JG

Jessica Gonzalez

Answers (6)

JG

Answered

One of the follower characteristics in path-goal theory is perception of one's own ability.As perception of ability goes up,directive leadership should go down.Why is this? And what is the effect on the follower if directive leadership continues to be used?

On Jul 23, 2024

When followers feel as if they know what they are doing,having a leader that tells them what to do and how to do it can feel punitive and redundant.Continuing to direct this follower may make them resentful of the leader and it could actually decrease their motivation,exactly the opposite of the focus of path-goal,which is to keep motivation of followers high.

JG

Answered

Auto Mart sells new and used vehicles and finances its inventory through ABC Bank.Finn purchases a new car from Auto Mart and receives good title free and clear of ABC's security interest.Which of the following is false?

A) Finn receives this protection to promote confidence in commercial transactions.

B) ABC is more interested in the proceeds from the sale rather than the inventory.

C) Finn is liable to ABC because ABC has superior title.

D) Finn is a buyer in the ordinary course of business.

A) Finn receives this protection to promote confidence in commercial transactions.

B) ABC is more interested in the proceeds from the sale rather than the inventory.

C) Finn is liable to ABC because ABC has superior title.

D) Finn is a buyer in the ordinary course of business.

On Jul 21, 2024

C

JG

Answered

An increase in appraisal costs will usually result in an increase in:

A) prevention costs.

B) internal failure costs.

C) external failure costs.

D) opportunity costs.

A) prevention costs.

B) internal failure costs.

C) external failure costs.

D) opportunity costs.

On Jun 23, 2024

B

JG

Answered

We use the value added approach in calculating GDP to

A) avoid double counting.

B) account for market price differences.

C) account for changes in population.

D) account for consumer income differences.

A) avoid double counting.

B) account for market price differences.

C) account for changes in population.

D) account for consumer income differences.

On Jun 21, 2024

A

JG

Answered

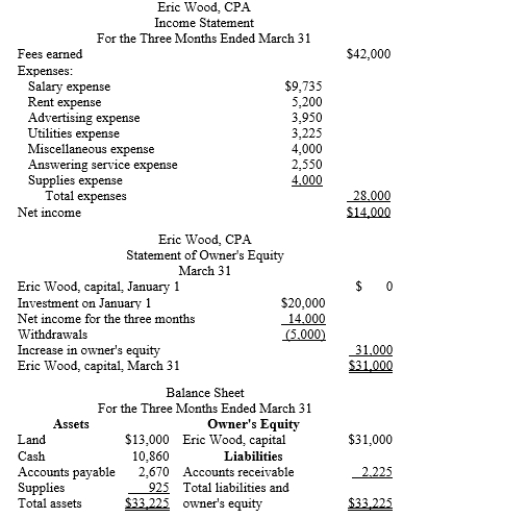

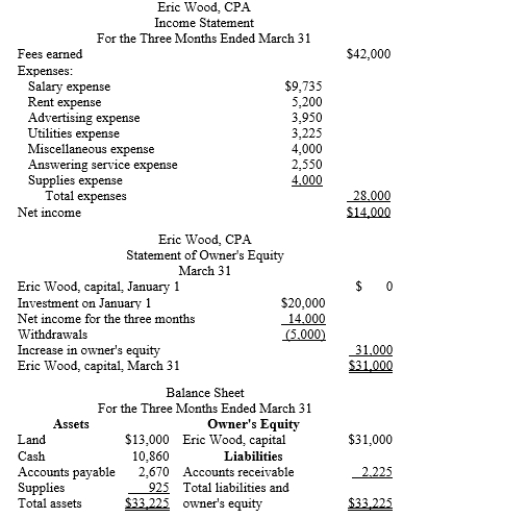

Eric Wood, CPA, was organized on January 1 as a proprietorship. List the errors that you find in the following financial statements and prepare the corrected statements for the three months ended March 31.+  ?

?

?

?On May 24, 2024

Errors in the Eric Wood, CPA, financial statements include the following:

(1)Miscellaneous expense is incorrectly listed after utilities expense on the income statement. Miscellaneous expense should be listed as the last expense, regardless of the amount.

(2)The operating expenses are incorrectly added. Instead of $28,000, the total should be $32,660.

(3)Because operating expenses are incorrectly added, the net income is incorrect. It should be listed as $9,340.

(4)The statement of owner's equity should be for a period of time instead of a specific date. That is, the statement of owner's equity should be reported "For the Three Months Ended March 31."

(5)Because the net income was incorrect, the increase in owners' equity and the balance in Eric Wood, Capital are incorrect. They should both be shown as $24,340.

(6)The name of the company is missing from the balance sheet heading.

(7)The balance sheet should be as of "March 31," not "For the Three Months Ended March 31."

(8)Cash, not land, should be the first asset listed on the balance sheet.

(9)Accounts payable is incorrectly listed as an asset on the balance sheet. Accounts payable should be listed as a liability.

