GJ

Gloria James

Answers (6)

GJ

Answered

The evidence suggests that taken collectively,taxes in the U.S.economy are:

A) extremely regressive.

B) extremely progressive.

C) somewhat progressive.

D) proportional.

A) extremely regressive.

B) extremely progressive.

C) somewhat progressive.

D) proportional.

On Jul 17, 2024

C

GJ

Answered

Stephen's Auto Body Shop (Oshawa) has a debt-equity ratio of.6, a total asset turnover of 1.43, and a profit margin of 5 %. The firm has a return on assets of _____ % and a return on equity of _____ %.

A) 7.15; 4.29

B) 7.15; 11.44

C) 8.58; 4.29

D) 8.58; 7.15

E) 11.44; 7.15

A) 7.15; 4.29

B) 7.15; 11.44

C) 8.58; 4.29

D) 8.58; 7.15

E) 11.44; 7.15

On Jul 14, 2024

B

GJ

Answered

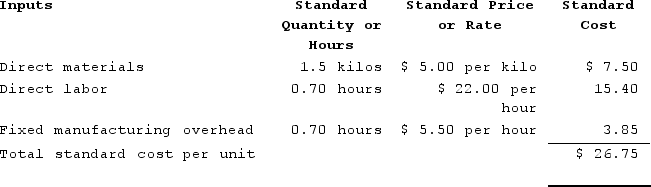

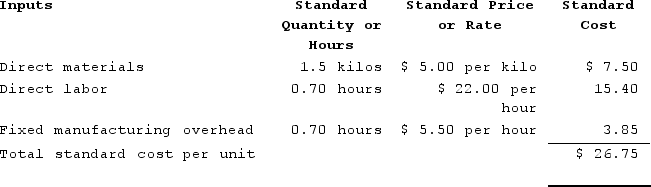

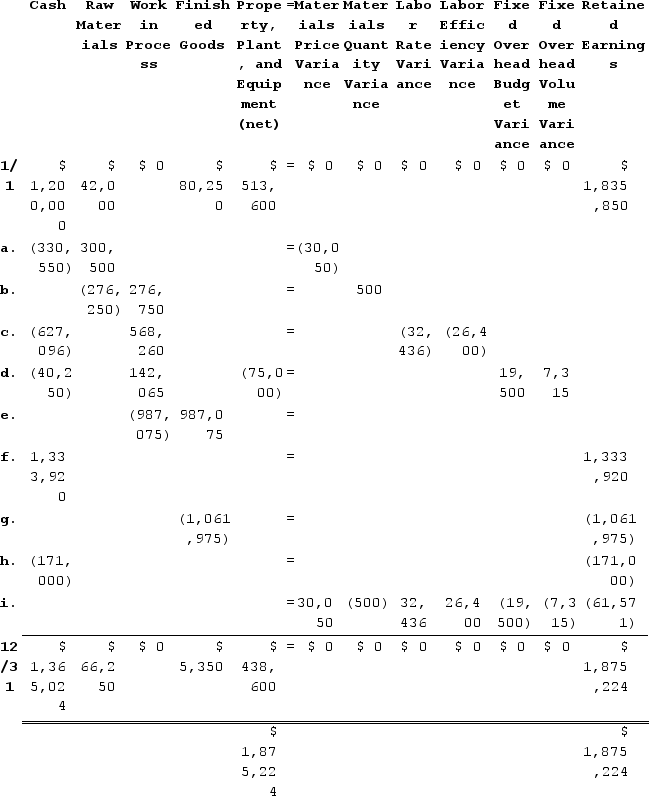

Lusher Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

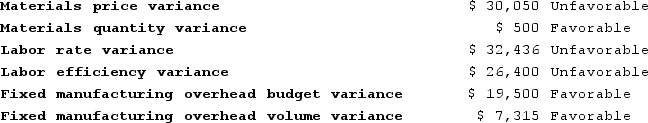

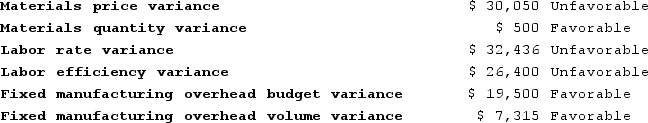

The company calculated the following variances for the year:

