MG

Marissa Gallo

Answers (6)

MG

Answered

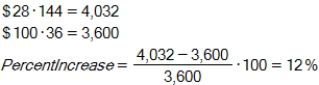

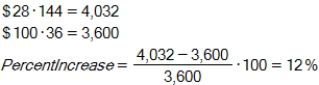

Asa's most recent credit card statement had a balance of $2,622.77.The minimum payment warning box indicates that it will take 12 years to pay off the card if he makes the minimum payment of $28 per month.If he makes a monthly payment of $100,it will take 3 years to pay off the balance.What will be the percent increase in total payments if Asa only pays the minimum rather than the $100 per month?

On Jul 27, 2024

Multiply the monthly payment by the time required in months to pay off the credit card.Then use the total payments for the $100-per-month option as the basis of comparison in the percent increase formula.

MG

Answered

If two variables are significantly correlated,this means that one variable causes the other.

On Jul 14, 2024

False

MG

Answered

You can use a continuous random variable to ____________________ a discrete random variable that takes on a countable,but very large,number of possible values.

On Jun 20, 2024

approximate

MG

Answered

A sample is chosen randomly from a population that was strongly skewed to the right.Describe the sampling distribution model for the sample mean if the sample size is small.

A) Skewed right,centre at ?,standard deviation ?/ n\sqrt { n }n

B) Normal,centre at ?,standard deviation σ/n\sqrt { \sigma / n }σ/n

C) There is not enough information to describe the sampling distribution model.

D) Normal,centre at ?,standard deviation ?/ n\sqrt { n }n

E) Skewed right,centre at ?,standard deviation σ/n\sqrt { \sigma / n }σ/n

A) Skewed right,centre at ?,standard deviation ?/ n\sqrt { n }n

B) Normal,centre at ?,standard deviation σ/n\sqrt { \sigma / n }σ/n

C) There is not enough information to describe the sampling distribution model.

D) Normal,centre at ?,standard deviation ?/ n\sqrt { n }n

E) Skewed right,centre at ?,standard deviation σ/n\sqrt { \sigma / n }σ/n

On Jun 14, 2024

A

MG

Answered

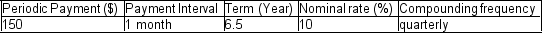

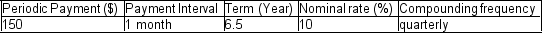

Determine the future value (accurate to the cent) of the ordinary general annuity:

On May 17, 2024

$16,339.57

MG

Answered

An individual wants to receive end-of-month payments of $1,200 for 20 years after she retires 15 years from now. What lump amount must she invest today to provide the retirement income? Assume the investment earns 7% compounded monthly for the entire 35 years.

A) $49,864.93

B) $54,645.42

C) $54,328.50

D) $187,835.65

E) $155,681.89

A) $49,864.93

B) $54,645.42

C) $54,328.50

D) $187,835.65

E) $155,681.89

On May 14, 2024

C