LM

Libby Mckill

Answers (2)

LM

Answered

Compared to external recruitment, internal recruiting:

A) the most qualified candidates may never be considered because they don't work for the company.

B) increases labor costs

C) eliminates conflict among job candidates

D) is in all ways superior

E) is accurately described by none of the above

A) the most qualified candidates may never be considered because they don't work for the company.

B) increases labor costs

C) eliminates conflict among job candidates

D) is in all ways superior

E) is accurately described by none of the above

On Sep 28, 2024

A

LM

Answered

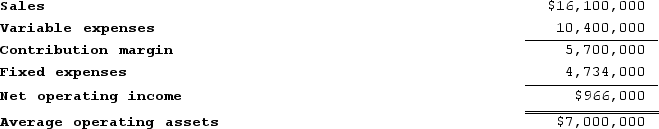

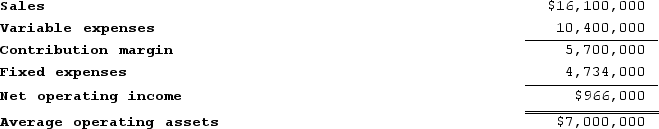

Familia Incorporated reported the following results from last year's operations:

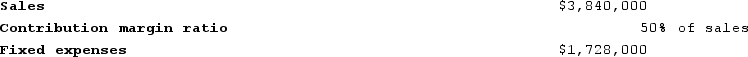

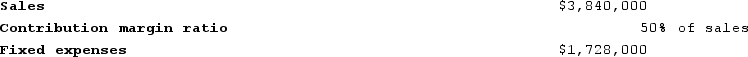

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 13%.

The company's minimum required rate of return is 13%.

Required:

1. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

2. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

3. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

4. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics: The company's minimum required rate of return is 13%.

The company's minimum required rate of return is 13%.Required:

1. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

2. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

3. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

4. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

On Sep 23, 2024

1. Last year's Return on investment = Net operating income ÷ Average operating assets = $966,000 ÷ $7,000,000 = 13.8%

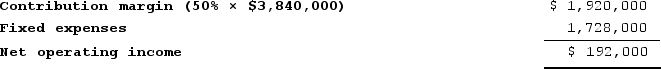

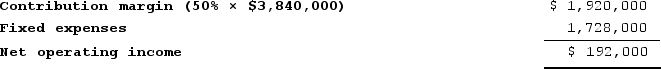

2. The return on investment for this year's investment opportunity is:

Return on investment = Net operating income ÷ Average operating assets = $192,000 ÷ $1,200,000 = 16.0%

Return on investment = Net operating income ÷ Average operating assets = $192,000 ÷ $1,200,000 = 16.0%

3. If the company pursues the investment opportunity and otherwise performs the same as last year, the return on investment will be:

Net operating income = $966,000 + $192,000 = $1,158,000

Average operating assets = $7,000,000 + $1,200,000 = $8,200,000

Return on investment = Net operating income ÷ Average operating assets = $1,158,000 ÷ $8,200,000 = 14.1%

4. The chief executive officer would pursue the investment opportunity because it increases the overall return on investment. The owners of the company would want the chief executive officer to pursue the investment opportunity because its return on investment is greater than the company's minimum required rate of return.

2. The return on investment for this year's investment opportunity is:

Return on investment = Net operating income ÷ Average operating assets = $192,000 ÷ $1,200,000 = 16.0%

Return on investment = Net operating income ÷ Average operating assets = $192,000 ÷ $1,200,000 = 16.0%3. If the company pursues the investment opportunity and otherwise performs the same as last year, the return on investment will be:

Net operating income = $966,000 + $192,000 = $1,158,000

Average operating assets = $7,000,000 + $1,200,000 = $8,200,000

Return on investment = Net operating income ÷ Average operating assets = $1,158,000 ÷ $8,200,000 = 14.1%

4. The chief executive officer would pursue the investment opportunity because it increases the overall return on investment. The owners of the company would want the chief executive officer to pursue the investment opportunity because its return on investment is greater than the company's minimum required rate of return.