LA

Luis Angel Rivera

Answers (7)

LA

Answered

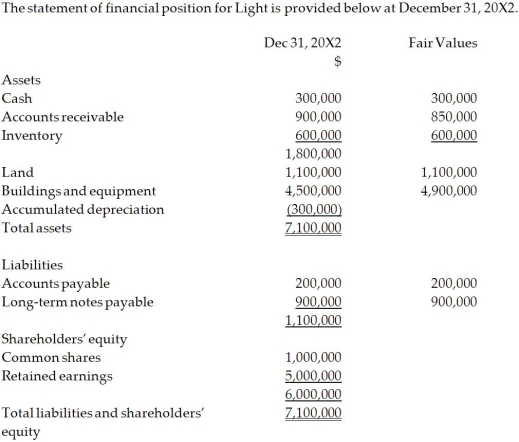

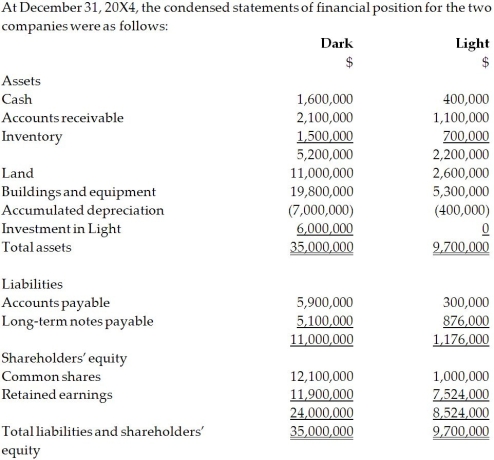

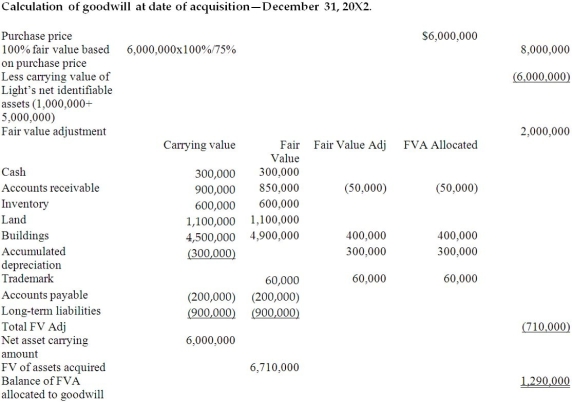

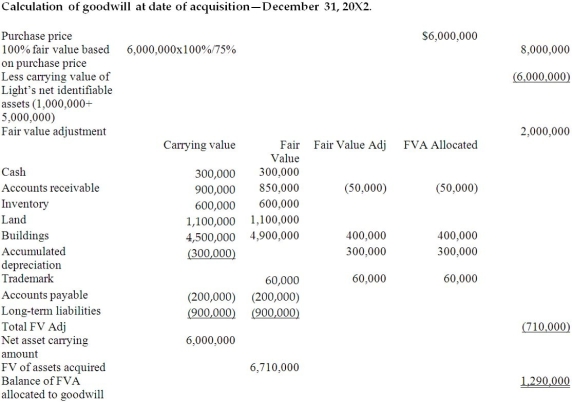

On December 31, 20X2, Dark Company purchased 75% of the outstanding common shares of Light Company for $6.0 million in cash. On that date, the shareholders' equity of Light totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization.  For the year ending December 31,20X431,20 \mathrm { X } 431,20X4 , the statements of comprehensive income for Dark and Light were as follows:

For the year ending December 31,20X431,20 \mathrm { X } 431,20X4 , the statements of comprehensive income for Dark and Light were as follows:

Dark Light Sales and other revenue $12,500,000$6,804,000 Cost of goods sold 8,000,0004,000,000 Depreciation expense 1,500,0001,000,000 Other expenses 1,800,0001,200,000 Total expenses 11,300,000‾6,200,000Net income$1,200,000‾$604,000‾\begin{array}{lcc}&\text { Dark } &\text { Light } \\ \text { Sales and other revenue } & \$ 12,500,000 & \$ 6,804,000 \\ \text { Cost of goods sold } & 8,000,000 & 4,000,000 \\\text { Depreciation expense } & 1,500,000 & 1,000,000 \\\text { Other expenses } & 1,800,000 & 1,200,000 \\ \text { Total expenses } & \underline{11,300,000} & 6,200,000 \\ \text {Net income}& \underline{\$ 1,200,000}& \underline{\$ 604,000} \\\end{array} Sales and other revenue Cost of goods sold Depreciation expense Other expenses Total expenses Net income Dark $12,500,0008,000,0001,500,0001,800,00011,300,000$1,200,000 Light $6,804,0004,000,0001,000,0001,200,0006,200,000$604,000 OTHER INFORMATION:

