MH

Mohamad Halimeh

Answers (6)

MH

Answered

Reporting contribution margin by market segment is useful in assessing the profitability of each segment.

On Jul 12, 2024

True

MH

Answered

Define display rules. Give several examples of how display rules impact work cultures in different countries.

On Jul 10, 2024

Display rules, also called informal standards, govern the degree to which it is appropriate for people from different cultures to display their emotions similarly. As an example, Great Britain encourages downplaying emotions, while Mexicans are much more demonstrative in public. Also, Wal-Mart's emphasis on friendliness has been shown not to work in Germany. There, serious German shoppers have been shown not to like Wal-Mart's friendly greeters and helpful personnel. In Israel, shoppers equate smiling cashiers with inexperience, so the cashiers are encouraged to look somber.

MH

Answered

In general _____ by unanticipated inflation.

A) creditors and debtors are both helped

B) creditors and debtors are both hurt

C) creditors are helped and debtors are hurt

D) creditors are hurt and debtors are helped

A) creditors and debtors are both helped

B) creditors and debtors are both hurt

C) creditors are helped and debtors are hurt

D) creditors are hurt and debtors are helped

On Jun 12, 2024

D

MH

Answered

The expected amount of time to recover the initial amount of an investment is called the:

A) Amortization period.

B) Payback period.

C) Interest period.

D) Budgeting period.

E) Discounted cash flow period.

A) Amortization period.

B) Payback period.

C) Interest period.

D) Budgeting period.

E) Discounted cash flow period.

On Jun 10, 2024

B

MH

Answered

_________________ divided by the contribution margin ratio will give the amount of _________________ to break even.

On May 12, 2024

Fixed costs sales (in dollars)

MH

Answered

Thoen Heavy Machinery Corporation has developed a new drill press-model OU-84-that has been designed to outperform a competitor's best-selling drill press. The competitor's product has a useful life of 30,000 hours of service, has operating costs that average $1.60 per hour, and sells for $189,000. In contrast, model OU-84 has a useful life of 120,000 hours of service and its operating cost is $1.00 per hour. Thoen has not yet established a selling price for model OU-84.

Required:

From a value-based pricing standpoint what range of possible prices should Thoen consider when setting a price for model OU-84?

Required:

From a value-based pricing standpoint what range of possible prices should Thoen consider when setting a price for model OU-84?

On May 11, 2024

The range of possible prices is determined as follows:

Reference value ≤ Value-based price ≤ Economic value to the customer (EVC)

The reference value is the price of the competing alternative, which in this case is $189,000.

The economic value to the customer (EVC) is determined as follows:

EVC = Reference value + Differentiation value

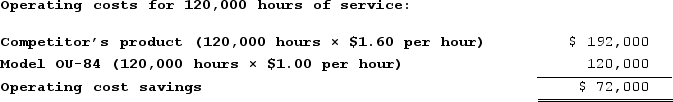

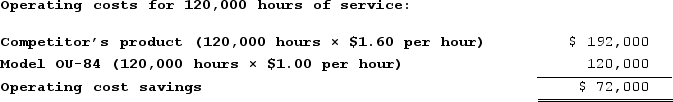

The differentiation value has two components. First, customers who purchase a model OU-84 rather than the competing alternative would avoid the need to buy four drill presses for $189,000 rather than just one OU-84 to achieve 120,000 hours of service. This is a savings of $567,000 (= 3 × $189,000) for the additional drill presss that would have to be purchased. Second, customers who purchase a model OU-84 rather than the competing alternative would realize operating cost savings computed as follows:

Differentiation value = $567,000 + $72,000 = $639,000

Differentiation value = $567,000 + $72,000 = $639,000

EVC = Reference value + Differentiation value = $189,000 + $639,000 = $828,000

Reference value ≤ Value-based price ≤ EVC

$189,000 ≤ Value-based price ≤ $828,000

Reference value ≤ Value-based price ≤ Economic value to the customer (EVC)

The reference value is the price of the competing alternative, which in this case is $189,000.

The economic value to the customer (EVC) is determined as follows:

EVC = Reference value + Differentiation value

The differentiation value has two components. First, customers who purchase a model OU-84 rather than the competing alternative would avoid the need to buy four drill presses for $189,000 rather than just one OU-84 to achieve 120,000 hours of service. This is a savings of $567,000 (= 3 × $189,000) for the additional drill presss that would have to be purchased. Second, customers who purchase a model OU-84 rather than the competing alternative would realize operating cost savings computed as follows:

Differentiation value = $567,000 + $72,000 = $639,000

Differentiation value = $567,000 + $72,000 = $639,000EVC = Reference value + Differentiation value = $189,000 + $639,000 = $828,000

Reference value ≤ Value-based price ≤ EVC

$189,000 ≤ Value-based price ≤ $828,000