MA

Michael and Roni Steinmeyer

Answers (9)

MA

Answered

The amount of cash needed for transactions over a period of time is needed to determine the optimal strategy using the BAT model.

On Jul 31, 2024

True

MA

Answered

Patridge Company uses a standard cost system in which it applies manufacturing overhead to units of product on the basis of direct labour-hours. The information below is taken from the company's flexible budget for manufacturing overhead: Percent of capacity 70%80%90% Direct labour-hours 21,00024,00027,000 Variable overhead $42,000$48,000$54,000 Fixed overhead 108,000108,000108,000 Total overhead $150,000$156,000$162,000\begin{array} { | l | l | l | l | } \hline \text { Percent of capacity } & 70 \% & 80 \% & 90 \% \\\hline \text { Direct labour-hours } & 21,000 & 24,000 & 27,000 \\\hline \text { Variable overhead } & \$ 42,000 & \$ 48,000 & \$ 54,000 \\\hline \text { Fixed overhead } & 108,000 & 108,000 & 108,000 \\\hline \text { Total overhead } & \$ 150,000 & \$ 156,000 & \$ 162,000 \\\hline\end{array} Percent of capacity Direct labour-hours Variable overhead Fixed overhead Total overhead 70%21,000$42,000108,000$150,00080%24,000$48,000108,000$156,00090%27,000$54,000108,000$162,000 During the year, the company operated at exactly 80% of capacity, but applied manufacturing overhead to products based on the 90% level. The company's fixed overhead volume variance for the year was:

A) $6,000 favourable.

B) $12,000 unfavourable.

C) $12,000 favourable.

D) $6,000 unfavourable.

A) $6,000 favourable.

B) $12,000 unfavourable.

C) $12,000 favourable.

D) $6,000 unfavourable.

On Jul 30, 2024

B

MA

Answered

The Capital Asset Pricing Model (CAPM) assumes that a risk-free asset has no systematic risk.

On Jul 01, 2024

True

MA

Answered

The Wilson Company has provided the following information: • Net sales,$200,000

• Net operating income,$40,000

• Net income,$20,000

• Average total assets,$125,000

• Average net fixed assets;$80,000

What is Wilson's fixed asset turnover ratio?

A) 1.60

B) 2.50

C) 0.25

D) 0.50

• Net operating income,$40,000

• Net income,$20,000

• Average total assets,$125,000

• Average net fixed assets;$80,000

What is Wilson's fixed asset turnover ratio?

A) 1.60

B) 2.50

C) 0.25

D) 0.50

On Jun 30, 2024

B

MA

Answered

___ satisfies esteem needs.

A) Physical comfort on the job

B) Praise and recognition from boss

C) Adequate compensation and benefits

D) Interaction with customers

E) Reasonable work hours

A) Physical comfort on the job

B) Praise and recognition from boss

C) Adequate compensation and benefits

D) Interaction with customers

E) Reasonable work hours

On Jun 01, 2024

B

MA

Answered

The entry to replenish the petty cash fund for $100 of various minor expenditures would include a

A) debit to Petty Cash

B) debit to Cash

C) credit to Petty Cash

D) credit to Cash

A) debit to Petty Cash

B) debit to Cash

C) credit to Petty Cash

D) credit to Cash

On May 31, 2024

D

MA

Answered

Discuss ways to retain information when the information is important and might be used later.

On May 02, 2024

If the information you hear will be important to use later,write it down or otherwise record it.Don't rely on your memory.If you do need to memorize,you can hold information in short-term memory by repeating it silently or organizing a long list of items into several shorter lists.To store information in long-term memory,four techniques can help: (1)associate new information with something closely related (such as the restaurant in which you met a new client),(2)categorize the new information into logical groups (such as alphabetizing a list of names),(3)visualize words and ideas as pictures,and (4)create mnemonics such as acronyms or rhymes.