OTHER INFORMATION:

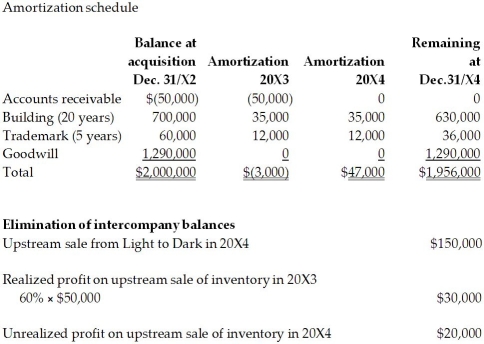

1. On December 31, 20X2, Light had a building with a fair value that was $4,900,000 and an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Light had a trademark that had a fair value of $60,000. The trademark has an expected useful life of five years.

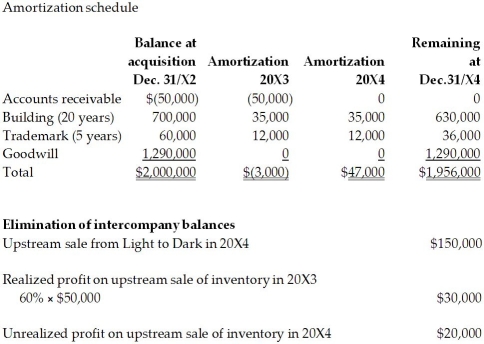

3. During 20X3, Light sold merchandise to Dark for $150,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Dark and the other 60% remained in its December 31, 20X3, inventories.

4. On December 31, 20X4, the inventories of Dark contained merchandise purchased from Light on which Light had recognized a gross profit in the amount of $20,000. Total sales from Light to Dark were $150,000 during 20X4.

5. During 20X4, Dark declared and paid dividends of $300,000 while Light declared and paid dividends of $100,000.

6. Dark accounts for its investment in Light using the cost method.

Required:

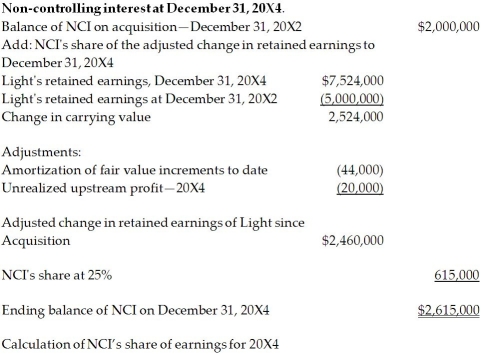

Calculate the non-controlling interest on the consolidated statement of financial position at December 31, 20X4, under the entity method.

Calculate the NCI's share of earnings for 20X4.

For the year ending December 31,20X431,20 \mathrm { X } 431,20X4 , the statements of comprehensive income for Dark and Light were as follows:

For the year ending December 31,20X431,20 \mathrm { X } 431,20X4 , the statements of comprehensive income for Dark and Light were as follows:Dark Light Sales and other revenue $12,500,000$6,804,000 Cost of goods sold 8,000,0004,000,000 Depreciation expense 1,500,0001,000,000 Other expenses 1,800,0001,200,000 Total expenses 11,300,000‾6,200,000Net income$1,200,000‾$604,000‾\begin{array}{lcc}&\text { Dark } &\text { Light } \\ \text { Sales and other revenue } & \$ 12,500,000 & \$ 6,804,000 \\ \text { Cost of goods sold } & 8,000,000 & 4,000,000 \\\text { Depreciation expense } & 1,500,000 & 1,000,000 \\\text { Other expenses } & 1,800,000 & 1,200,000 \\ \text { Total expenses } & \underline{11,300,000} & 6,200,000 \\ \text {Net income}& \underline{\$ 1,200,000}& \underline{\$ 604,000} \\\end{array} Sales and other revenue Cost of goods sold Depreciation expense Other expenses Total expenses Net income Dark $12,500,0008,000,0001,500,0001,800,00011,300,000$1,200,000 Light $6,804,0004,000,0001,000,0001,200,0006,200,000$604,000

OTHER INFORMATION:

OTHER INFORMATION:1. On December 31, 20X2, Light had a building with a fair value that was $4,900,000 and an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Light had a trademark that had a fair value of $60,000. The trademark has an expected useful life of five years.

3. During 20X3, Light sold merchandise to Dark for $150,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Dark and the other 60% remained in its December 31, 20X3, inventories.

4. On December 31, 20X4, the inventories of Dark contained merchandise purchased from Light on which Light had recognized a gross profit in the amount of $20,000. Total sales from Light to Dark were $150,000 during 20X4.

