KB

Karra Biggs

Answers (6)

KB

Answered

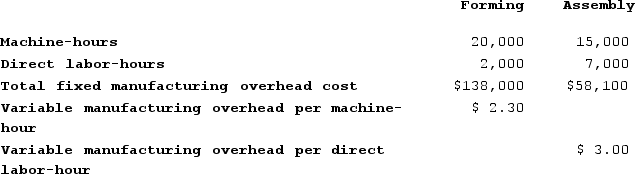

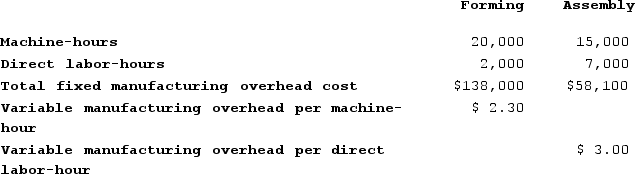

Stoke Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A460. The following data were recorded for this job:

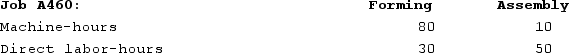

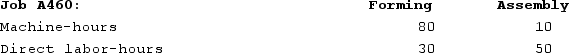

During the current month the company started and finished Job A460. The following data were recorded for this job:

The amount of overhead applied in the Assembly Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Assembly Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $415.00

B) $150.00

C) $565.00

D) $79,100.00

During the current month the company started and finished Job A460. The following data were recorded for this job:

During the current month the company started and finished Job A460. The following data were recorded for this job: The amount of overhead applied in the Assembly Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Assembly Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.) A) $415.00

B) $150.00

C) $565.00

D) $79,100.00

On Jul 18, 2024

C

KB

Answered

Workers' compensation insurance is based on a system of individual liability.

On Jul 17, 2024

False

KB

Answered

NSF check

A) Bank statement adjustment

B) Company books adjustment

C) Either

A) Bank statement adjustment

B) Company books adjustment

C) Either

On Jun 17, 2024

B

KB

Answered

Parts administration is an example of a:

A) Unit-level activity.

B) Batch-level activity.

C) Product-level activity.

D) Organization-sustaining.

A) Unit-level activity.

B) Batch-level activity.

C) Product-level activity.

D) Organization-sustaining.

On Jun 16, 2024

C

KB

Answered

Colin has sued Peter, and Peter has just sent a counterclaim. Since Colin has received it, the case can now be set down for trial.

On May 18, 2024

False

KB

Answered

Which of the following would not be included within the operating activities section of a cash flow statement?

A) Cash received from customers.

B) Cash paid for insurance.

C) Cash paid for interest expense.

D) Cash paid to acquire a patent.

A) Cash received from customers.

B) Cash paid for insurance.

C) Cash paid for interest expense.

D) Cash paid to acquire a patent.

On May 17, 2024

D