MM

Michael Murray

Answers (6)

MM

Answered

Bentley Inc. received $31,000 in dividends over the past year. If 80% are excluded from taxation and assuming a flat tax rate of 35%, what is Bentley's tax liability?

A) $0

B) $2,170

C) $8,680

D) $6,200

A) $0

B) $2,170

C) $8,680

D) $6,200

On Jul 09, 2024

B

MM

Answered

Yellowstone Stores accepts both its own and national credit cards. During the year the following selected summary transactions occurred.

Jan. 15 Made Yellowstone credit card sales totaling $28000. (There were no balances prior to January 15.)

20 Made Visa credit card sales (service charge fee 3%) totaling $5000.

Feb. 10 Collected $17000 on Yellowstone credit card sales.

15 Added finance charges of 1% to Yellowstone credit card balance.

Instructions

(a) Journalize the transactions for Yellowstone Stores.

(b) Indicate the statement presentation of the interest revenue and the credit card service charge expense for Yellowstone Stores.

Jan. 15 Made Yellowstone credit card sales totaling $28000. (There were no balances prior to January 15.)

20 Made Visa credit card sales (service charge fee 3%) totaling $5000.

Feb. 10 Collected $17000 on Yellowstone credit card sales.

15 Added finance charges of 1% to Yellowstone credit card balance.

Instructions

(a) Journalize the transactions for Yellowstone Stores.

(b) Indicate the statement presentation of the interest revenue and the credit card service charge expense for Yellowstone Stores.

On Jul 08, 2024

(a)

Jan. 15 Accounts Receivable 28,000 Sales Revenue 28,00020 Cash($5,000−$150). 4,850 Service Charge Expense150 ($5,000×3%) Sales Revenue5,000\begin{array}{lll} \text { Jan. 15 } & \text { Accounts Receivable } &28,000\\& \text { Sales Revenue } &&28,000\\\\& \text {20 Cash\( (\$ 5,000-\$ 150) \). } &4,850\\& \text { Service Charge Expense} &150\\ &\text { \( (\$ 5,000 \times 3 \%) \) } &\\& \text { Sales Revenue} &&5,000\\\end{array} Jan. 15 Accounts Receivable Sales Revenue 20 Cash($5,000−$150). Service Charge Expense ($5,000×3%) Sales Revenue28,0004,85015028,0005,000

(b)

Feb 10 Cash. 17,000 Accounts Receivable 17,00015 Accounts Receivable ($11,000×1%) 110 Interest Revenue 110\begin{array}{lll} \text { Feb 10 } &\text {Cash. } &17,000\\ &\text { Accounts Receivable } &&17,000\\\\&15 \text { Accounts Receivable \( (\$ 11,000 \times 1 \%) \) } &110\\ &\text { Interest Revenue } &&110\\\end{array} Feb 10 Cash. Accounts Receivable 15 Accounts Receivable ($11,000×1%) Interest Revenue 17,00011017,000110

(b) Interest Revenue is reported under other revenues and gains.

Service Charge Expense is a selling expense.

Jan. 15 Accounts Receivable 28,000 Sales Revenue 28,00020 Cash($5,000−$150). 4,850 Service Charge Expense150 ($5,000×3%) Sales Revenue5,000\begin{array}{lll} \text { Jan. 15 } & \text { Accounts Receivable } &28,000\\& \text { Sales Revenue } &&28,000\\\\& \text {20 Cash\( (\$ 5,000-\$ 150) \). } &4,850\\& \text { Service Charge Expense} &150\\ &\text { \( (\$ 5,000 \times 3 \%) \) } &\\& \text { Sales Revenue} &&5,000\\\end{array} Jan. 15 Accounts Receivable Sales Revenue 20 Cash($5,000−$150). Service Charge Expense ($5,000×3%) Sales Revenue28,0004,85015028,0005,000

(b)

