MI

Marwa Igbariya

Answers (6)

MI

Answered

Determine the tax liability in each of the following cases.

a.Single individual,taxable income of $64,985.

b.Married couple,taxable income of $62,717.

c.Single individual,wage income of $92,437.No other sources of income.

a.Single individual,taxable income of $64,985.

b.Married couple,taxable income of $62,717.

c.Single individual,wage income of $92,437.No other sources of income.

On Jul 11, 2024

Answers are derived from the Tax Tables.

a.$11,983.

b.$8,476.

c.$82,037.

For item c,remember to subtract the $10,400 permitted deduction before going to the Tax Tables.

a.$11,983.

b.$8,476.

c.$82,037.

For item c,remember to subtract the $10,400 permitted deduction before going to the Tax Tables.

MI

Answered

________ commitment is negatively related to performance.

On Jul 08, 2024

Continuance

MI

Answered

An intentional tort exists under which of the following circumstances?

A) The act that was committed is prohibited by Common Law.

B) The act was intentional.

C) The act was outside of a contract or trust.

D) All of the responses are correct.

A) The act that was committed is prohibited by Common Law.

B) The act was intentional.

C) The act was outside of a contract or trust.

D) All of the responses are correct.

On Jun 11, 2024

D

MI

Answered

Performance appraisal is the process of evaluating individual job performance as a basis for making objective personnel decisions.

On Jun 08, 2024

True

MI

Answered

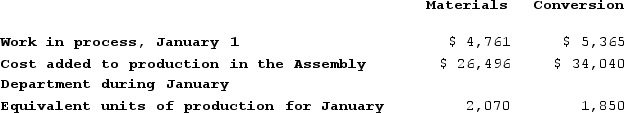

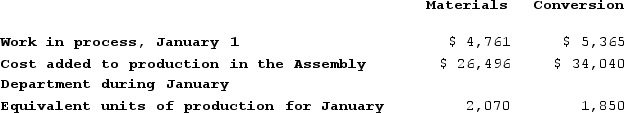

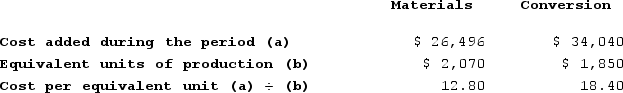

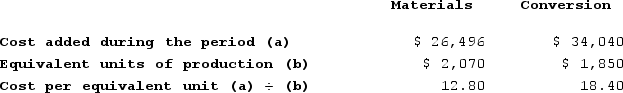

Zubris Corporation uses the first-in, first-out method in its process costing. The following data concern the company's Assembly Department for the month of January.

Required:Compute the costs per equivalent unit for the Assembly Department for January using the first-in, first-out method.

Required:Compute the costs per equivalent unit for the Assembly Department for January using the first-in, first-out method.

Required:Compute the costs per equivalent unit for the Assembly Department for January using the first-in, first-out method.

Required:Compute the costs per equivalent unit for the Assembly Department for January using the first-in, first-out method.On May 12, 2024

First-in, first-out method:

MI

Answered

Change in which an organization moves to a radically different, and sometimes unknown, future state is known as incremental change.

On May 09, 2024

False