KT

Kristen Torres

Answers (6)

KT

Answered

The best example of a law which governs the behaviour of top executives is the Sarbanes-Oxley Act.

On Jul 27, 2024

True

KT

Answered

A n example of high self-esteem behavior on the part of an employee would be waiting for specific instructions before attempting to solve problems.

On Jul 24, 2024

False

KT

Answered

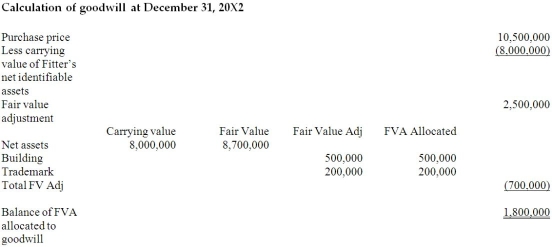

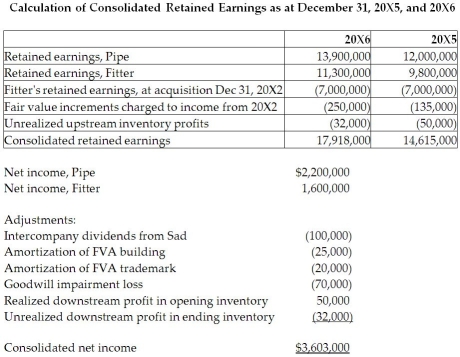

On December 31, 20X2, Pipe Ltd. purchased 100% of the outstanding common shares of Fitter Ltd. for $10.5 million in cash. On that date, the shareholders' equity of Fitter totalled $8 million and consisted of $1 million in no par common shares and $7 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization. Goodwill, if any arises as a result of this business combination, is written down if there is a permanent impairment in its value.

For the year ending December 31, 20X6, the income statements for Pipe and Fitter were as follows:

Pipe Fitter Sales and other revenue $22,500,000‾$9,800,000‾ Cost of goods sold 16,000,0005,000,000 Depreciation expense 2,500,0002,000,000 Other expenses 1,800,000‾1,200,000‾Net income$2,200,000‾1,600,000‾\begin{array}{lll}&\text {Pipe }&\text {Fitter}\\\text { Sales and other revenue } & \underline{\$ 22,500,000 }& \underline{\$ 9,800,000} \\\text { Cost of goods sold } & 16,000,000 & 5,000,000 \\\text { Depreciation expense } & 2,500,000 & 2,000,000 \\\text { Other expenses } & \underline{1,800,000} & \underline{1,200,000} \\\text {Net income}& \underline{\$ 2,200,000 }& \underline{1,600,000}\end{array} Sales and other revenue Cost of goods sold Depreciation expense Other expenses Net incomePipe $22,500,00016,000,0002,500,0001,800,000$2,200,000Fitter$9,800,0005,000,0002,000,0001,200,0001,600,000 At December 31, 20X6, the condensed balance sheets for the two companies were as follows:

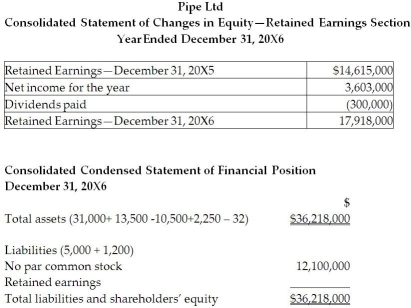

Pipe Fitter Total assets $31,000,000$13,500,000\begin{array} { l l l } & \text { Pipe } & \text { Fitter } \\\text { Total assets } & \$ 31,000,000 & \$ 13,500,000\end{array} Total assets Pipe $31,000,000 Fitter $13,500,000 Liabilities $5,000,000$1,200,000 No par common stock 12,100,0001,000,000 Retained earnings 13,900,000‾11,300,000‾ Total liabilities and shareholders’ equity $13,000,000‾$13,500,000‾\begin{array} { l l l } \text { Liabilities } & \$ 5,000,000 & \$ 1,200,000 \\\text { No par common stock } & 12,100,000 & 1,000,000 \\\text { Retained earnings } & \underline { 13,900,000 } & \underline { 11,300,000 } \\\text { Total liabilities and shareholders' equity } & \underline {\$ 13,000,000 }& \underline { \$ 13,500,000}\end{array} Liabilities No par common stock Retained earnings Total liabilities and shareholders’ equity $5,000,00012,100,00013,900,000$13,000,000$1,200,0001,000,00011,300,000$13,500,000 OTHER INFORMATION:

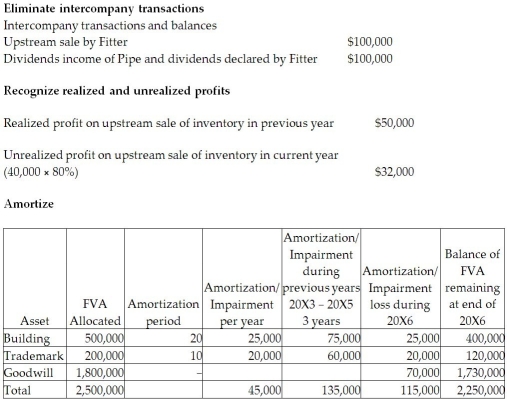

1. On December 31, 20X2, Fitter had a building with a fair value that was $500,000 greater than its carrying value. The building had an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Fitter had trademark that was not reported on its balance sheet, but had a fair value that was $200,000. The trademark is amortized over 10 years.

3. During 20X6, Fitter sold merchandise to Pipe for $100,000, a price that included a gross profit of $40,000. During 20X6, 20% of this merchandise was resold by Pipe and the other 80% remains in its December 31, 20X6, inventories. On December 31, 20X5, the inventories of Pipe contained merchandise purchased from Fitter on which Fitter had recognized a gross profit in the amount of $50,000.

4. During 20X6, it was determined that the goodwill arising at the date of acquisition was impaired and that an impairment loss of $70,000 should be recorded. No impairment had been charged in earlier years.

5. During 20X6, Pipe declared and paid dividends of $300,000, while Fitter declared and paid dividends of $100,000.

6. Pipe accounts for its investment in Fitter using the cost method.

The retained earnings of Pipe as at December 31, 20X5, equalled $12,000,000. On that date, Fitter had retained earnings of $9,800,000. Fitter has not issued any common stock since its acquisition by Pipe.

Required:

Calculate the consolidated retained earnings at December 31, 20X5, and December 31, 20X6. Calculate the consolidated net earnings for 20X6. Prepare the consolidated statement of changes equity-partial statement showing the change in retained earnings for December 31, 20X6, for Pipe. Prepare the condensed consolidated statement of financial position for Pipe as at December 31, 20X6.

For the year ending December 31, 20X6, the income statements for Pipe and Fitter were as follows:

Pipe Fitter Sales and other revenue $22,500,000‾$9,800,000‾ Cost of goods sold 16,000,0005,000,000 Depreciation expense 2,500,0002,000,000 Other expenses 1,800,000‾1,200,000‾Net income$2,200,000‾1,600,000‾\begin{array}{lll}&\text {Pipe }&\text {Fitter}\\\text { Sales and other revenue } & \underline{\$ 22,500,000 }& \underline{\$ 9,800,000} \\\text { Cost of goods sold } & 16,000,000 & 5,000,000 \\\text { Depreciation expense } & 2,500,000 & 2,000,000 \\\text { Other expenses } & \underline{1,800,000} & \underline{1,200,000} \\\text {Net income}& \underline{\$ 2,200,000 }& \underline{1,600,000}\end{array} Sales and other revenue Cost of goods sold Depreciation expense Other expenses Net incomePipe $22,500,00016,000,0002,500,0001,800,000$2,200,000Fitter$9,800,0005,000,0002,000,0001,200,0001,600,000 At December 31, 20X6, the condensed balance sheets for the two companies were as follows:

Pipe Fitter Total assets $31,000,000$13,500,000\begin{array} { l l l } & \text { Pipe } & \text { Fitter } \\\text { Total assets } & \$ 31,000,000 & \$ 13,500,000\end{array} Total assets Pipe $31,000,000 Fitter $13,500,000 Liabilities $5,000,000$1,200,000 No par common stock 12,100,0001,000,000 Retained earnings 13,900,000‾11,300,000‾ Total liabilities and shareholders’ equity $13,000,000‾$13,500,000‾\begin{array} { l l l } \text { Liabilities } & \$ 5,000,000 & \$ 1,200,000 \\\text { No par common stock } & 12,100,000 & 1,000,000 \\\text { Retained earnings } & \underline { 13,900,000 } & \underline { 11,300,000 } \\\text { Total liabilities and shareholders' equity } & \underline {\$ 13,000,000 }& \underline { \$ 13,500,000}\end{array} Liabilities No par common stock Retained earnings Total liabilities and shareholders’ equity $5,000,00012,100,00013,900,000$13,000,000$1,200,0001,000,00011,300,000$13,500,000 OTHER INFORMATION:

1. On December 31, 20X2, Fitter had a building with a fair value that was $500,000 greater than its carrying value. The building had an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Fitter had trademark that was not reported on its balance sheet, but had a fair value that was $200,000. The trademark is amortized over 10 years.

3. During 20X6, Fitter sold merchandise to Pipe for $100,000, a price that included a gross profit of $40,000. During 20X6, 20% of this merchandise was resold by Pipe and the other 80% remains in its December 31, 20X6, inventories. On December 31, 20X5, the inventories of Pipe contained merchandise purchased from Fitter on which Fitter had recognized a gross profit in the amount of $50,000.

4. During 20X6, it was determined that the goodwill arising at the date of acquisition was impaired and that an impairment loss of $70,000 should be recorded. No impairment had been charged in earlier years.

5. During 20X6, Pipe declared and paid dividends of $300,000, while Fitter declared and paid dividends of $100,000.

6. Pipe accounts for its investment in Fitter using the cost method.

The retained earnings of Pipe as at December 31, 20X5, equalled $12,000,000. On that date, Fitter had retained earnings of $9,800,000. Fitter has not issued any common stock since its acquisition by Pipe.

Required:

Calculate the consolidated retained earnings at December 31, 20X5, and December 31, 20X6. Calculate the consolidated net earnings for 20X6. Prepare the consolidated statement of changes equity-partial statement showing the change in retained earnings for December 31, 20X6, for Pipe. Prepare the condensed consolidated statement of financial position for Pipe as at December 31, 20X6.

On Jun 26, 2024

KT

Answered

If the credit balance of the Allowance for Doubtful Accounts account exceeds the amount of a bad debt being written off,the entry to record the write-off against the allowance account results in:

A) An increase in the expenses of the current period.

B) An increase in current assets.

C) A reduction in equity.

D) No effect on the expenses of the current period.

E) A reduction in current liabilities.

A) An increase in the expenses of the current period.

B) An increase in current assets.

C) A reduction in equity.

D) No effect on the expenses of the current period.

E) A reduction in current liabilities.

On Jun 24, 2024

D

KT

Answered

Territory undermines performance for one key reason: individuals whose work areas are located near one another tend to engage in frequent,spontaneous interactions that interfere with productivity.

On May 27, 2024

False

KT

Answered

All of the following are characteristics of organic organizations except:

A) broadly defined job responsibilities

B) decentralized and shared decision making

C) heavy reliance on formal rules and regulations

D) authority structure with fewer levels in the hierarchy

A) broadly defined job responsibilities

B) decentralized and shared decision making

C) heavy reliance on formal rules and regulations

D) authority structure with fewer levels in the hierarchy

On May 24, 2024

C