MB

Matheus Bittencourt

Answers (6)

MB

Answered

Explain expectancy theory.

On Jul 24, 2024

Answers will vary. Expectancy theory, sometimes referred to as VIE theory, is a fairly complex theory from a cognitive perspective because it casts an employee in the role of decision maker. It developed from early work in psychology, as well as basic economic theory, which assumes that people work to maximize their personal (positive) outcomes. Expectancy theory is concerned with three components and the links among them. The components are termed "effort," "performance," and "outcomes." The links among these three are more central to the theory. The first link is between effort and performance, and it is sometimes referred to as the "expectancy" term. Specifically, the effort-to-performance expectancy is a person's perception of the probability that an increase in effort will result in an increase in performance. The second link is between performance and outcomes and is sometimes referred to as the "instrumentality" term. Specifically, the performance-to-outcomes expectancy (instrumentality) is the person's perception of the probability that improved performance will lead to certain outcomes. The final piece of the model is not really a link between two other components but an extra component. Valence refers to how attractive or unattractive an outcome looks to a person.

MB

Answered

The Happy Mountain Brewing Company sells ground organic coffee in one pound containers through several grocery chains in the US. The firm has two divisions: the roasting division buys raw organic coffee beans and then blends, roasts, and grinds the beans, and the merchandising division packages and distributes the ground coffee.

a. Please draw a carefully labeled figure that illustrates the optimal transfer pricing policy for the firm if there is no outside market and the firm is a monopoly seller (i.e., there are no other sellers of ground organic coffee). In particular, please show the optimal transfer price that is paid to the roasting division, the optimal retail price charged by the merchandising division, and the optimal amount of coffee sold.

b. Suppose poor weather conditions in South American increase the price of raw coffee beans. How does this affect the marginal cost curve for the roasting division? Does this also affect the marginal cost of merchandising (packaging and distribution)? How do the optimal transfer price, retail coffee price, and quantity sold change due to this weather problem?

a. Please draw a carefully labeled figure that illustrates the optimal transfer pricing policy for the firm if there is no outside market and the firm is a monopoly seller (i.e., there are no other sellers of ground organic coffee). In particular, please show the optimal transfer price that is paid to the roasting division, the optimal retail price charged by the merchandising division, and the optimal amount of coffee sold.

b. Suppose poor weather conditions in South American increase the price of raw coffee beans. How does this affect the marginal cost curve for the roasting division? Does this also affect the marginal cost of merchandising (packaging and distribution)? How do the optimal transfer price, retail coffee price, and quantity sold change due to this weather problem?

On Jul 23, 2024

a.The figure should be structured like Figure A11.1 in the text. In this case, the optimal quantity of coffee is determined where the marginal cost of roasted coffee intersects the net marginal revenue curve, and the optimal transfer price is also determined at this point of intersection. The optimal retail price of coffee is determined by the market demand curve at the optimal quantity of coffee production.

b.Under this scenario, the marginal cost of roasted coffee shifts upward, and the marginal cost of merchandising does not shift. Accordingly, the net marginal revenue curve does not shift, but the optimal quantity of coffee production declines due to the upward shift in the marginal cost of roasting. The optimal transfer price for roasted coffee increases, and the optimal retail price of coffee also increases due to the decline in the profit maximizing quantity of coffee.

b.Under this scenario, the marginal cost of roasted coffee shifts upward, and the marginal cost of merchandising does not shift. Accordingly, the net marginal revenue curve does not shift, but the optimal quantity of coffee production declines due to the upward shift in the marginal cost of roasting. The optimal transfer price for roasted coffee increases, and the optimal retail price of coffee also increases due to the decline in the profit maximizing quantity of coffee.

MB

Answered

Mary and John, two workers at ABC Inc., have a profound dislike for each other. In weekly sales meetings it is not uncommon to find Mary and John calling each other names for no apparent reason. What type of conflict best describes the situation between Mary and John?

A) intrapersonal

B) accommodating

C) issue-based

D) interpersonal

A) intrapersonal

B) accommodating

C) issue-based

D) interpersonal

On Jun 24, 2024

D

MB

Answered

"Nudging" is the term used to refer to making people make better choices for themselves, using lessons about human behavior which economists have learned from

A) neoclassical theory.

B) purely competitive markets.

C) marginal analysis.

D) behavioral economics.

A) neoclassical theory.

B) purely competitive markets.

C) marginal analysis.

D) behavioral economics.