MA

Answered

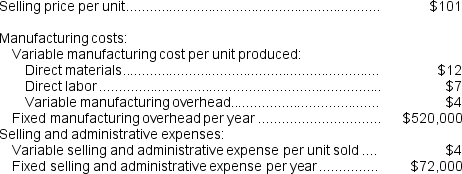

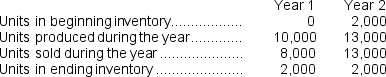

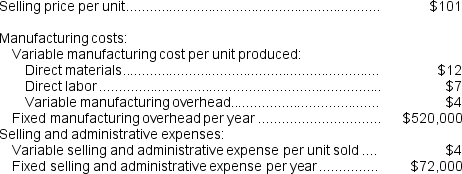

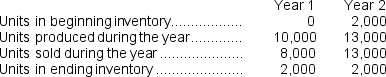

Waltzer Corporation has provided the following data for its two most recent years of operation:

Required:

Required:

a.Assume the company uses absorption costing.Compute the unit product cost in each year.

b.Assume the company uses absorption costing.Prepare an income statement for each year.

c.Assume the company uses variable costing.Compute the unit product cost in each year.

d.Assume the company uses variable costing.Prepare an income statement for each year.

e.Prepare a report in good form reconciling the variable costing and absorption costing net incomes.

Required:

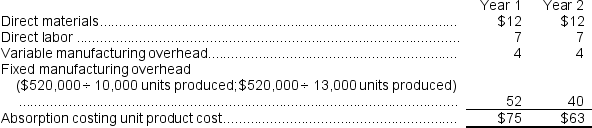

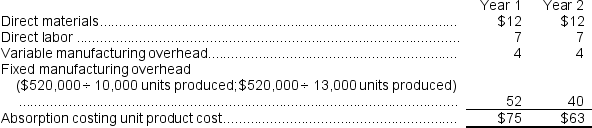

Required:a.Assume the company uses absorption costing.Compute the unit product cost in each year.

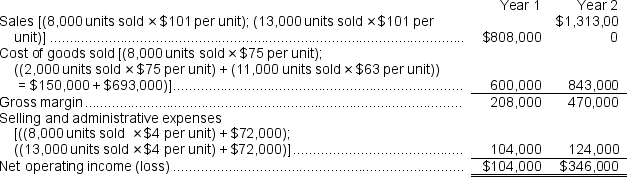

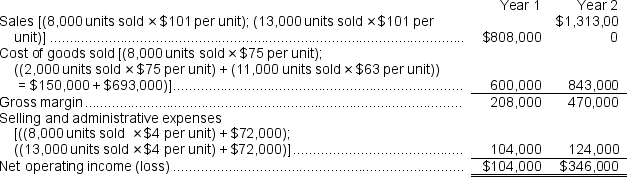

b.Assume the company uses absorption costing.Prepare an income statement for each year.

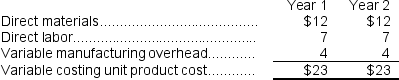

c.Assume the company uses variable costing.Compute the unit product cost in each year.

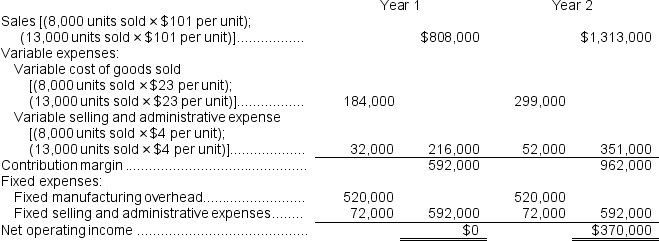

d.Assume the company uses variable costing.Prepare an income statement for each year.

e.Prepare a report in good form reconciling the variable costing and absorption costing net incomes.

