KM

Khaled Mahmud

Answers (6)

KM

Answered

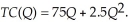

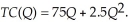

Trisha's Fashion Boutique is considering a profit sharing arrangement with her employees. Currently, the employees receive an annual bonus. In a "Boom" market, Trisha can sell all the output she produces for $225 per unit. In a "Bust" market, Trisha can sell all the output she produces for $125 per unit. The probability of a "Boom" market is 75% and the probability of a bust market is 25%. Trisha's total cost function (including bonus payments to employees) is:  The marginal cost function is:

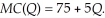

The marginal cost function is:  The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:

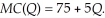

The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:  . The relevant marginal cost function becomes:

. The relevant marginal cost function becomes:  Which plan offers Trisha the greatest expected profits for herself? Suppose the employees will only approve a profit sharing plan if they are guaranteed their portion of profits will be at least $400. Will the employees approve of the profit sharing program?

Which plan offers Trisha the greatest expected profits for herself? Suppose the employees will only approve a profit sharing plan if they are guaranteed their portion of profits will be at least $400. Will the employees approve of the profit sharing program?

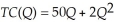

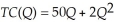

The marginal cost function is:

The marginal cost function is:  The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:

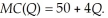

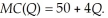

The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:  . The relevant marginal cost function becomes:

. The relevant marginal cost function becomes:  Which plan offers Trisha the greatest expected profits for herself? Suppose the employees will only approve a profit sharing plan if they are guaranteed their portion of profits will be at least $400. Will the employees approve of the profit sharing program?

Which plan offers Trisha the greatest expected profits for herself? Suppose the employees will only approve a profit sharing plan if they are guaranteed their portion of profits will be at least $400. Will the employees approve of the profit sharing program?On Jul 20, 2024

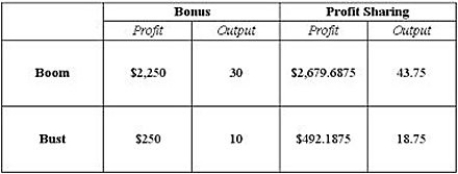

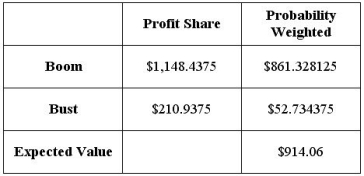

The table below displays Trisha's profit maximizing output level and profits under each of the market scenarios.  The following table lists Trisha's employees' portion of the profits under the profit sharing program.

The following table lists Trisha's employees' portion of the profits under the profit sharing program.  Since the profit sharing plan provides only $210.94 in a "Bust" market, the employees will not approve of the plan.

Since the profit sharing plan provides only $210.94 in a "Bust" market, the employees will not approve of the plan.

The following table lists Trisha's employees' portion of the profits under the profit sharing program.

The following table lists Trisha's employees' portion of the profits under the profit sharing program.  Since the profit sharing plan provides only $210.94 in a "Bust" market, the employees will not approve of the plan.

Since the profit sharing plan provides only $210.94 in a "Bust" market, the employees will not approve of the plan.KM

Answered

Materials Conversion Cost Work in process, beginning $8,000$6,000 Current added during January $40,000$32,000 Equivalent units of production 100,00095,000 Cost per equivalent unit $0.48$0.40 Units completed and transferred to the next department 90,000 units Work in process, ending 10,000 units \begin{array} { | l | l | l | } \hline & \text { Materials } & \text { Conversion Cost } \\\hline \text { Work in process, beginning } & \$ 8,000 & \$ 6,000 \\\hline \text { Current added during January } & \$ 40,000 & \$ 32,000 \\\hline \text { Equivalent units of production } & 100,000 & 95,000 \\\hline \text { Cost per equivalent unit } & \$ 0.48 & \$ 0.40 \\\hline \begin{array} { l } \text { Units completed and transferred to the next } \\\text { department }\end{array} & 90,000 \text { units } & \\\hline \text { Work in process, ending } & 10,000 \text { units } & \\\hline\end{array} Work in process, beginning Current added during January Equivalent units of production Cost per equivalent unit Units completed and transferred to the next department Work in process, ending Materials $8,000$40,000100,000$0.4890,000 units 10,000 units Conversion Cost $6,000$32,00095,000$0.40 Materials are added at the beginning of the process. The ending work in process is 50% complete with respect to conversion costs. What cost would be recorded for the ending work in process inventory?

A) $8,800.

B) $4,400.

C) $6,800.

D) $3,400.

A) $8,800.

B) $4,400.

C) $6,800.

D) $3,400.

On Jul 18, 2024

C

KM

Answered

The most customary type of dividend is a:

A) stock dividend.

B) distribution.

C) property dividend.

D) liquidating dividend.

A) stock dividend.

B) distribution.

C) property dividend.

D) liquidating dividend.

On Jun 20, 2024

B

KM

Answered

The use of the qualifying word(s) __________ is/are understood to place purchasers on notice that they may not rely on the credit of the person using this language.

A) "Accepted"

B) "Certified"

C) "Without recourse"

D) "Insufficient funds"

A) "Accepted"

B) "Certified"

C) "Without recourse"

D) "Insufficient funds"

On Jun 18, 2024

C

KM

Answered

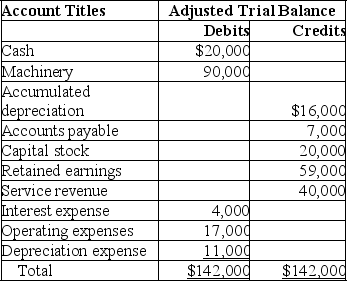

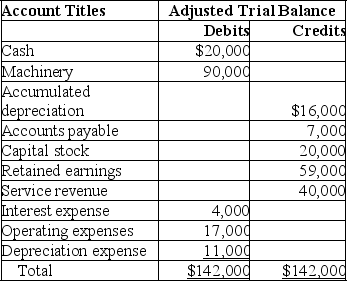

The adjusted trial balance of Tahoe Company at the end of the accounting year,December 31,2019,showed the following:

A.Prepare all the required closing entries for Tahoe Company at December 31,2019.

A.Prepare all the required closing entries for Tahoe Company at December 31,2019.

B.Calculate the 2019 ending balance in retained earnings.

A.Prepare all the required closing entries for Tahoe Company at December 31,2019.

A.Prepare all the required closing entries for Tahoe Company at December 31,2019.B.Calculate the 2019 ending balance in retained earnings.

On May 20, 2024

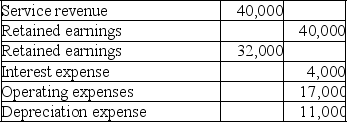

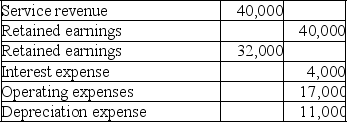

A.

B.$59,000 + $8,000* = $67,000 (balance of retained earnings at the end of 2019).

B.$59,000 + $8,000* = $67,000 (balance of retained earnings at the end of 2019).

* ($40,000 - $32,000)

B.$59,000 + $8,000* = $67,000 (balance of retained earnings at the end of 2019).

B.$59,000 + $8,000* = $67,000 (balance of retained earnings at the end of 2019).* ($40,000 - $32,000)

KM

Answered

A partner can put his or her self-interest before the interest of the partnership without violating any fiduciary duty owed to the firm.

On May 19, 2024

False