MA

Maria Anagnostopoulos

Answers (8)

MA

Answered

A government policy generates $10,000 of benefits to underprivileged youth at a cost of $5,000 to taxpayers. The policy is Pareto efficient.

On Jul 29, 2024

False

MA

Answered

Which group of ethical theories focuses on who the leaders are as people?

A) deontological

B) teleological

C) altruism

D) virtue-based

A) deontological

B) teleological

C) altruism

D) virtue-based

On Jul 26, 2024

D

MA

Answered

Bella generally stays at her office beyond normal work hours in order to complete special projects. She also comes to work every weekend and on other holidays. From this information, it is likely that Bella has high ___.

A) personal wellness

B) Machiavellianism

C) self-serving bias

D) openness to experience

E) job involvement

A) personal wellness

B) Machiavellianism

C) self-serving bias

D) openness to experience

E) job involvement

On Jun 25, 2024

E

MA

Answered

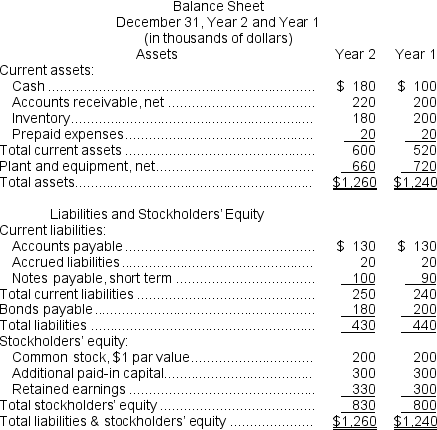

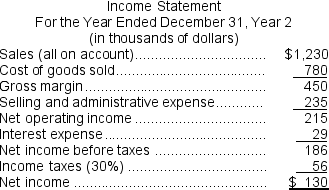

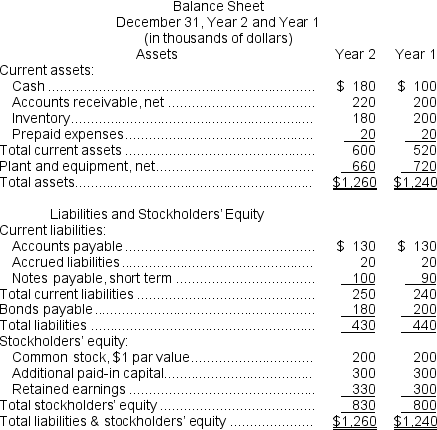

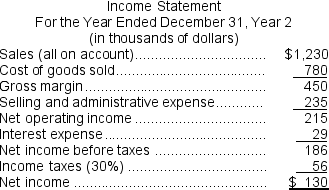

Sidell Corporation's most recent balance sheet and income statement appear below:

Required:

Required:

Compute the following for Year 2:

a.Times interest earned ratio.

b.Debt-to-equity ratio.

Required:

Required:Compute the following for Year 2:

a.Times interest earned ratio.

b.Debt-to-equity ratio.

On May 29, 2024

a.Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense

= $215 ÷ $29 = 7.41

b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $430 ÷ $830 = 0.52

= $215 ÷ $29 = 7.41

b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $430 ÷ $830 = 0.52

MA

Answered

The net result of governments exercising greater control over the activities of citizens is the creation of a large bureaucracy at provincial and federal levels of government, and a substantial restriction of the freedom of the individual through many and varied regulations.

On May 26, 2024

True

MA

Answered

Assume that you own an exhaustible resource that is sold competitively. The price of the resource is:

Pt + 1 - C = 1.08(Pt -

C),

where t = 0 at the beginning of 2005,

and

and

It is also known that the demand for the resource is:

It is also known that the demand for the resource is:

Q = 1,000,000 - 25,000 P,

where Q represents output in tons per year. If the beginning of 2005 price is $30 per ton and the marginal cost of extraction is $10 per ton, what will the price be at the end of 2009? What is the user cost of production in 2009? Is it different from the user cost for 2005? Explain. How much of the resource will be extracted in 2009? What is the market rate of interest on money? Explain.

Pt + 1 - C = 1.08(Pt -

C),

where t = 0 at the beginning of 2005,

and

and It is also known that the demand for the resource is:

It is also known that the demand for the resource is:Q = 1,000,000 - 25,000 P,

where Q represents output in tons per year. If the beginning of 2005 price is $30 per ton and the marginal cost of extraction is $10 per ton, what will the price be at the end of 2009? What is the user cost of production in 2009? Is it different from the user cost for 2005? Explain. How much of the resource will be extracted in 2009? What is the market rate of interest on money? Explain.

On Apr 29, 2024

The price at the end of 2009 will be determined from equation (1).

time(t) Net Price

beginning 0 30 - 10 = 20

end of 2005 1 P1 - 10 = 21.600

end of 2006 2 P2 - 10 = 23.328

end of 2007 3 P3 - 10 = 25.194

end of 2008 4 P4 - 10 = 27.210

end of 2009 5 P5- 10 = 29.390

Thus, the end of 2009 price is The user cost is the difference between the selling price of 39.39 and the marginal cost of extraction of 10.000 or 29.39/ton. This user price is higher in 2009 than in 2005 reflecting the fact that more of the resource has been extracted by 2009 than by 2005, and the value of each remaining unit has risen.

The user cost is the difference between the selling price of 39.39 and the marginal cost of extraction of 10.000 or 29.39/ton. This user price is higher in 2009 than in 2005 reflecting the fact that more of the resource has been extracted by 2009 than by 2005, and the value of each remaining unit has risen.

At the price of $39.39 per ton, the quantity extracted in 2009 is:

Q = 1,000,000 - 25,000(39.39) = 15,250 tons/year

The market rate of interest on money is the same rate as the rate at which increases each year. In this problem,

increases each year. In this problem,  therefore,

therefore,  per year.

per year.

time(t) Net Price

beginning 0 30 - 10 = 20

end of 2005 1 P1 - 10 = 21.600

end of 2006 2 P2 - 10 = 23.328

end of 2007 3 P3 - 10 = 25.194

end of 2008 4 P4 - 10 = 27.210

end of 2009 5 P5- 10 = 29.390

Thus, the end of 2009 price is

The user cost is the difference between the selling price of 39.39 and the marginal cost of extraction of 10.000 or 29.39/ton. This user price is higher in 2009 than in 2005 reflecting the fact that more of the resource has been extracted by 2009 than by 2005, and the value of each remaining unit has risen.

The user cost is the difference between the selling price of 39.39 and the marginal cost of extraction of 10.000 or 29.39/ton. This user price is higher in 2009 than in 2005 reflecting the fact that more of the resource has been extracted by 2009 than by 2005, and the value of each remaining unit has risen.At the price of $39.39 per ton, the quantity extracted in 2009 is:

Q = 1,000,000 - 25,000(39.39) = 15,250 tons/year

The market rate of interest on money is the same rate as the rate at which

increases each year. In this problem,

increases each year. In this problem,  therefore,

therefore,  per year.

per year.MA

Answered

Dexter Company is considering purchasing equipment. The equipment will produce the following cash flows: Year 1 $120,000 Year 2 $200,000\begin{array} { l l } \text { Year 1 } & \$ 120,000 \\\text { Year 2 } & \$ 200,000\end{array} Year 1 Year 2 $120,000$200,000 Dexter requires a minimum rate of return of 10%. What is the maximum price Dexter should pay for this equipment?

A) $274381

B) $165290

C) $320000

D) $160000

A) $274381

B) $165290

C) $320000

D) $160000

On Apr 26, 2024

A