IG

Israel Gonzalez

Answers (7)

IG

Answered

The variable overhead efficiency variance measures the difference between the actual level of activity and the standard activity allowed for the actual output, multiplied by the variable part of the predetermined overhead rate.

On Jul 27, 2024

True

IG

Answered

Which of the following statements about interim financial statements for public companies is true?

A) Interim financial statements must be audited.

B) Interim financial statements should be in a format consistent with the year-end financial statements.

C) Interim financial statements must have the same level of detail as the annual financial statements.

D) Interim financial statements do not have to be in full compliance with IFRS.

A) Interim financial statements must be audited.

B) Interim financial statements should be in a format consistent with the year-end financial statements.

C) Interim financial statements must have the same level of detail as the annual financial statements.

D) Interim financial statements do not have to be in full compliance with IFRS.

On Jun 30, 2024

B

IG

Answered

Usually,people will weigh information they receive later on much more heavily than initial information they learn about you.

On Jun 27, 2024

False

IG

Answered

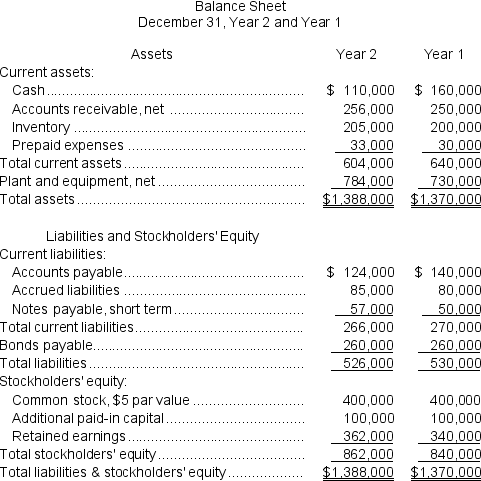

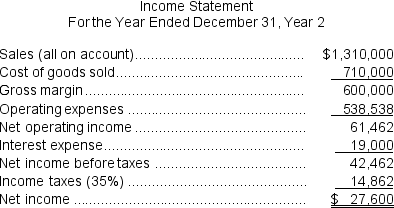

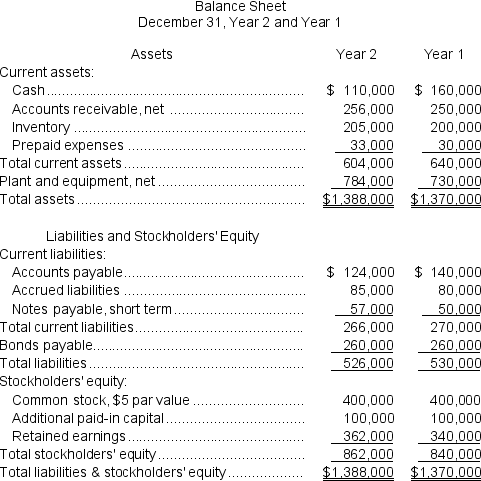

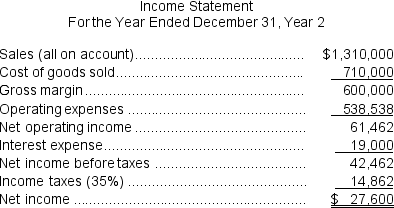

Gehlhausen Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $5,600.The market price of common stock at the end of Year 2 was $5.60 per share.

Dividends on common stock during Year 2 totaled $5,600.The market price of common stock at the end of Year 2 was $5.60 per share.

Required:

a.What is the company's net profit margin percentage for Year 2?

b.What is the company's gross margin percentage for Year 2?

c.What is the company's return on total assets for Year 2?

d.What is the company's return on equity for Year 2?

Dividends on common stock during Year 2 totaled $5,600.The market price of common stock at the end of Year 2 was $5.60 per share.

Dividends on common stock during Year 2 totaled $5,600.The market price of common stock at the end of Year 2 was $5.60 per share.Required:

a.What is the company's net profit margin percentage for Year 2?

b.What is the company's gross margin percentage for Year 2?

c.What is the company's return on total assets for Year 2?

d.What is the company's return on equity for Year 2?

On May 31, 2024

a.Net profit margin percentage = Net income ÷ Sales

= $27,600 ÷ $1,310,000 = 2.1% (rounded)

b.Gross margin percentage = Gross margin ÷ Sales

= $600,000 ÷ $1,310,000 = 45.8% (rounded)

c.Return on total assets = Adjusted net income* ÷ Average total assets**

= $39,950 ÷ $1,379,000 = 2.90% (rounded)

*Adjusted net income = Net income + [Interest expense × (1 - Tax rate)]

= $27,600 + [$19,000 × (1 - 0.35)] = $39,950

**Average total assets = ($1,388,000 + $1,370,000)÷ 2 = $1,379,000

d.Return on equity = Net income ÷ Average stockholders' equity*

= $27,600 ÷ $851,000 = 3.24% (rounded)

*Average stockholders' equity = ($862,000 + $840,000)÷ 2 = $851,000

= $27,600 ÷ $1,310,000 = 2.1% (rounded)

b.Gross margin percentage = Gross margin ÷ Sales

= $600,000 ÷ $1,310,000 = 45.8% (rounded)

c.Return on total assets = Adjusted net income* ÷ Average total assets**

= $39,950 ÷ $1,379,000 = 2.90% (rounded)

*Adjusted net income = Net income + [Interest expense × (1 - Tax rate)]

= $27,600 + [$19,000 × (1 - 0.35)] = $39,950

**Average total assets = ($1,388,000 + $1,370,000)÷ 2 = $1,379,000

d.Return on equity = Net income ÷ Average stockholders' equity*

= $27,600 ÷ $851,000 = 3.24% (rounded)

*Average stockholders' equity = ($862,000 + $840,000)÷ 2 = $851,000

IG

Answered

What is the primary objective of financial reporting?

On May 28, 2024

The primary objective of financial reporting is to provide financial information about the reporting entity that is useful to external decision makers such as investors,lenders,and other creditors to help them make decisions about providing resources to the entity.

IG

Answered

If a firm that's doing very well pays the same return to equity and debt shareholders, and needs to raise more money, it may be wise to use debt because:

A) interest is tax deductible resulting in a lower cost to the firm.

B) Equity is the less desirable source of capital.

C) borrowing is always less of an effort than raising additional equity capital.

D) All of the above

A) interest is tax deductible resulting in a lower cost to the firm.

B) Equity is the less desirable source of capital.

C) borrowing is always less of an effort than raising additional equity capital.

D) All of the above

On May 01, 2024

A

IG

Answered

Which of the following is untrue regarding the revocation of a will?

A) There can be a partial revocation.

B) An inadvertent destruction of a will acts as a revocation.

C) The execution of a second will does not of itself constitute a revocation of an earlier will.

D) Divorce does not ordinarily revoke a will.

A) There can be a partial revocation.

B) An inadvertent destruction of a will acts as a revocation.

C) The execution of a second will does not of itself constitute a revocation of an earlier will.

D) Divorce does not ordinarily revoke a will.

On Apr 28, 2024

B