The company calculated the following variances for the year:

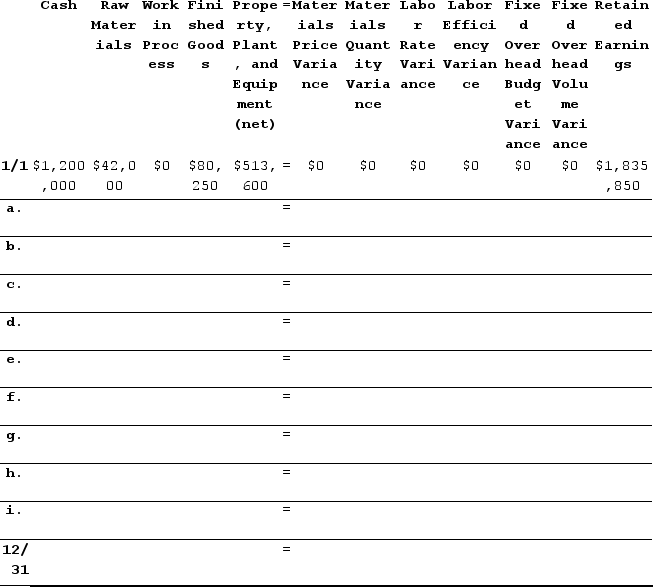

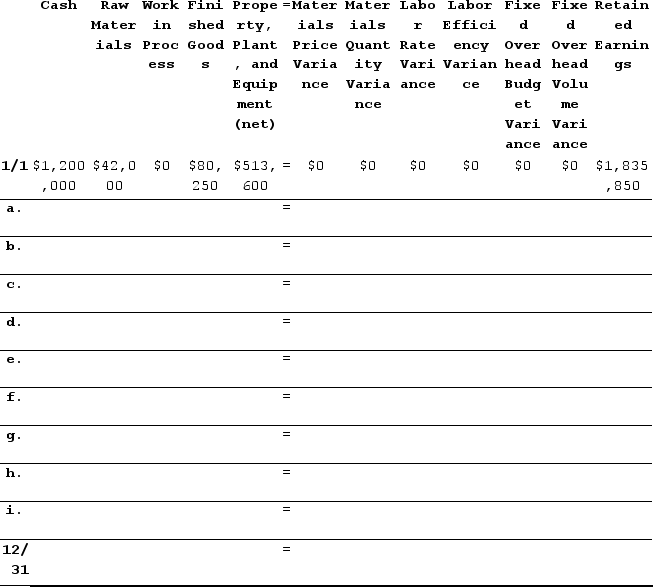

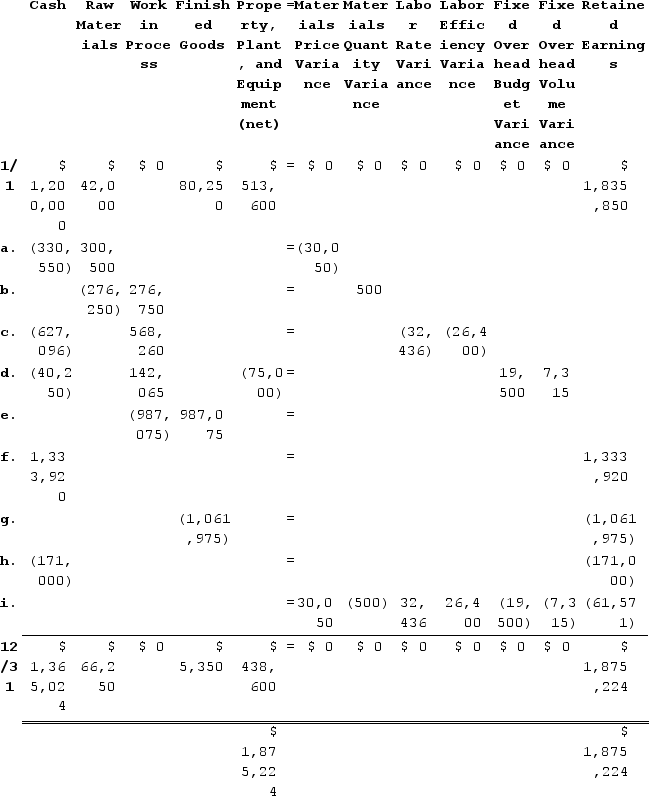

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $134,750 and budgeted activity of 24,500 hours.During the year, the company completed the following transactions:Purchased 60,100 kilos of raw material at a price of $5.50 per kilo.Used 55,250 kilos of the raw material to produce 36,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 27,030 hours at an average cost of $23.20 per hour.Applied fixed overhead to the 36,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $115,250. Of this total, $40,250 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment.Transferred 36,900 units from work in process to finished goods.Sold for cash 39,700 units to customers at a price of $33.60 per unit.Completed and transferred the standard cost associated with the 39,700 units sold from finished goods to cost of goods sold.Paid $171,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $134,750 and budgeted activity of 24,500 hours.During the year, the company completed the following transactions:Purchased 60,100 kilos of raw material at a price of $5.50 per kilo.Used 55,250 kilos of the raw material to produce 36,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 27,030 hours at an average cost of $23.20 per hour.Applied fixed overhead to the 36,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $115,250. Of this total, $40,250 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment.Transferred 36,900 units from work in process to finished goods.Sold for cash 39,700 units to customers at a price of $33.60 per unit.Completed and transferred the standard cost associated with the 39,700 units sold from finished goods to cost of goods sold.Paid $171,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

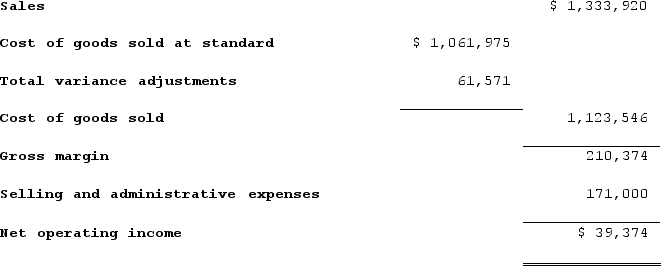

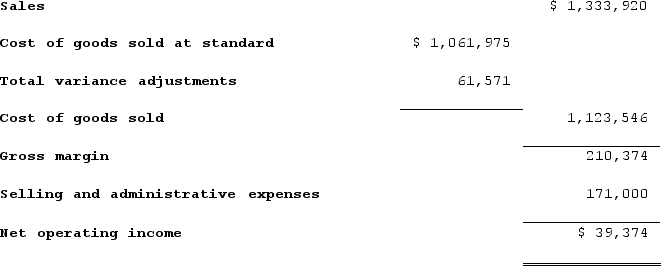

2. Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

2. Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

The company calculated the following variances for the year:

The company calculated the following variances for the year: The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $134,750 and budgeted activity of 24,500 hours.During the year, the company completed the following transactions:Purchased 60,100 kilos of raw material at a price of $5.50 per kilo.Used 55,250 kilos of the raw material to produce 36,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 27,030 hours at an average cost of $23.20 per hour.Applied fixed overhead to the 36,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $115,250. Of this total, $40,250 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment.Transferred 36,900 units from work in process to finished goods.Sold for cash 39,700 units to customers at a price of $33.60 per unit.Completed and transferred the standard cost associated with the 39,700 units sold from finished goods to cost of goods sold.Paid $171,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $134,750 and budgeted activity of 24,500 hours.During the year, the company completed the following transactions:Purchased 60,100 kilos of raw material at a price of $5.50 per kilo.Used 55,250 kilos of the raw material to produce 36,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 27,030 hours at an average cost of $23.20 per hour.Applied fixed overhead to the 36,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $115,250. Of this total, $40,250 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment.Transferred 36,900 units from work in process to finished goods.Sold for cash 39,700 units to customers at a price of $33.60 per unit.Completed and transferred the standard cost associated with the 39,700 units sold from finished goods to cost of goods sold.Paid $171,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net). 2. Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

2. Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.On Jun 17, 2024

1. and 2.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 60,100 kilos × $5.50 per kilo = $330,550. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 60,100 kilos × $5.00 per kilo = $300,500. The materials price variance is $30,050 Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 55,250 kilos × $5.00 per kilo = $276,250. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (36,900 units ×1.5 kilos per unit) × $5.00 per kilo = 55,350 kilos × $5.00 per kilo = $276,750. The difference is the Materials Quantity Variance which is $500 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 27,030 hours × $23.20 per hour = $627,096. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (36,900 units × 0.70 hours per unit) × $22.00 per hour = 25,830 hours × $22.00 per hour = $568,260. The difference consists of the Labor Rate Variance which is $32,436 Unfavorable and the Labor Efficiency Variance which is $26,400 Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $40,250. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (36,900 units × 0.70 hours per unit) × $5.50 per hour = 25,830 hours × $5.50 per hour = $142,065. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $75,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $19,500 Favorable and the Fixed Overhead (FOH) Volume Variance which is $7,315 Favorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 36,900 units × $26.75 per unit = $987,075. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 39,700 units × $33.6 per unit = $1,333,920. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 39,700 units × $26.75 per unit = $1,061,975. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $171,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 60,100 kilos × $5.50 per kilo = $330,550. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 60,100 kilos × $5.00 per kilo = $300,500. The materials price variance is $30,050 Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 55,250 kilos × $5.00 per kilo = $276,250. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (36,900 units ×1.5 kilos per unit) × $5.00 per kilo = 55,350 kilos × $5.00 per kilo = $276,750. The difference is the Materials Quantity Variance which is $500 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 27,030 hours × $23.20 per hour = $627,096. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (36,900 units × 0.70 hours per unit) × $22.00 per hour = 25,830 hours × $22.00 per hour = $568,260. The difference consists of the Labor Rate Variance which is $32,436 Unfavorable and the Labor Efficiency Variance which is $26,400 Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $40,250. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (36,900 units × 0.70 hours per unit) × $5.50 per hour = 25,830 hours × $5.50 per hour = $142,065. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $75,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $19,500 Favorable and the Fixed Overhead (FOH) Volume Variance which is $7,315 Favorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 36,900 units × $26.75 per unit = $987,075. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 39,700 units × $33.6 per unit = $1,333,920. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 39,700 units × $26.75 per unit = $1,061,975. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $171,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 60,100 kilos × $5.50 per kilo = $330,550. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 60,100 kilos × $5.00 per kilo = $300,500. The materials price variance is $30,050 Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 55,250 kilos × $5.00 per kilo = $276,250. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (36,900 units ×1.5 kilos per unit) × $5.00 per kilo = 55,350 kilos × $5.00 per kilo = $276,750. The difference is the Materials Quantity Variance which is $500 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 27,030 hours × $23.20 per hour = $627,096. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (36,900 units × 0.70 hours per unit) × $22.00 per hour = 25,830 hours × $22.00 per hour = $568,260. The difference consists of the Labor Rate Variance which is $32,436 Unfavorable and the Labor Efficiency Variance which is $26,400 Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $40,250. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (36,900 units × 0.70 hours per unit) × $5.50 per hour = 25,830 hours × $5.50 per hour = $142,065. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $75,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $19,500 Favorable and the Fixed Overhead (FOH) Volume Variance which is $7,315 Favorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 36,900 units × $26.75 per unit = $987,075. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 39,700 units × $33.6 per unit = $1,333,920. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 39,700 units × $26.75 per unit = $1,061,975. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $171,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 60,100 kilos × $5.50 per kilo = $330,550. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 60,100 kilos × $5.00 per kilo = $300,500. The materials price variance is $30,050 Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 55,250 kilos × $5.00 per kilo = $276,250. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (36,900 units ×1.5 kilos per unit) × $5.00 per kilo = 55,350 kilos × $5.00 per kilo = $276,750. The difference is the Materials Quantity Variance which is $500 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 27,030 hours × $23.20 per hour = $627,096. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (36,900 units × 0.70 hours per unit) × $22.00 per hour = 25,830 hours × $22.00 per hour = $568,260. The difference consists of the Labor Rate Variance which is $32,436 Unfavorable and the Labor Efficiency Variance which is $26,400 Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $40,250. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (36,900 units × 0.70 hours per unit) × $5.50 per hour = 25,830 hours × $5.50 per hour = $142,065. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $75,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $19,500 Favorable and the Fixed Overhead (FOH) Volume Variance which is $7,315 Favorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 36,900 units × $26.75 per unit = $987,075. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 39,700 units × $33.6 per unit = $1,333,920. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 39,700 units × $26.75 per unit = $1,061,975. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $171,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

