MT

Mason Twitty

Answers (6)

MT

Answered

T.J. Waxham's has a beginning receivables balance on January 1 of $1,460. Sales for January through April are $1,200, $1,450, $1,580, and $1,640, respectively. The accounts receivable period is 30 days. How much did the firm collect in the month of April? Assume that a year has 360 days.

A) $1,200

B) $1,450

C) $1,460

D) $1,580

E) $1,640

A) $1,200

B) $1,450

C) $1,460

D) $1,580

E) $1,640

On Jul 20, 2024

D

MT

Answered

Which of the following actions is the Federal Reserve Board most likely to take in an attempt to increase the money supply in the economy?

A) Raise reserve requirements

B) Buy government securities

C) Print more money

D) Raise discount rates

E) Restrict credit controls

A) Raise reserve requirements

B) Buy government securities

C) Print more money

D) Raise discount rates

E) Restrict credit controls

On Jul 17, 2024

B

MT

Answered

Audiences hold negotiators accountable in all but one of the following ways.Which one?

A) When the negotiator's performance is visible.

B) When the audience is dependent upon the negotiator for their outcomes.

C) When the negotiating agents were members of a group that developed the negotiating position.

D) When the audience is able to judge how well a negotiator performs.

E) When the audience insists that the negotiator be tough,firm,and demanding.

A) When the negotiator's performance is visible.

B) When the audience is dependent upon the negotiator for their outcomes.

C) When the negotiating agents were members of a group that developed the negotiating position.

D) When the audience is able to judge how well a negotiator performs.

E) When the audience insists that the negotiator be tough,firm,and demanding.

On Jun 20, 2024

C

MT

Answered

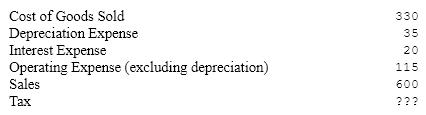

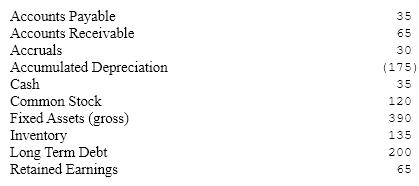

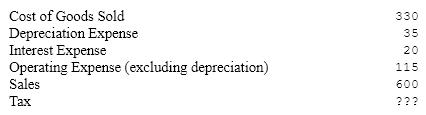

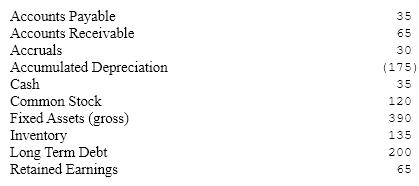

The following question(s)refer to the year-end account balances for UBUS, Inc. The accounts are listed in alphabetical order, NOT in the order they appear on the financial statements. The applicable tax rate is 40%.

UBUS Income Statement

UBUS Balance Sheet

UBUS Balance Sheet

a)What was UBUS Inc.'s earnings before interest and taxes (EBIT)?

a)What was UBUS Inc.'s earnings before interest and taxes (EBIT)?

a. $155

b. $120

c. $100

d. $215

e. $200

b)What is UBUS Inc.'s tax liability?

a. $48

b. $60

c. $55

d. $40

e. $35

c)What was UBUS Inc.'s Net Income?

a. $72

b. $45

c. $60

d. ($20)

e. $100

d)What is UBUS Inc.'s Total Assets?

a. $420

b. $570

c. $625

d. $450

e. $490

e)What is UBUS Inc.'s Total Equity?

a. $115

b. $120

c. $185

d. $205

e. $240

f)What is UBUS Inc.'s Net Working Capital?

a. $35

b. $70

c. $100

d. $130

e. $170

UBUS Income Statement

UBUS Balance Sheet

UBUS Balance Sheet  a)What was UBUS Inc.'s earnings before interest and taxes (EBIT)?

a)What was UBUS Inc.'s earnings before interest and taxes (EBIT)? a. $155

b. $120

c. $100

d. $215

e. $200

b)What is UBUS Inc.'s tax liability?

a. $48

b. $60

c. $55

d. $40

e. $35

c)What was UBUS Inc.'s Net Income?

a. $72

b. $45

c. $60

d. ($20)

e. $100

d)What is UBUS Inc.'s Total Assets?

a. $420

b. $570

c. $625

d. $450

e. $490

e)What is UBUS Inc.'s Total Equity?

a. $115

b. $120

c. $185

d. $205

e. $240

f)What is UBUS Inc.'s Net Working Capital?

a. $35

b. $70

c. $100

d. $130

e. $170

On Jun 17, 2024

a) b $600-$330-$115-$35=$120

b) d EBT=$120-$20=$100

Tax=$100 × .4=$40

c) c $100 − $40=$60

d) d $35+$65+$135+$390-$175=$450

e) c $120 + $65 = $185

f) e $35+$65+$135-$35-$30=$170

b) d EBT=$120-$20=$100

Tax=$100 × .4=$40

c) c $100 − $40=$60

d) d $35+$65+$135+$390-$175=$450

e) c $120 + $65 = $185

f) e $35+$65+$135-$35-$30=$170

MT

Answered

The classicals assumed ________ wages and _________ prices.

On May 21, 2024

flexible (downward);flexible (downward)

MT

Answered

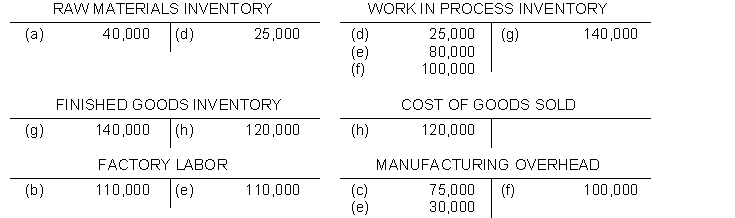

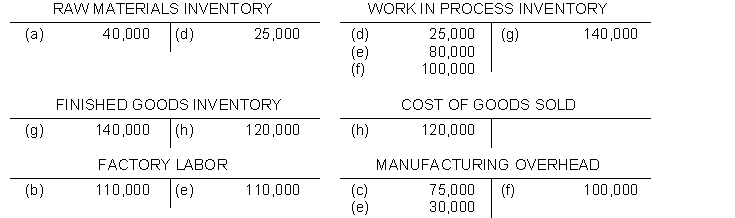

Selected accounts of Kosar Manufacturing Company at year end appear below:  Instructions

Instructions

Explain the probable transaction that took place for each of the items identified by letters in the accounts. For example:

(a) Raw materials costing $40000 were purchased.

Instructions

InstructionsExplain the probable transaction that took place for each of the items identified by letters in the accounts. For example:

(a) Raw materials costing $40000 were purchased.

On May 18, 2024

(a) Raw materials costing $40000 were purchased.

(b) Factory labor costs incurred amounted to $110000.

(c) Actual manufacturing overhead costs incurred were $75000.

(d) Direct materials requisitioned for production amounted to $25000.

(e) Factory labor used consisted of:

Direct labor $80000

Indirect labor 30000

(f) Manufacturing overhead applied to production was $100000.

(g) Completed goods costing $140000 were transferred to finished goods inventory.

(h) Finished goods costing $120000 were sold.