LB

Laura Bowers

Answers (7)

LB

Answered

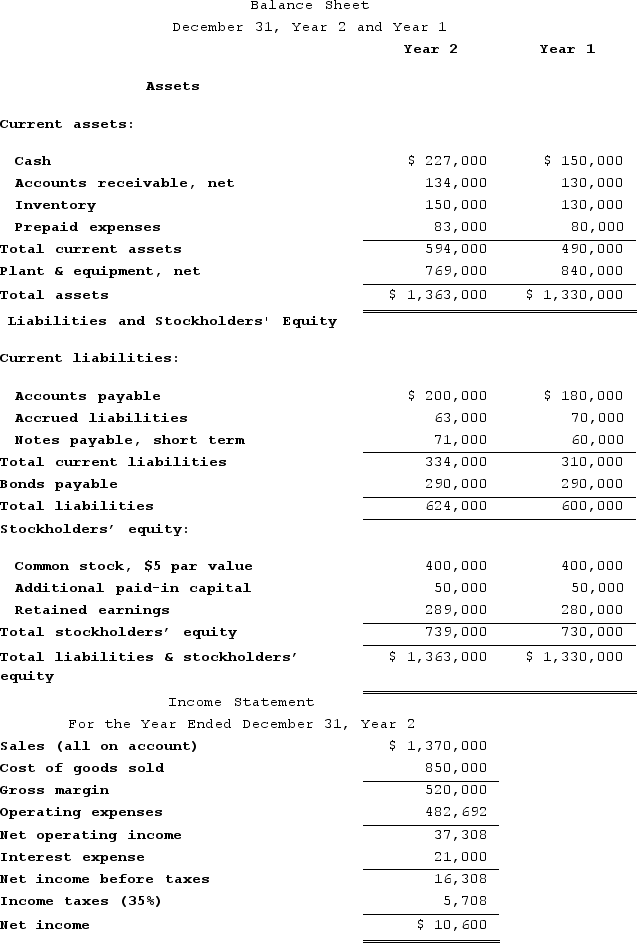

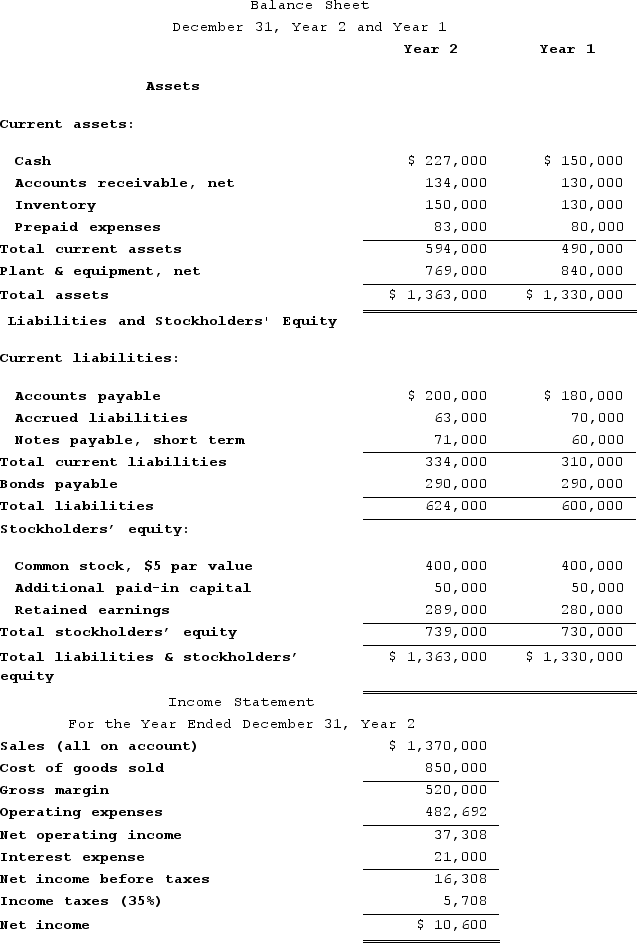

Dahn Corporation has provided the following financial data:  Dividends on common stock during Year 2 totaled $1,600. The market price of common stock at the end of Year 2 was $2.37 per share. The company's accounts receivable turnover for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $1,600. The market price of common stock at the end of Year 2 was $2.37 per share. The company's accounts receivable turnover for Year 2 is closest to:

A) 0.97

B) 10.38

C) 1.03

D) 10.22

Dividends on common stock during Year 2 totaled $1,600. The market price of common stock at the end of Year 2 was $2.37 per share. The company's accounts receivable turnover for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $1,600. The market price of common stock at the end of Year 2 was $2.37 per share. The company's accounts receivable turnover for Year 2 is closest to:A) 0.97

B) 10.38

C) 1.03

D) 10.22

On Jul 09, 2024

B

LB

Answered

Which one of the following statements about the payback method of capital budgeting i? correct?