GJ

Answered

The introductory section of a formal proposal includes all of the following EXCEPT

A) a statement of your qualifications.

B) the scope or boundaries of the proposal.

C) background information or a problem statement.

D) an overview of how the document is organized.

A) a statement of your qualifications.

B) the scope or boundaries of the proposal.

C) background information or a problem statement.

D) an overview of how the document is organized.

On Jun 14, 2024

A

GJ

Answered

Briefly explain the following terms and how they either add or detract from teams in a business setting:

Social loafing

Cohesiveness

Distributed leadership

Groupthink

Social loafing

Cohesiveness

Distributed leadership

Groupthink

On May 18, 2024

Social loafing is the tendency of some people to avoid responsibility by "free-riding" in groups. Social loafing and other problems can easily turn the great potential of teams into frustration and failure, and can cost the team much in time, effort, morale and output.

Cohesiveness is the degree to which members are attracted to and motivated to remain part of a team. Persons in a highly cohesive team value their membership and strive to maintain positive relationships with other team members. Because they experience satisfaction from team identification, they tend to conform to the norms. This leads to more effective and efficient teams.

Distributed leadership is when all members of a team contribute helpful task and maintenance behaviours. This is useful in a business setting as it spreads out the maintenance responsibilities and promotes cohesion among team members. This facilitates a more effective team environment

Groupthink is a tendency for highly cohesive teams to lose their evaluative capabilities. Groupthink can occur anywhere. In fact, Janis ties a variety of well-known historical blunders to the phenomenon, including the lack of preparedness of U.S. naval forces for the Japanese attack on Pearl Harbour and the U.S. Bay of Pigs invasion under President John F. Kennedy.

Cohesiveness is the degree to which members are attracted to and motivated to remain part of a team. Persons in a highly cohesive team value their membership and strive to maintain positive relationships with other team members. Because they experience satisfaction from team identification, they tend to conform to the norms. This leads to more effective and efficient teams.

Distributed leadership is when all members of a team contribute helpful task and maintenance behaviours. This is useful in a business setting as it spreads out the maintenance responsibilities and promotes cohesion among team members. This facilitates a more effective team environment

Groupthink is a tendency for highly cohesive teams to lose their evaluative capabilities. Groupthink can occur anywhere. In fact, Janis ties a variety of well-known historical blunders to the phenomenon, including the lack of preparedness of U.S. naval forces for the Japanese attack on Pearl Harbour and the U.S. Bay of Pigs invasion under President John F. Kennedy.

GJ

Answered

Strategic planning for a firm such as Disney with several SBUs probably most likely occurs ________.

A) as needed based upon the success or failure of each division

B) at both the corporate level and the business unit level

C) only at the business unit level

D) only at the corporate level

A) as needed based upon the success or failure of each division

B) at both the corporate level and the business unit level

C) only at the business unit level

D) only at the corporate level

On May 15, 2024

B