5. During 20X4, Dark declared and paid dividends of $300,000 while Light declared and paid dividends of $100,000.

6. Dark accounts for its investment in Light using the cost method.

Required:

Calculate the non-controlling interest on the consolidated statement of financial position at December 31, 20X4, under the entity method.

Calculate the NCI's share of earnings for 20X4.

On Jul 10, 2024

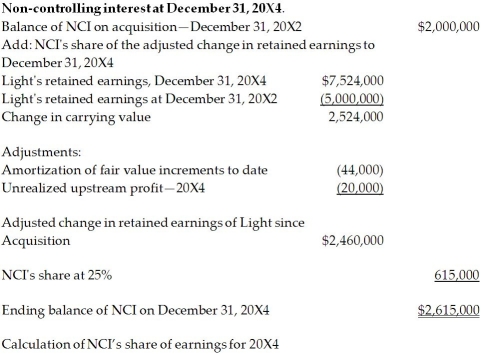

Entity Method  Non-controlling interest is 25% × 8,000,000 (fair value)= 2,000,000

Non-controlling interest is 25% × 8,000,000 (fair value)= 2,000,000

Details Amount Net income of Light for 20X4 ( separate entity financial statement) 604,000 Add: Realized profit on upstream sale of inventory in previous year 30,000 Less: Unrealized profit on upstream sale of inventory in current year (20,000) Amortization of FVA during the year (47,000) Adjusted net income of Light for 20X4 567,000 NCI’s share @25%141,750\begin{array} { | l | r | } \hline \text { Details } & \text { Amount } \\\hline \text { Net income of Light for 20X4 ( separate entity financial statement) } & 604,000 \\\hline \text { Add: Realized profit on upstream sale of inventory in previous year } & 30,000 \\\hline \text { Less: } & \\\hline \text { Unrealized profit on upstream sale of inventory in current year } &( 20,000 )\\\hline \text { Amortization of FVA during the year } & ( 47,000 ) \\\hline \text { Adjusted net income of Light for 20X4 } & 567,000\\\hline \text { NCI's share } @ 25 \% & 141,750 \\\hline\end{array} Details Net income of Light for 20X4 ( separate entity financial statement) Add: Realized profit on upstream sale of inventory in previous year Less: Unrealized profit on upstream sale of inventory in current year Amortization of FVA during the year Adjusted net income of Light for 20X4 NCI’s share @25% Amount 604,00030,000(20,000)(47,000)567,000141,750

Details Amount Net income of Light for 20X4 ( separate entity financial statement) 604,000 Add: Realized profit on upstream sale of inventory in previous year 30,000 Less: Unrealized profit on upstream sale of inventory in current year (20,000) Amortization of FVA during the year (47,000) Adjusted net income of Light for 20X4 567,000 NCI’s share @25%141,750\begin{array} { | l | r | } \hline \text { Details } & \text { Amount } \\\hline \text { Net income of Light for 20X4 ( separate entity financial statement) } & 604,000 \\\hline \text { Add: Realized profit on upstream sale of inventory in previous year } & 30,000 \\\hline \text { Less: } & \\\hline \text { Unrealized profit on upstream sale of inventory in current year } &( 20,000 )\\\hline \text { Amortization of FVA during the year } & ( 47,000 ) \\\hline \text { Adjusted net income of Light for 20X4 } & 567,000\\\hline \text { NCI's share } @ 25 \% & 141,750 \\\hline\end{array} Details Net income of Light for 20X4 ( separate entity financial statement) Add: Realized profit on upstream sale of inventory in previous year Less: Unrealized profit on upstream sale of inventory in current year Amortization of FVA during the year Adjusted net income of Light for 20X4 NCI’s share @25% Amount 604,00030,000(20,000)(47,000)567,000141,750

Non-controlling interest is 25% × 8,000,000 (fair value)= 2,000,000

Non-controlling interest is 25% × 8,000,000 (fair value)= 2,000,000

Details Amount Net income of Light for 20X4 ( separate entity financial statement) 604,000 Add: Realized profit on upstream sale of inventory in previous year 30,000 Less: Unrealized profit on upstream sale of inventory in current year (20,000) Amortization of FVA during the year (47,000) Adjusted net income of Light for 20X4 567,000 NCI’s share @25%141,750\begin{array} { | l | r | } \hline \text { Details } & \text { Amount } \\\hline \text { Net income of Light for 20X4 ( separate entity financial statement) } & 604,000 \\\hline \text { Add: Realized profit on upstream sale of inventory in previous year } & 30,000 \\\hline \text { Less: } & \\\hline \text { Unrealized profit on upstream sale of inventory in current year } &( 20,000 )\\\hline \text { Amortization of FVA during the year } & ( 47,000 ) \\\hline \text { Adjusted net income of Light for 20X4 } & 567,000\\\hline \text { NCI's share } @ 25 \% & 141,750 \\\hline\end{array} Details Net income of Light for 20X4 ( separate entity financial statement) Add: Realized profit on upstream sale of inventory in previous year Less: Unrealized profit on upstream sale of inventory in current year Amortization of FVA during the year Adjusted net income of Light for 20X4 NCI’s share @25% Amount 604,00030,000(20,000)(47,000)567,000141,750

