and have it appraised; if someone else holds the debtor's property,the trustee has the power to require the person to return that property; and the trustee may temporarily take over the debtor's business.

E) The trustee may take possession of the debtor's property and have it appraised,and if someone else holds the debtor's property,the trustee has the power to require the person to return that property; however,the trustee may not take over the debtor's business even temporarily.

A) The trustee may take possession of the debtor's property and have it appraised.

B) If someone else holds the debtor's property,the trustee has the power to require the person to return that property.

C) The trustee may temporarily take over the debtor's business.

D) The trustee may take possession of the debtor's property and have it appraised; if someone else holds the debtor's property,the trustee has the power to require the person to return that property; and the trustee may temporarily take over the debtor's business.

E) The trustee may take possession of the debtor's property and have it appraised,and if someone else holds the debtor's property,the trustee has the power to require the person to return that property; however,the trustee may not take over the debtor's business even temporarily.

On Jun 01, 2024

D

GM

Answered

A portfolio beta can be defined as the:

A) Weighted average of the betas of the individual securities within the portfolio.

B) Total of the betas of the individual securities within the portfolio.

C) Amount of unsystematic risk remaining after the portfolio is diversified.

D) Measure of the unsystematic risk of the portfolio relative to the level of market risk.

E) Measure of the total risk of the portfolio in excess of the level of market risk.

A) Weighted average of the betas of the individual securities within the portfolio.

B) Total of the betas of the individual securities within the portfolio.

C) Amount of unsystematic risk remaining after the portfolio is diversified.

D) Measure of the unsystematic risk of the portfolio relative to the level of market risk.

E) Measure of the total risk of the portfolio in excess of the level of market risk.

On May 03, 2024

A

GM

Answered

An organization that seeks in increase the cohesiveness of its teams can

A) communicate a communal perspective to the team by stressing unity.

B) institute a program of group-level rewards rather than individual bonuses.

C) arrange for the teams to undertake enjoyable team challenges,such as backpacking together.

D) decrease the diversity of the teams.

E) use all the methods listed here to increase cohesion.

A) communicate a communal perspective to the team by stressing unity.

B) institute a program of group-level rewards rather than individual bonuses.

C) arrange for the teams to undertake enjoyable team challenges,such as backpacking together.

D) decrease the diversity of the teams.

E) use all the methods listed here to increase cohesion.

On May 02, 2024

E