On Jun 23, 2024

D

MB

Answered

Disclosures required for reportable segments include all of the following except

A) depreciation, depletion, and amortization expense

B) capital expenditures for additions to long-lived assets

C) research and development expenditures

D) interest revenue and interest expense

A) depreciation, depletion, and amortization expense

B) capital expenditures for additions to long-lived assets

C) research and development expenditures

D) interest revenue and interest expense

On May 25, 2024

C

MB

Answered

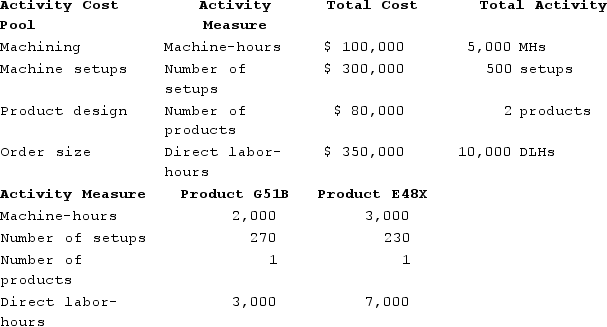

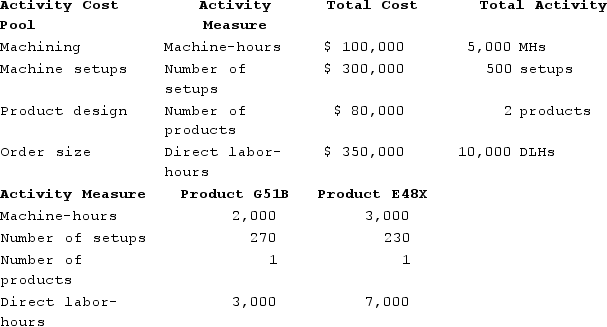

Aresco Corporation manufactures two products: Product G51B and Product E48X. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products G51B and E48X.

Required:a. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product G51B?b. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product E48X?c. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product G51B?d. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product E48X?

Required:a. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product G51B?b. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product E48X?c. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product G51B?d. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product E48X?

Required:a. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product G51B?b. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product E48X?c. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product G51B?d. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product E48X?

Required:a. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product G51B?b. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product E48X?c. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product G51B?d. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product E48X?On May 24, 2024

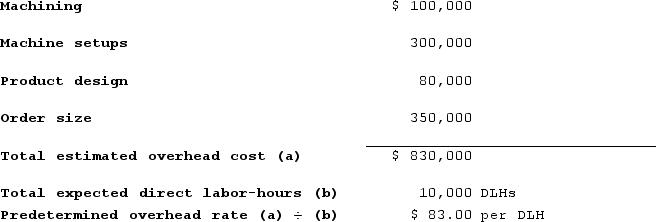

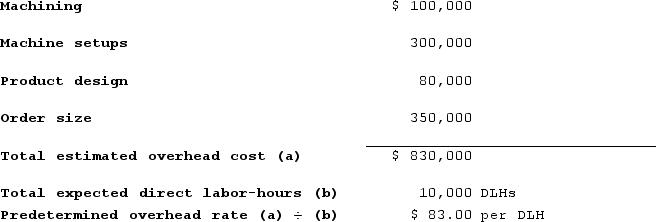

a. & b. The company's plantwide overhead rate is computed as follows:

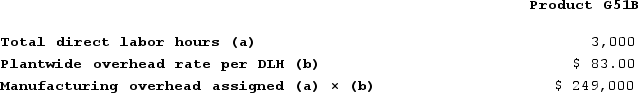

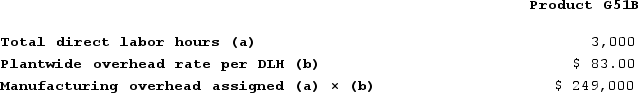

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product G51B is computed as follows:

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product G51B is computed as follows:

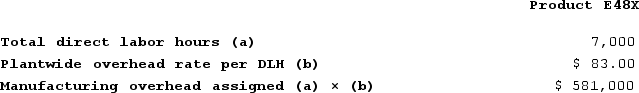

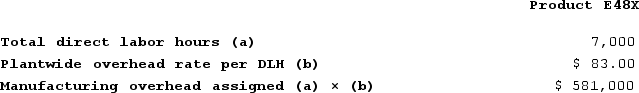

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product E48X is computed as follows:

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product E48X is computed as follows:

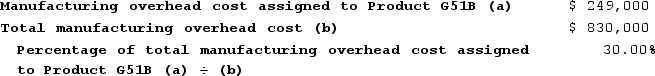

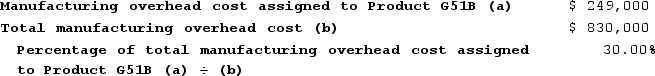

Using the plantwide overhead rate, the percentage of the total overhead cost allocated to Product G51B is computed as follows:

Using the plantwide overhead rate, the percentage of the total overhead cost allocated to Product G51B is computed as follows:

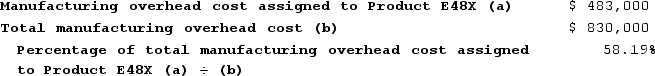

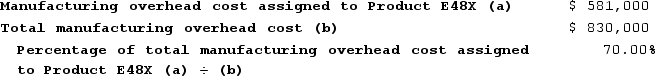

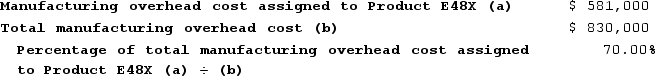

Using the plantwide overhead rate, the percentage of the total overhead cost allocated to Product E48X is computed as follows:

Using the plantwide overhead rate, the percentage of the total overhead cost allocated to Product E48X is computed as follows:

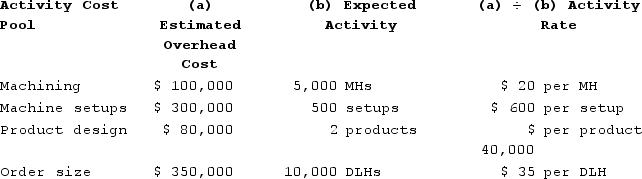

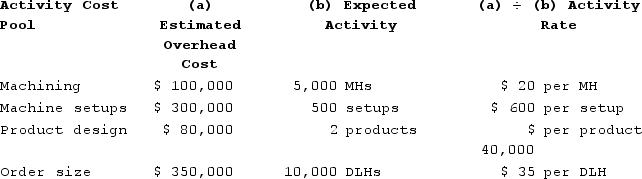

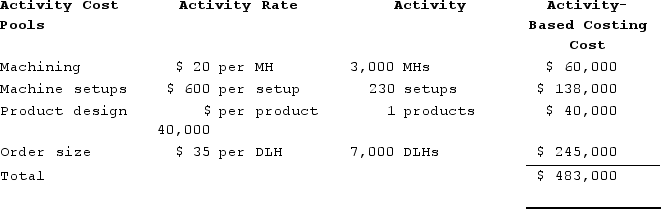

c. & d. The activity rates would be computed as follows for the activity-based costing system:

c. & d. The activity rates would be computed as follows for the activity-based costing system:

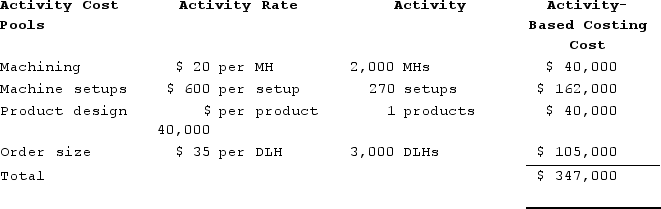

The overhead cost charged to Product G51B under the activity-based costing system is:

The overhead cost charged to Product G51B under the activity-based costing system is:

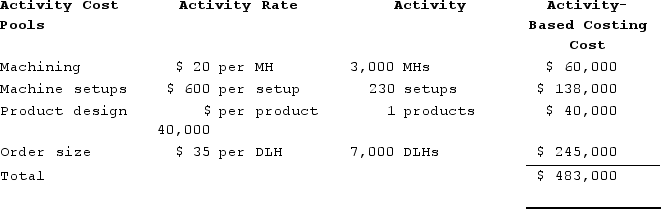

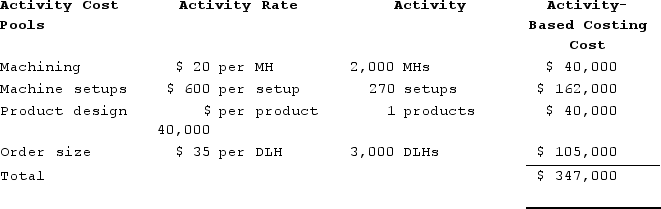

The overhead cost charged to Product E48X under the activity-based costing system is:

The overhead cost charged to Product E48X under the activity-based costing system is:

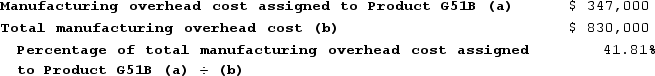

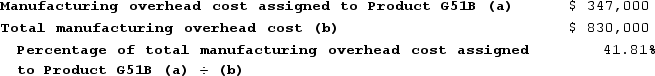

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product G51B is computed as follows:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product G51B is computed as follows:

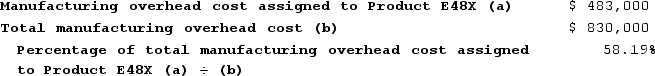

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product E48X is computed as follows:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product E48X is computed as follows:

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product G51B is computed as follows:

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product G51B is computed as follows: Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product E48X is computed as follows:

Using the plantwide overhead rate, the manufacturing overhead cost that would be allocated to Product E48X is computed as follows: Using the plantwide overhead rate, the percentage of the total overhead cost allocated to Product G51B is computed as follows:

Using the plantwide overhead rate, the percentage of the total overhead cost allocated to Product G51B is computed as follows: Using the plantwide overhead rate, the percentage of the total overhead cost allocated to Product E48X is computed as follows:

Using the plantwide overhead rate, the percentage of the total overhead cost allocated to Product E48X is computed as follows: c. & d. The activity rates would be computed as follows for the activity-based costing system:

c. & d. The activity rates would be computed as follows for the activity-based costing system: The overhead cost charged to Product G51B under the activity-based costing system is:

The overhead cost charged to Product G51B under the activity-based costing system is: The overhead cost charged to Product E48X under the activity-based costing system is:

The overhead cost charged to Product E48X under the activity-based costing system is: Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product G51B is computed as follows:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product G51B is computed as follows: Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product E48X is computed as follows:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product E48X is computed as follows: