JW

Jasmine Williams

Answers (6)

JW

Answered

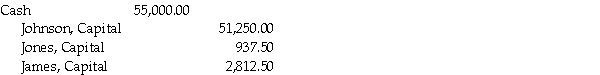

Jones and James' partnership capital balances are $65,000 and $85,000, respectively. They share profits and losses in a 1:3 ratio for Jones and James, respectively. Johnson is admitted to the partnership and invests $55,000 for a one-fourth interest, with a bonus to the old partners. Prepare the journal entry to admit Johnson to the partnership.

On Jul 29, 2024

Total capital = $68,000 + $85,000 + $55,000 = $205,000

Total capital = $68,000 + $85,000 + $55,000 = $205,0001/4 × $205,000 = $51,250

$55,000 - $51,250 = $3,750 bonus to old partners

Jones = 1/4 × $3,750 = $937.50

James = 3/4 × $3,750 = $2,812.50

JW

Answered

_____ of ethics emphasize the results of behavior.

A) Consequential theories

B) Rule-based theories

C) Character theories

D) Fact-based theories

A) Consequential theories

B) Rule-based theories

C) Character theories

D) Fact-based theories

On Jul 25, 2024

A

JW

Answered

A small business may use a web portal as a means of forming a supply chain that can respond to its needs.

On Jun 29, 2024

True

JW

Answered

What kind of knowledge is acquired by an employee who repeatedly practices repairing copy machines?

On Jun 25, 2024

Technical skills-based learning

JW

Answered

The statement of cash flows provides information about all of the following except:

A) organizing activities.

B) investing activities.

C) operating activities.

D) financing activities.

A) organizing activities.

B) investing activities.

C) operating activities.

D) financing activities.

On May 30, 2024

A

JW

Answered

To distinguish the total on a financial statement, use single underline.

On May 26, 2024

False