Details Amount Net income of Light for 20X4 ( separate entity financial statement) 604,000 Add: Realized profit on upstream sale of inventory in previous year 30,000 Less: Unrealized profit on upstream sale of inventory in current year (20,000) Amortization of FVA during the year (47,000) Adjusted net income of Light for 20X4 567,000 NCI’s share @25%141,750\begin{array} { | l | r | } \hline \text { Details } & \text { Amount } \\\hline \text { Net income of Light for 20X4 ( separate entity financial statement) } & 604,000 \\\hline \text { Add: Realized profit on upstream sale of inventory in previous year } & 30,000 \\\hline \text { Less: } & \\\hline \text { Unrealized profit on upstream sale of inventory in current year } &( 20,000 )\\\hline \text { Amortization of FVA during the year } & ( 47,000 ) \\\hline \text { Adjusted net income of Light for 20X4 } & 567,000\\\hline \text { NCI's share } @ 25 \% & 141,750 \\\hline\end{array} Details Net income of Light for 20X4 ( separate entity financial statement) Add: Realized profit on upstream sale of inventory in previous year Less: Unrealized profit on upstream sale of inventory in current year Amortization of FVA during the year Adjusted net income of Light for 20X4 NCI’s share @25% Amount 604,00030,000(20,000)(47,000)567,000141,750LA

Answered

Which of the following best describes a balanced scorecard?

A) a combination of performance measures directed toward the company's long- and short-term goals and used as the basis for awarding incentive pay

B) a performance review process where the organization collects feedback from customers, managers, and subordinates; assigns ratings; and lists them on the company's performance card

C) an arrangement in which the organization distributes shares of stock to all its employees by placing the stock into a trust

D) a type of incentive pay in which payments are a percentage of the organization's profits and do not become part of the employees' base salary

E) a system designed to measure the performance of HR personnel based on the quality of recruitment

A) a combination of performance measures directed toward the company's long- and short-term goals and used as the basis for awarding incentive pay

B) a performance review process where the organization collects feedback from customers, managers, and subordinates; assigns ratings; and lists them on the company's performance card

C) an arrangement in which the organization distributes shares of stock to all its employees by placing the stock into a trust

D) a type of incentive pay in which payments are a percentage of the organization's profits and do not become part of the employees' base salary

E) a system designed to measure the performance of HR personnel based on the quality of recruitment

On Jul 10, 2024

A

LA

Answered

An alternative name for Bad Debt Expense is

A) Collection Expense

B) Credit Loss Expense

C) Uncollectible Accounts Expense

D) Deadbeat Expense

A) Collection Expense

B) Credit Loss Expense

C) Uncollectible Accounts Expense

D) Deadbeat Expense

On Jul 08, 2024

C

LA

Answered

Brown Inc., a publishing company, is a partial state-owned enterprise in Descibelia, a country in South America. It is likely that:

A) the government of Descibelia gets indirect benefits from the jobs created by Emerald Inc.

B) Brown Inc. gives some of its profits to the government of Descibelia.

C) Brown Inc.'s goal is to serve environmental needs.

D) the government of Descibelia has bought stocks and bonds in Emerald Inc.

A) the government of Descibelia gets indirect benefits from the jobs created by Emerald Inc.

B) Brown Inc. gives some of its profits to the government of Descibelia.

C) Brown Inc.'s goal is to serve environmental needs.

D) the government of Descibelia has bought stocks and bonds in Emerald Inc.

On Jun 10, 2024

B

LA

Answered

A start-up is being financed by a long-standing and established company.This company takes financial support from wealthy investors.In this context,the company that is financing the start-up is a(n)

A) finance manager.

B) borrower.

C) angel investor.

D) venture capitalist.

A) finance manager.

B) borrower.

C) angel investor.

D) venture capitalist.

On Jun 08, 2024

D

LA

Answered

Assume you are advising the Nepalese government about trade policies and government actions affecting trade. What options does the government have? Which would you recommend the country do to stimulate the domestic economy?

On May 11, 2024

The trade policy choices include tariffs, quotas, and exchange controls. Quotas could be reduced on things like trekking permits for Mount Everest to increase tourism revenues. Tariffs on certain imported goods could be used to protect domestic producers. Exchange controls could be used to reduce the cost of Nepalese exports.