LG

Linda Greer

Answers (6)

LG

Answered

Which of the following statements about a novation is false?

A) A novation is a type of substitute contract.

B) Under a novation,the original obligor has no further obligation under the contract.

C) A novation only requires the obligee's consent to having the delegatee perform the duties.

D) Under a novation,the obligee has the right to look to the new obligor for fulfillment of the contract.

A) A novation is a type of substitute contract.

B) Under a novation,the original obligor has no further obligation under the contract.

C) A novation only requires the obligee's consent to having the delegatee perform the duties.

D) Under a novation,the obligee has the right to look to the new obligor for fulfillment of the contract.

On Jul 10, 2024

C

LG

Answered

Determine the total liabilities at the end of the current year for Scott Industries.

On Jun 11, 2024

$17,000

($12,000 Accounts payable + $5,000 Income taxes payable = $17,000)

($12,000 Accounts payable + $5,000 Income taxes payable = $17,000)

LG

Answered

Waldo's utility function is U(x, y) xy.Waldo consumes 5 units of x and 25 units of y.

A) Waldo would be willing to make small exchanges of x for y in which he would give up 5 units of x for every unit of y he got.

B) Waldo would be willing to trade away all of his x for y as long as he got more than 5 units of y for every unit of x he gave up.

C) Waldo likes x and y equally well so he is always willing to exchange 1 unit of either good for more than 1 unit of the other.

D) Waldo will always be willing to make trades at any price if he does not have equal amounts of the two goods.

E) None of the above.

A) Waldo would be willing to make small exchanges of x for y in which he would give up 5 units of x for every unit of y he got.

B) Waldo would be willing to trade away all of his x for y as long as he got more than 5 units of y for every unit of x he gave up.

C) Waldo likes x and y equally well so he is always willing to exchange 1 unit of either good for more than 1 unit of the other.

D) Waldo will always be willing to make trades at any price if he does not have equal amounts of the two goods.

E) None of the above.

On Jun 09, 2024

E

LG

Answered

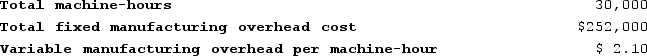

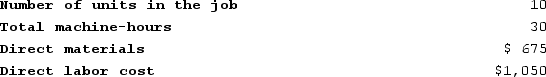

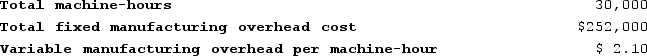

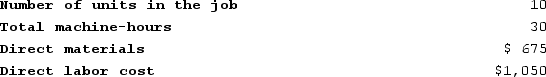

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T687 was completed with the following characteristics:

Recently, Job T687 was completed with the following characteristics:

If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $81.60

B) $305.60

C) $285.60

D) $241.50

Recently, Job T687 was completed with the following characteristics:

Recently, Job T687 was completed with the following characteristics: If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.) A) $81.60

B) $305.60

C) $285.60

D) $241.50

On May 12, 2024

C

LG

Answered

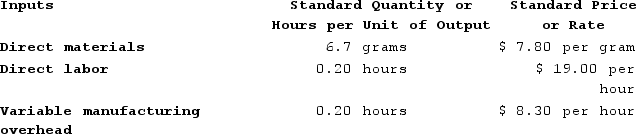

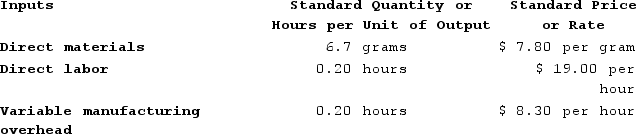

Heye Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

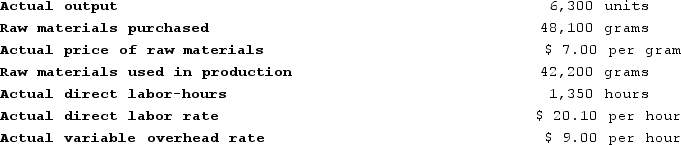

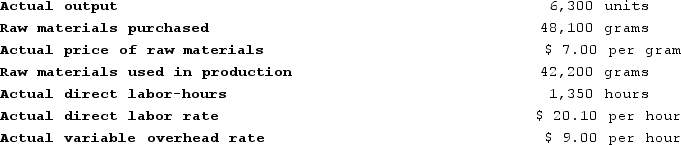

The company has reported the following actual results for the product for August:

The company has reported the following actual results for the product for August:

Required:

Required:

a. Compute the materials price variance for August.

b. Compute the materials quantity variance for August.

c. Compute the labor rate variance for August.

d. Compute the labor efficiency variance for August.

e. Compute the variable overhead rate variance for August.

f. Compute the variable overhead efficiency variance for August.

The company has reported the following actual results for the product for August:

The company has reported the following actual results for the product for August: Required:

Required:a. Compute the materials price variance for August.

b. Compute the materials quantity variance for August.

c. Compute the labor rate variance for August.

d. Compute the labor efficiency variance for August.

e. Compute the variable overhead rate variance for August.

f. Compute the variable overhead efficiency variance for August.

On May 10, 2024

a. Materials price variance = (Actual quantity × Actual price) − (Actual quantity × Standard price)

= Actual quantity × (Actual price − Standard price)

= 48,100 grams × ($7.00 per gram − $7.80 per gram)

= 48,100 grams × (−$0.80 per gram)

= $38,480 Favorable

b. Standard quantity = 6,300 units × 6.7 grams per unit = 42,210 grams

Materials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)

= (Actual quantity − Standard quantity) × Standard price

= (42,200 grams − 42,210 grams) × $7.80 per gram

= −10 grams × $7.80 per gram

= $78 Favorable

c. Labor rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 1,350 hours × ($20.10 per hour − $19.00 per hour)

= 1,350 hours × ($1.10 per hour)

= $1,485 Unfavorable

d. Standard hours = 6,300 units × 0.20 hours per unit = 1,260 hours

Labor efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,350 hours − 1,260 hours) × $19.00 per hour

= (90 hours) × $19.00 per hour

= $1,710 Unfavorable

e. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 1,350 hours × ($9.00 per hour − $8.30 per hour)

= 1,350 hours × ($0.70 per hour)

= $945 Unfavorable

f. Standard hours = 6,300 units × 0.20 hours per unit = 1,260 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,350 hours − 1,260 hours) × $8.30 per hour

= (90 hours) × $8.30 per hour

= $747 Unfavorable

= Actual quantity × (Actual price − Standard price)

= 48,100 grams × ($7.00 per gram − $7.80 per gram)

= 48,100 grams × (−$0.80 per gram)

= $38,480 Favorable

b. Standard quantity = 6,300 units × 6.7 grams per unit = 42,210 grams

Materials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)

= (Actual quantity − Standard quantity) × Standard price

= (42,200 grams − 42,210 grams) × $7.80 per gram

= −10 grams × $7.80 per gram

= $78 Favorable

c. Labor rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 1,350 hours × ($20.10 per hour − $19.00 per hour)

= 1,350 hours × ($1.10 per hour)

= $1,485 Unfavorable

d. Standard hours = 6,300 units × 0.20 hours per unit = 1,260 hours

Labor efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,350 hours − 1,260 hours) × $19.00 per hour

= (90 hours) × $19.00 per hour

= $1,710 Unfavorable

e. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 1,350 hours × ($9.00 per hour − $8.30 per hour)

= 1,350 hours × ($0.70 per hour)

= $945 Unfavorable

f. Standard hours = 6,300 units × 0.20 hours per unit = 1,260 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,350 hours − 1,260 hours) × $8.30 per hour

= (90 hours) × $8.30 per hour

= $747 Unfavorable