MJ

Megan Johnson

Answers (6)

MJ

Answered

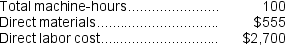

Cardosa Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on 70,000 machine-hours, total fixed manufacturing overhead cost of $308,000, and a variable manufacturing overhead rate of $2.10 per machine-hour.Job M556, which was for 50 units of a custom product, was recently completed.The job cost sheet for the job contained the following data:  Required:

Required:

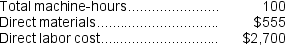

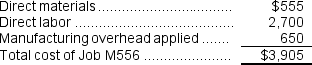

a.Calculate the total job cost for Job M556.

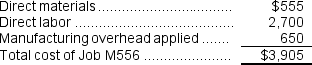

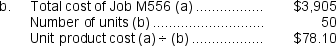

b.Calculate the unit product cost for Job M556.

Required:

Required:a.Calculate the total job cost for Job M556.

b.Calculate the unit product cost for Job M556.

On Jul 09, 2024

a.Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base)= $308,000 + ($2.10 per machine-hour × 70,000 machine-hours)= $308,000 + $147,000 = $455,000

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $455,000 ÷ 70,000 machine-hours = $6.50 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $6.50 per machine-hour × 100 machine-hours = $650

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $455,000 ÷ 70,000 machine-hours = $6.50 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $6.50 per machine-hour × 100 machine-hours = $650

MJ

Answered

You have sent a news release to a journalist who emails to request more details for an article,but you receive the request while you are out of town.What should you do?

A) reply as soon as you return

B) let your email autoreply relay that you are out of town

C) reply immediately and say you will get back with the journalist upon your return

D) reply immediately to determine the journalist's needs and then follow up accordingly

A) reply as soon as you return

B) let your email autoreply relay that you are out of town

C) reply immediately and say you will get back with the journalist upon your return

D) reply immediately to determine the journalist's needs and then follow up accordingly

On Jul 08, 2024

D

MJ

Answered

A farmer who has fixed amounts of land and capital finds that total product is 24 for the first worker hired, 32 when two workers are hired, 37 when three are hired, and 40 when four are hired. The farmer's product sells for $2.50 per unit, and the wage rate is $19 per worker. The marginal product of the first worker is

A) 19

B) 1

C) 60

D) 24

A) 19

B) 1

C) 60

D) 24

On Jun 09, 2024

D

MJ

Answered

According to Daniel Goleman, the _____ mind is aware of reality and which allows us to ponder and reflect.

On Jun 08, 2024

rational

MJ

Answered

__________ is the combination of machines, artifacts, procedures, and systems used to gather, store, analyze, and disseminate information for translating it into knowledge.

On May 10, 2024

Information technology

MJ

Answered

A contra asset account is subtracted from a related account in the balance sheet.

On May 09, 2024

True