KS

Kevin Sambuco

Answers (4)

KS

Answered

When you're preparing an RFP,identify decision criteria and choose information to measure against those criteria.Otherwise,you will

A) place unreasonable demands on bidders.

B) cause unnecessary complications in your review process.

C) discourage some potentially attractive bidders from responding.

D) all of the above.

A) place unreasonable demands on bidders.

B) cause unnecessary complications in your review process.

C) discourage some potentially attractive bidders from responding.

D) all of the above.

On Jun 16, 2024

D

KS

Answered

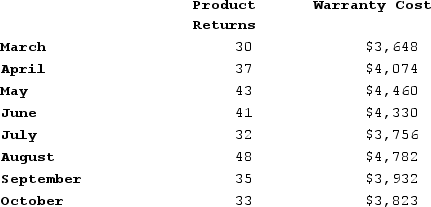

The management of Rutledge Corporation would like to better understand the behavior of the company's warranty costs. Those costs are listed below for a number of recent months:

Management believes that warranty cost is a mixed cost that depends on the number of product returns.Required:Estimate the variable cost per product return and the fixed cost per month using the least-squares regression method.

Management believes that warranty cost is a mixed cost that depends on the number of product returns.Required:Estimate the variable cost per product return and the fixed cost per month using the least-squares regression method.

Management believes that warranty cost is a mixed cost that depends on the number of product returns.Required:Estimate the variable cost per product return and the fixed cost per month using the least-squares regression method.

Management believes that warranty cost is a mixed cost that depends on the number of product returns.Required:Estimate the variable cost per product return and the fixed cost per month using the least-squares regression method.On Jun 15, 2024

The solution using Microsoft Excel functions is:Variable cost per product return = Slope = $63.59Fixed cost per month = Intercept = $1,724The solution using the formulas in the text is:n = 8ΣX = 299ΣY = $32,805ΣXY = $1,242,995ΣX2 = 11,441b = [n(ΣXY) − (ΣX)(ΣY))]/[n(ΣX2) − (ΣX)2]= [8($1,242,995) − (299)($32,805))]/[8(11,441) − (299)2]= $63.59a = [(ΣY) − b(ΣX)]/n= [($32,805) − $63.59(299)]/8= $1,724 Any difference in the solutions is due to rounding errors when the formulas are used.

KS

Answered

Suppose that in a country the total holdings of banks were as follows:

required reserves = $45 million

excess reserves = $15 million

deposits = $750 million

loans = $600 million

Treasury bonds = $90 million

Show that the balance sheet balances if these are the only assets and liabilities.

Assuming that people hold no currency, what happens to each of these values if the central bank changes the reserve requirement ratio to 2%, banks still want to hold the same percentage of excess reserves, and banks don't change their holdings of Treasury bonds? How much does the money supply change by?

required reserves = $45 million

excess reserves = $15 million

deposits = $750 million

loans = $600 million

Treasury bonds = $90 million

Show that the balance sheet balances if these are the only assets and liabilities.

Assuming that people hold no currency, what happens to each of these values if the central bank changes the reserve requirement ratio to 2%, banks still want to hold the same percentage of excess reserves, and banks don't change their holdings of Treasury bonds? How much does the money supply change by?

On May 17, 2024

The only liability is deposits which equal $750 million. Total reserves are $60 billion which summed with loans, $600 million, and Treasury bonds $90 million = $750. Since liabilities equal assets, the balance sheet balances.

Initially banks need to hold 6% on reserve and want to hold 2% as excess reserves. When the Fed lowers the reserve requirement ratio to 2%, the bank only has to hold $15 million on reserve and so now has $30 million of excess reserves. Between the 2% requirement and the 2% for excess the reserve ratio is now 4% and the multiplier is now 1/.04 = 25. So, the decrease in the reserve requirement ratio leads to an increase in deposits of $750 million.

(Also, total reserves are $60 million and the multiplier is now 25, so deposits should be $1,500 million.)

Required reserves are 2% of $1,500 million of deposits = $30 million.

Excess reserves are 2% of $1,500 million of deposits and so now also equal $30 million.

Deposits rose by as much as the money supply since people don't hold currency, so that the money supply rose by $750 million. The additional deposits came by way of additional lending, so loans should have also increased by $750 million. Also, since deposits rose by $750 million, liabilities should have risen by $750 million. Under the given assumptions, this means loans should have risen by $750 million.

Overall the money supply rose by $750 as explained above.

Initially banks need to hold 6% on reserve and want to hold 2% as excess reserves. When the Fed lowers the reserve requirement ratio to 2%, the bank only has to hold $15 million on reserve and so now has $30 million of excess reserves. Between the 2% requirement and the 2% for excess the reserve ratio is now 4% and the multiplier is now 1/.04 = 25. So, the decrease in the reserve requirement ratio leads to an increase in deposits of $750 million.

(Also, total reserves are $60 million and the multiplier is now 25, so deposits should be $1,500 million.)

Required reserves are 2% of $1,500 million of deposits = $30 million.

Excess reserves are 2% of $1,500 million of deposits and so now also equal $30 million.

Deposits rose by as much as the money supply since people don't hold currency, so that the money supply rose by $750 million. The additional deposits came by way of additional lending, so loans should have also increased by $750 million. Also, since deposits rose by $750 million, liabilities should have risen by $750 million. Under the given assumptions, this means loans should have risen by $750 million.

Overall the money supply rose by $750 as explained above.

KS

Answered

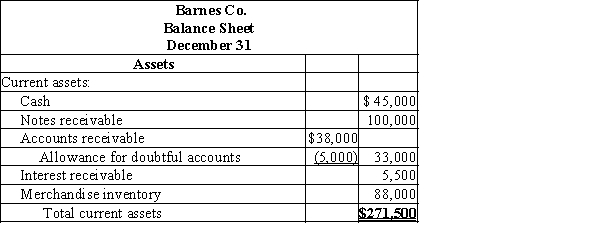

The following are the current assets of Barnes Co. as of December 31:  Prepare the current assets section of the balance sheet.

Prepare the current assets section of the balance sheet.

Prepare the current assets section of the balance sheet.

Prepare the current assets section of the balance sheet.On May 16, 2024