Feb 10 Cash. 17,000 Accounts Receivable 17,00015 Accounts Receivable ($11,000×1%) 110 Interest Revenue 110\begin{array}{lll} \text { Feb 10 } &\text {Cash. } &17,000\\ &\text { Accounts Receivable } &&17,000\\\\&15 \text { Accounts Receivable \( (\$ 11,000 \times 1 \%) \) } &110\\ &\text { Interest Revenue } &&110\\\end{array} Feb 10 Cash. Accounts Receivable 15 Accounts Receivable ($11,000×1%) Interest Revenue 17,00011017,000110

(b) Interest Revenue is reported under other revenues and gains.

Service Charge Expense is a selling expense.

MM

Answered

Which of the following is not a money market security?

A) U.S. Treasury bill

B) 6-month maturity certificate of deposit

C) common stock

D) All of the options.

A) U.S. Treasury bill

B) 6-month maturity certificate of deposit

C) common stock

D) All of the options.

On Jun 09, 2024

C

MM

Answered

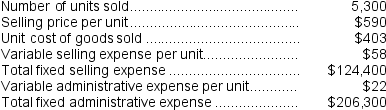

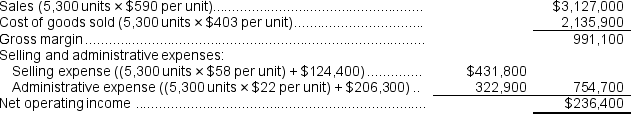

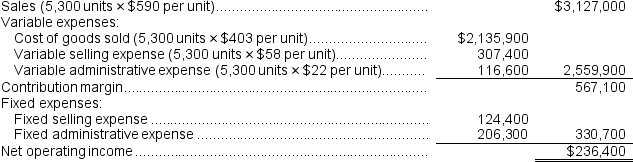

Fanelli Corporation, a merchandising company, reported the following results for July:  Cost of goods sold is a variable cost in this company.

Cost of goods sold is a variable cost in this company.

Required:

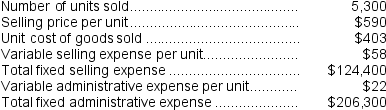

a.Prepare a traditional format income statement for July.

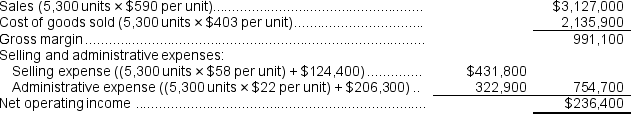

b.Prepare a contribution format income statement for July.

Cost of goods sold is a variable cost in this company.

Cost of goods sold is a variable cost in this company.Required:

a.Prepare a traditional format income statement for July.

b.Prepare a contribution format income statement for July.

On Jun 08, 2024

a.Traditional Format Income Statement  b.Contribution Format Income Statement

b.Contribution Format Income Statement

b.Contribution Format Income Statement

b.Contribution Format Income Statement

MM

Answered

______ are cultural obstacles that impede progress and make it difficult for the organization to adapt to different situations.

A) Change hindrances

B) Diversity hindrances

C) Mission hindrances

D) Mergers and acquisitions hindrances

A) Change hindrances

B) Diversity hindrances

C) Mission hindrances

D) Mergers and acquisitions hindrances

On May 10, 2024

A

MM

Answered

The Sunshine Corporation finds that its costs are $40 when it produces no output.Its total variable costs (TVC) change with output as shown in the accompanying table.Use this information to answer the following question. Output TVC 1$302503654855110\begin{array} { c c c } \text { Output } & & \text { TVC } \\\hline1 & & \$ 30 \\2 & & 50 \\3 & & 65 \\4 & & 85 \\5 & & 110\end{array} Output 12345 TVC $30506585110 Refer to the information.The average total cost of 3 units of output is:

A) $65.

B) $21.67.

C) $40.

D) $35.

A) $65.

B) $21.67.

C) $40.

D) $35.

On May 09, 2024

D