PG

Prakhar Gupta

Answers (8)

PG

Answered

The purchasing-power-parity theory holds that exchange rates should equalize the inflation rates among the trading nations.

On Jul 29, 2024

False

PG

Answered

Provide a definition for same day value.

On Jul 22, 2024

Bank makes proceeds of cheques deposited available the same day before cheques clear.

PG

Answered

Bright School is a private school operating as a NFP with a fiscal year end of December 31, 20X8. Bright School has an endowment fund and an operating fund. Earnings of the endowment fund can only be used to provide scholarships to students in need during the year. In any year that the full earnings are not paid out in scholarships, they may be carried forward and used in future years. Scholarships are paid from the operating fund. During the year, the following transactions occurred:

1. The endowment fund earned interest income of $40,000. Only $30,000 was paid out in scholarships in the current year.

2. An additional endowment contribution was received of $750,000 at the end of the year. In this case, earnings on this endowment can only be used to purchase equipment for the science labs in the school.

3. A pledge for an endowment for $350,000 was received in October, 20X8. This arose on the death of a long-time donor who made provisions in their will to leave to the school this endowment contribution. The lawyer handling the estate stated that the funds would be released in early February 20X9 once all of the legal requirements pertaining to the estate had been completed.

Required:

Prepare the journal entries to record the above transactions for the fiscal year-end December 31, 20X8. Bright School uses the deferral method of reporting.

1. The endowment fund earned interest income of $40,000. Only $30,000 was paid out in scholarships in the current year.

2. An additional endowment contribution was received of $750,000 at the end of the year. In this case, earnings on this endowment can only be used to purchase equipment for the science labs in the school.

3. A pledge for an endowment for $350,000 was received in October, 20X8. This arose on the death of a long-time donor who made provisions in their will to leave to the school this endowment contribution. The lawyer handling the estate stated that the funds would be released in early February 20X9 once all of the legal requirements pertaining to the estate had been completed.

Required:

Prepare the journal entries to record the above transactions for the fiscal year-end December 31, 20X8. Bright School uses the deferral method of reporting.

On Jun 29, 2024

The following entries would be made in the operating fund:

Cash 40,000 Deferred revenue 40,000\begin{array}{llr} \text {Cash } &40,000\\ \text { Deferred revenue } &&40,000\\\end{array}Cash Deferred revenue 40,00040,000

Scholarship expense 30,000Cash 30,000\begin{array}{llr} \text { Scholarship expense } &30,000\\ \text {Cash } &&30,000\\\end{array} Scholarship expense Cash 30,00030,000

Deferred revenue 30,000 Scholarship revenue 30,000\begin{array} { ll } \text { Deferred revenue }&30,000 \\\text { Scholarship revenue }&&30,000\end{array} Deferred revenue Scholarship revenue 30,00030,000 Cash 750,000 Net assets - Fund balance-endowment750,000\begin{array}{llr} \text { Cash } &750,000\\ \text { Net assets - Fund balance-endowment} &&750,000\\\end{array} Cash Net assets - Fund balance-endowment750,000750,000

Generally a pledge can only be recognized as a receivable if the amount can be reasonably estimated and the ultimate collection is assured. In this case, the endowment contribution has been legally documented in the will and the lawyer has stated that the funds will be released in February. It appears that both criteria have been met and Bright could record the receivable at December 31, 20X8. However, pledges are not normally recognized. In this case, an argument for recognizing the pledge on receipt is that there would not be any interest earned on the principal until after actual receipt. By recording this amount early in the books, users may expect a full year's worth of income to be received in the coming year and may question why this is not the case.

If the amount is not recognized, disclosure of the pledge could be included in the statements.

If it is decided to record the pledge, the following entry would be made:

Pledge-receivable 350,000 Net assets - Find balance -endowment 350,000\begin{array}{llr} \text { Pledge-receivable } &350,000\\ \text { Net assets - Find balance -endowment } &&350,000\\\end{array} Pledge-receivable Net assets - Find balance -endowment 350,000350,000

Cash 40,000 Deferred revenue 40,000\begin{array}{llr} \text {Cash } &40,000\\ \text { Deferred revenue } &&40,000\\\end{array}Cash Deferred revenue 40,00040,000

Scholarship expense 30,000Cash 30,000\begin{array}{llr} \text { Scholarship expense } &30,000\\ \text {Cash } &&30,000\\\end{array} Scholarship expense Cash 30,00030,000

Deferred revenue 30,000 Scholarship revenue 30,000\begin{array} { ll } \text { Deferred revenue }&30,000 \\\text { Scholarship revenue }&&30,000\end{array} Deferred revenue Scholarship revenue 30,00030,000 Cash 750,000 Net assets - Fund balance-endowment750,000\begin{array}{llr} \text { Cash } &750,000\\ \text { Net assets - Fund balance-endowment} &&750,000\\\end{array} Cash Net assets - Fund balance-endowment750,000750,000

Generally a pledge can only be recognized as a receivable if the amount can be reasonably estimated and the ultimate collection is assured. In this case, the endowment contribution has been legally documented in the will and the lawyer has stated that the funds will be released in February. It appears that both criteria have been met and Bright could record the receivable at December 31, 20X8. However, pledges are not normally recognized. In this case, an argument for recognizing the pledge on receipt is that there would not be any interest earned on the principal until after actual receipt. By recording this amount early in the books, users may expect a full year's worth of income to be received in the coming year and may question why this is not the case.

If the amount is not recognized, disclosure of the pledge could be included in the statements.

