LA

Leena Alayedh

Answers (6)

LA

Answered

In an ideal labor market, wages would adjust to balance the quantity of labor supplied and the quantity of labor demanded, ensuring that all workers are always fully employed.

On Jul 21, 2024

True

LA

Answered

According to UCC section 2-315,________ for a particular purpose arises when the seller has reason to know a particular purpose for which the buyer requires the goods.

A) express warranty

B) warranty of merchantability

C) implied warranty of fitness

D) multiple express warranties

A) express warranty

B) warranty of merchantability

C) implied warranty of fitness

D) multiple express warranties

On Jul 19, 2024

C

LA

Answered

When transferring investments between categories, unrealized holding gains for securities transferred from trading to available-for-sale must be

A) realized on the income statement

B) recognized on the income statement

C) realized and reported in comprehensive income

D) recognized and reported in comprehensive income

A) realized on the income statement

B) recognized on the income statement

C) realized and reported in comprehensive income

D) recognized and reported in comprehensive income

On Jun 21, 2024

D

LA

Answered

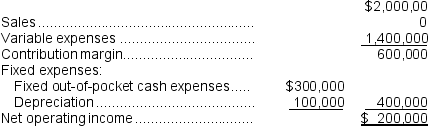

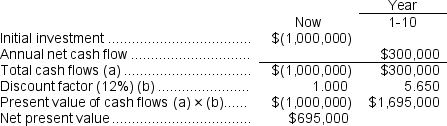

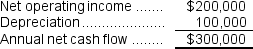

(Ignore income taxes in this problem.)Ursus, Inc., is considering a project that would have a ten-year life and would require a $1,000,000 investment in equipment.At the end of ten years, the project would terminate and the equipment would have no salvage value.The project would provide net operating income each year as follows:  All of the above items, except for depreciation, represent cash flows.The company's required rate of return is 12%.

All of the above items, except for depreciation, represent cash flows.The company's required rate of return is 12%.

Required:

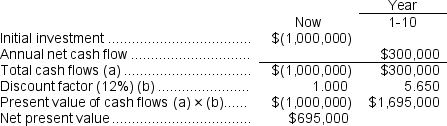

a.Compute the project's net present value.

b.Compute the project's internal rate of return to the nearest whole percent.

c.Compute the project's payback period.

d.Compute the project's simple rate of return.

All of the above items, except for depreciation, represent cash flows.The company's required rate of return is 12%.

All of the above items, except for depreciation, represent cash flows.The company's required rate of return is 12%.Required:

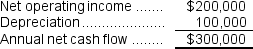

a.Compute the project's net present value.

b.Compute the project's internal rate of return to the nearest whole percent.

c.Compute the project's payback period.

d.Compute the project's simple rate of return.

On Jun 19, 2024

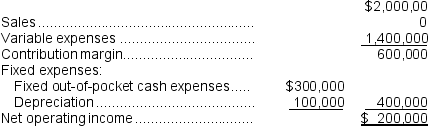

a.Because depreciation is the only noncash item on the income statement, the annual net cash flow can be computed by adding back depreciation to net operating income.

b.The formula for computing the factor of the internal rate of return (IRR)is:

b.The formula for computing the factor of the internal rate of return (IRR)is:

Factor of the IRR = Investment required ÷ Annual net cash inflow

= $1,000,000 ÷ $300,000 = 3.333

This factor is closest to the present value of an annuity over 10 years at 27%.Therefore, to the nearest whole percent, the internal rate of return is 27%.

c.The formula for the payback period is:

Investment required ÷ Annual net cash inflow = Payback period

$1,000,000 ÷ $300,000 per year = 3.33 years

d.The formula for the simple rate of return is:

Simple rate of return = Net operating income ÷ Initial investment

= $200,000 ÷ $1,000,000 = 20.0%

b.The formula for computing the factor of the internal rate of return (IRR)is:

b.The formula for computing the factor of the internal rate of return (IRR)is:Factor of the IRR = Investment required ÷ Annual net cash inflow

= $1,000,000 ÷ $300,000 = 3.333

This factor is closest to the present value of an annuity over 10 years at 27%.Therefore, to the nearest whole percent, the internal rate of return is 27%.

c.The formula for the payback period is:

Investment required ÷ Annual net cash inflow = Payback period

$1,000,000 ÷ $300,000 per year = 3.33 years

d.The formula for the simple rate of return is:

Simple rate of return = Net operating income ÷ Initial investment

= $200,000 ÷ $1,000,000 = 20.0%

LA

Answered

Allocative efficiency occurs when the

A) minimum of average total cost equals average revenue.

B) minimum of average total cost equals marginal revenue.

C) marginal cost equals the marginal benefit to society.

D) marginal revenue equals marginal benefit to society.

A) minimum of average total cost equals average revenue.

B) minimum of average total cost equals marginal revenue.

C) marginal cost equals the marginal benefit to society.

D) marginal revenue equals marginal benefit to society.

On May 22, 2024

C

LA

Answered

When deciding how to promote her new art gallery, Lila Williams decided that she did not need to throw a large grand opening reception. Instead, she promoted the center to the local artists groups and art schools in the area. Lila Williams was engaged in a concentrated targeting strategy.

On May 20, 2024

True