(10)Liabilities should be listed on the balance sheet ahead of owner's equity.

(11)Accounts receivable is incorrectly listed as a liability on the balance sheet. Accounts receivable should be listed as an asset.

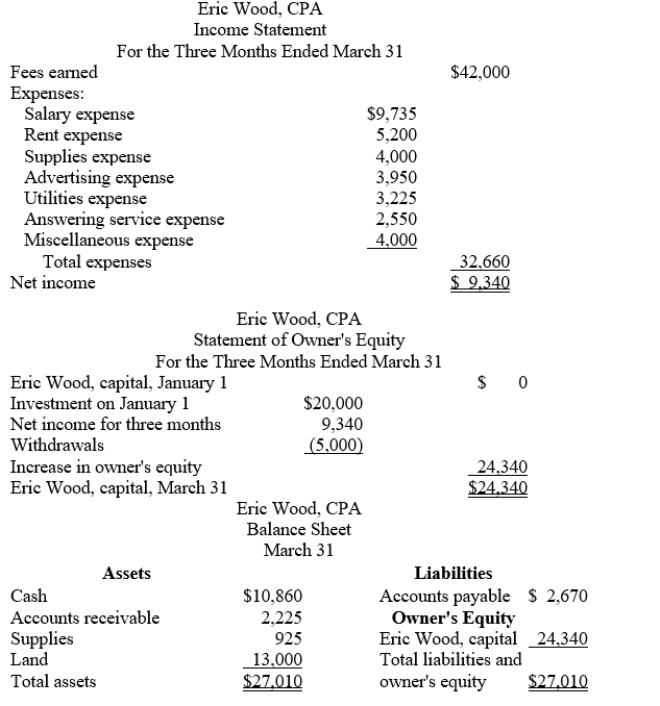

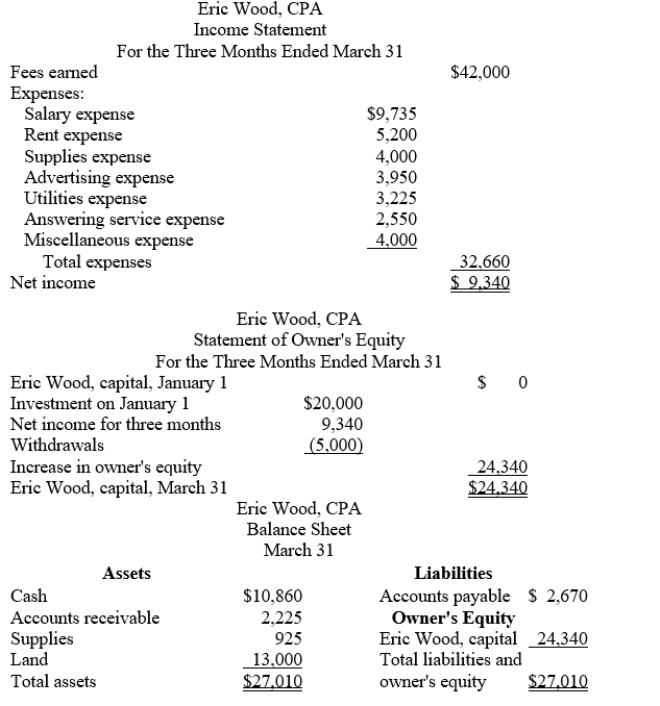

(12)The assets do not total to $33,225 as shown, making the balance sheet out of balance.Correctly prepared financial statements for Eric Wood, CPA, are shown below.??

(1)Miscellaneous expense is incorrectly listed after utilities expense on the income statement. Miscellaneous expense should be listed as the last expense, regardless of the amount.

(2)The operating expenses are incorrectly added. Instead of $28,000, the total should be $32,660.

(3)Because operating expenses are incorrectly added, the net income is incorrect. It should be listed as $9,340.

(4)The statement of owner's equity should be for a period of time instead of a specific date. That is, the statement of owner's equity should be reported "For the Three Months Ended March 31."

(5)Because the net income was incorrect, the increase in owners' equity and the balance in Eric Wood, Capital are incorrect. They should both be shown as $24,340.

(6)The name of the company is missing from the balance sheet heading.

(7)The balance sheet should be as of "March 31," not "For the Three Months Ended March 31."

(8)Cash, not land, should be the first asset listed on the balance sheet.

(9)Accounts payable is incorrectly listed as an asset on the balance sheet. Accounts payable should be listed as a liability.

(10)Liabilities should be listed on the balance sheet ahead of owner's equity.

(11)Accounts receivable is incorrectly listed as a liability on the balance sheet. Accounts receivable should be listed as an asset.

(12)The assets do not total to $33,225 as shown, making the balance sheet out of balance.Correctly prepared financial statements for Eric Wood, CPA, are shown below.??

JG

Answered

If you are writing a letter to a stranger,create goodwill by using the recipient's first name.

On May 22, 2024

False