On May 01, 2024

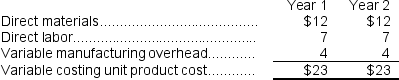

a.Absorption costing unit product costs:  b.Absorption costing income statements:

b.Absorption costing income statements:  c.Variable costing unit product costs:

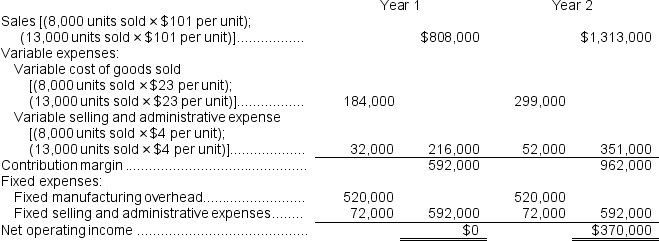

c.Variable costing unit product costs:  d.Variable costing income statements:

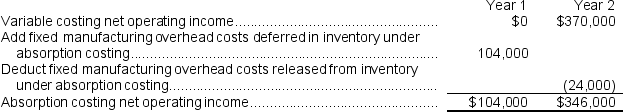

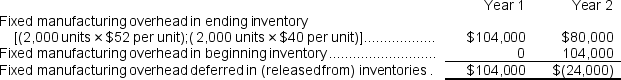

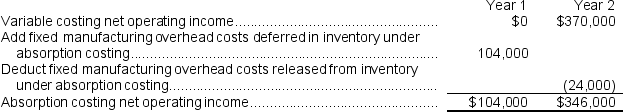

d.Variable costing income statements:  e.Reconcile the variable costing and absorption costing net operating incomes:

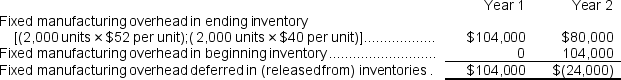

e.Reconcile the variable costing and absorption costing net operating incomes:

b.Absorption costing income statements:

b.Absorption costing income statements:  c.Variable costing unit product costs:

c.Variable costing unit product costs:  d.Variable costing income statements:

d.Variable costing income statements:  e.Reconcile the variable costing and absorption costing net operating incomes:

e.Reconcile the variable costing and absorption costing net operating incomes:

MA

Answered

For the year 2015,the gross profit of Alpha Company was $80,000;the cost of goods manufactured as $400,000;the beginning inventories of goods in process and finished goods were $28,000 and $50,000,respectively;and the ending inventories of goods in process and finished goods were $38,000 and $75,000,respectively.

Required:

What is the dollar amount of Alpha's sales for 2015?

Required:

What is the dollar amount of Alpha's sales for 2015?

On Apr 30, 2024

To find Alphas' sales for 2015,first look at the inventory T-account. Finished Goods Inventory Beginning balance Cost of goods $50,000 Manufactured 400,000X Solve for: Cost of goods sold Ending balance $75,000\begin{array}{l}\text { Finished Goods Inventory }\\\begin{array} { l c | c } \hline \begin{array} { l } \text { Beginning balance } \\\text { Cost of goods } \\\end{array} & \$ 50,000 & \\\text { Manufactured }& 400,000 & \mathrm { X } \quad \text { Solve for: Cost of goods sold } \\\hline \text { Ending balance } & \$ 75,000 &\end{array}\end{array} Finished Goods Inventory Beginning balance Cost of goods Manufactured Ending balance $50,000400,000$75,000X Solve for: Cost of goods sold

Since cost of goods manufactured is specified,there is no need to analyze work in process inventory.

Solve for cost of goods sold:$50,000 + $400,000 - X = $75,000

X = $375,000

After finding cost of goods sold,solve for sales using this figure and the gross profit amount given.Gross profit is the difference between sales revenue and cost of goods sold.So to find sales,add cost of goods sold to gross profit.Sales in 2015 would be:

$375,000 + $80,000 = $455,000

Since cost of goods manufactured is specified,there is no need to analyze work in process inventory.

Solve for cost of goods sold:$50,000 + $400,000 - X = $75,000

X = $375,000

After finding cost of goods sold,solve for sales using this figure and the gross profit amount given.Gross profit is the difference between sales revenue and cost of goods sold.So to find sales,add cost of goods sold to gross profit.Sales in 2015 would be:

$375,000 + $80,000 = $455,000