If it is decided to record the pledge, the following entry would be made:

Pledge-receivable 350,000 Net assets - Find balance -endowment 350,000\begin{array}{llr} \text { Pledge-receivable } &350,000\\ \text { Net assets - Find balance -endowment } &&350,000\\\end{array} Pledge-receivable Net assets - Find balance -endowment 350,000350,000

PG

Answered

In process costing, the same equivalent units figure is always used for both materials and conversion costs.

On Jun 22, 2024

False

PG

Answered

Which of the following statements about angel investors is/are accurate?

A) When venture capital is not available to the entrepreneur, the angel investor is a financing option.

B) Angel investors are helpful in the very early start-up stage of an entrepreneurial venture.

C) The presence of angel investors can help attract venture capital funding that might not be available otherwise.

D) all of the above

E) none of the above

A) When venture capital is not available to the entrepreneur, the angel investor is a financing option.

B) Angel investors are helpful in the very early start-up stage of an entrepreneurial venture.

C) The presence of angel investors can help attract venture capital funding that might not be available otherwise.

D) all of the above

E) none of the above

On Jun 20, 2024

D

PG

Answered

How is the cost computed for individual assets purchased as a lump-sum?

On May 23, 2024

Plant assets should be recorded at cost when acquired.Cost includes all normal and reasonable expenditures necessary to get the asset in place and ready for its intended use.The cost of a lump-sum purchase is allocated among its individual assets based on their relative market (or estimated)values.

PG

Answered

When the differences in useful lives of long-lived assets reflect real economic differences,the attempt on the part of financial analysts to undo these differences may

A) impede profit and loss comparisons.

B) enhance profit comparisons.

C) enhance profit comparisons,but impede loss comparisons.

D) enhance profit and loss comparisons.

A) impede profit and loss comparisons.

B) enhance profit comparisons.

C) enhance profit comparisons,but impede loss comparisons.

D) enhance profit and loss comparisons.

On May 21, 2024

A

PG

Answered

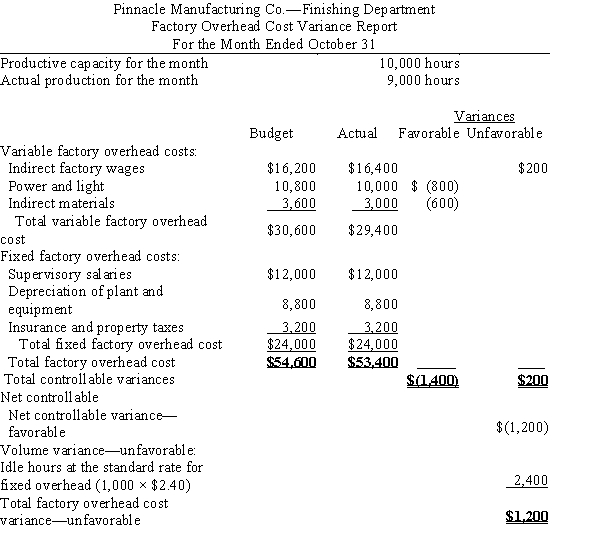

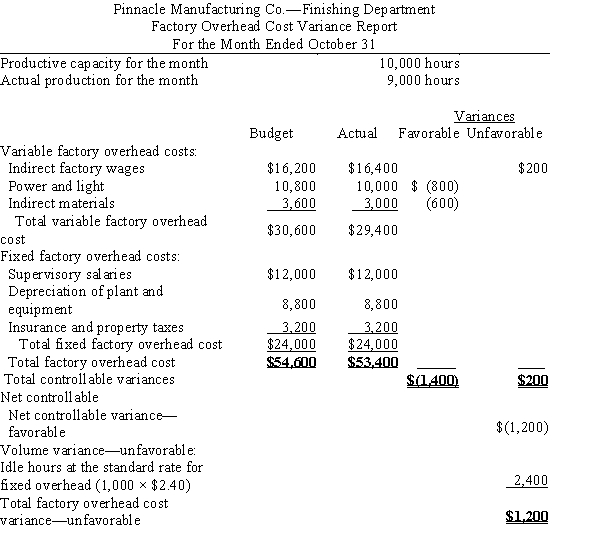

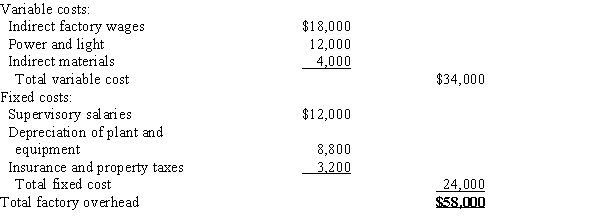

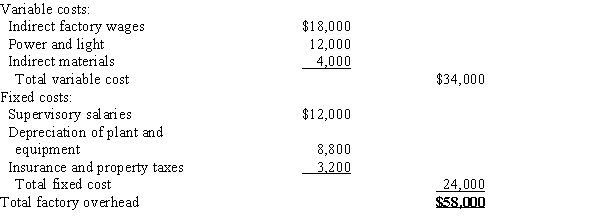

The Finishing Department of Pinnacle Manufacturing Co. prepared the following factory overhead cost budget for October of the current year, during which it expected to operate at a 100% capacity of 10,000 machine hours.  During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.Prepare a factory overhead cost variance report for October.

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.Prepare a factory overhead cost variance report for October.

(The budgeted amounts for actual amount produced should be based on 9,000 machine hours.)

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.Prepare a factory overhead cost variance report for October.

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.Prepare a factory overhead cost variance report for October. (The budgeted amounts for actual amount produced should be based on 9,000 machine hours.)

On May 20, 2024