A) The payback method considers cash flows after the payback has been reached.

B) The payback method uses discounted cash flow techniques.

C) The payback method does not consider the time value of money.

D) The payback method will lead to the same decision as other methods of capital budgeting.

A) The payback method considers cash flows after the payback has been reached.

B) The payback method uses discounted cash flow techniques.

C) The payback method does not consider the time value of money.

D) The payback method will lead to the same decision as other methods of capital budgeting.

On Jul 07, 2024

C

LB

Answered

In a situation where an artist is selling his own work to the galleries,the agent is

A) The artist

B) The gallery

C) Both of the above

D) None of the above

A) The artist

B) The gallery

C) Both of the above

D) None of the above

On Jun 08, 2024

A

LB

Answered

Silver River Company sells Products S and T and has made the following estimates for the coming year:  Fixed costs are estimated at $202,400. For the purposes of break-even analysis, determine the following:

Fixed costs are estimated at $202,400. For the purposes of break-even analysis, determine the following:

a. Break-even sales (units) for E

b. Break-even sales (units) of S and T

c. Sales units of E necessary to realize an operating income of $119,600 for the coming year

Fixed costs are estimated at $202,400. For the purposes of break-even analysis, determine the following:

Fixed costs are estimated at $202,400. For the purposes of break-even analysis, determine the following: a. Break-even sales (units) for E

b. Break-even sales (units) of S and T

c. Sales units of E necessary to realize an operating income of $119,600 for the coming year

On Jun 07, 2024

a. Unit selling price of E: ($30 × 60%) + ($70 × 40%) = $46.00

Unit variable cost of E: ($24 × 60%) + ($56 × 40%) = $36.80

Unit contribution margin of E: $46.00 - $36.80 = $9.20

Break-even sales (units) for E: $202,400 ÷ $9.20 = 22,000 units

b. S: 13,200 units (22,000 units × 60%)T: 8,800 units (22,000 units × 40%)c. Sales units of E: ($202,400 + $119,600) ÷ $9.20 = 35,000 units

Unit variable cost of E: ($24 × 60%) + ($56 × 40%) = $36.80

Unit contribution margin of E: $46.00 - $36.80 = $9.20

Break-even sales (units) for E: $202,400 ÷ $9.20 = 22,000 units

b. S: 13,200 units (22,000 units × 60%)T: 8,800 units (22,000 units × 40%)c. Sales units of E: ($202,400 + $119,600) ÷ $9.20 = 35,000 units

LB

Answered

If the Fed reduced reserve requirements,

A) banks would have less money to lend businesses and consumers

B) economic growth would decline

C) inflation would decline

D) banks would have more money to lend out

A) banks would have less money to lend businesses and consumers

B) economic growth would decline

C) inflation would decline

D) banks would have more money to lend out

On May 09, 2024

D

LB

Answered

Which of the following is a warranty of the transferor?

A) Transferor has no knowledge of any insolvency proceedings with respect to the maker, acceptor, or drawer of an unaccepted instrument.

B) Transferor warrants that all signatures are authentic and authorized.

C) Transferor warrants that he is entitled to enforce the instrument.

D) All of these are warranties of the transferor.

A) Transferor has no knowledge of any insolvency proceedings with respect to the maker, acceptor, or drawer of an unaccepted instrument.

B) Transferor warrants that all signatures are authentic and authorized.

C) Transferor warrants that he is entitled to enforce the instrument.

D) All of these are warranties of the transferor.

On May 08, 2024

D

LB

Answered

(Table: Firm's Willingness) The table Firm's Willingness explains the relation between the number of reports a firm is willing to produce and the lowest price it is willing to accept to prepare those reports.If the price of a report is $12,what is the value of producer surplus for the firm?

A) $27

B) $21

C) $16

D) $42

A) $27

B) $21

C) $16

D) $42

On May 07, 2024

B