PC

Priscah Chebet

Answers (6)

PC

Answered

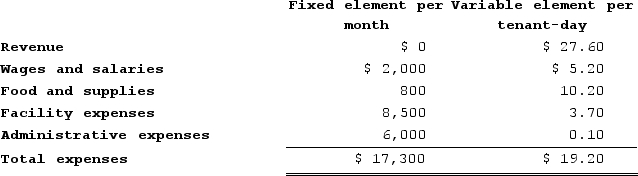

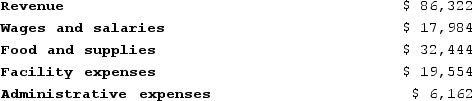

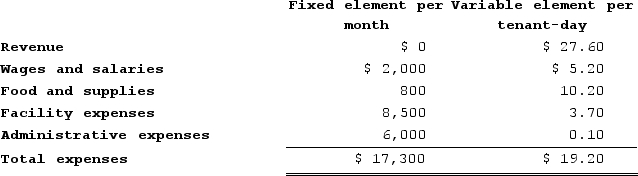

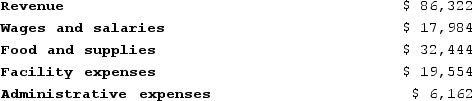

Gordin Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During May, the kennel budgeted for 3,000 tenant-days, but its actual level of activity was 3,020 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for May:Data used in budgeting:  Actual results for May:

Actual results for May:

The administrative expenses in the planning budget for May would be closest to:

The administrative expenses in the planning budget for May would be closest to:

A) $6,300

B) $6,302

C) $6,121

D) $6,162

Actual results for May:

Actual results for May: The administrative expenses in the planning budget for May would be closest to:

The administrative expenses in the planning budget for May would be closest to:A) $6,300

B) $6,302

C) $6,121

D) $6,162

On Jul 19, 2024

A

PC

Answered

In the absence of a promotional message, marketers can use a product's ________ to promote the product and help it stand out among the vast array of product choices faced by consumers.

On Jul 18, 2024

packaging

PC

Answered

The term that comprises organizational principles, values, and norms that may originate from individuals, organizational statements, or from the legal system that primarily guide individual and group behavior in business is defined as

A) stakeholder orientation

B) values

C) principles

D) business ethics

E) integrity management

A) stakeholder orientation

B) values

C) principles

D) business ethics

E) integrity management

On Jun 19, 2024

D

PC

Answered

In the changing global workplace there are several myths that persist about the Chinese business culture. Which of the following statements is most accurate about Chinese managers and businesspeople today?

A) They are very reluctant to take on any risk or get involved with entrepreneurship.

B) They will only give individual opinions or brainstorm openly when senior management is present.

C) They are long-term deliberators

D) They are more comfortable stepping out of the box, engaging in entrepreneurship and increased risk taking.

E) They thrive on offering individual opinions regardless of who is present and they no longer work in groups or teams.

A) They are very reluctant to take on any risk or get involved with entrepreneurship.

B) They will only give individual opinions or brainstorm openly when senior management is present.

C) They are long-term deliberators

D) They are more comfortable stepping out of the box, engaging in entrepreneurship and increased risk taking.

E) They thrive on offering individual opinions regardless of who is present and they no longer work in groups or teams.

On Jun 18, 2024

D

PC

Answered

Financial risk is not directly associated with ____.

A) ROE

B) EBIT

C) EPS

D) net income

A) ROE

B) EBIT

C) EPS

D) net income

On May 20, 2024

B

PC

Answered

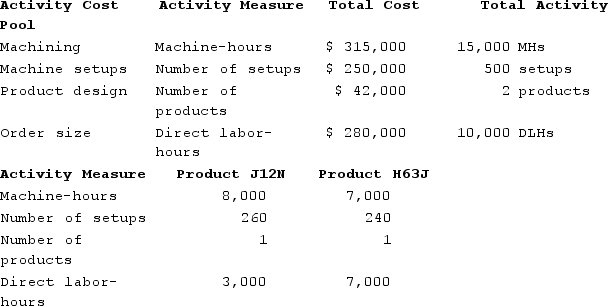

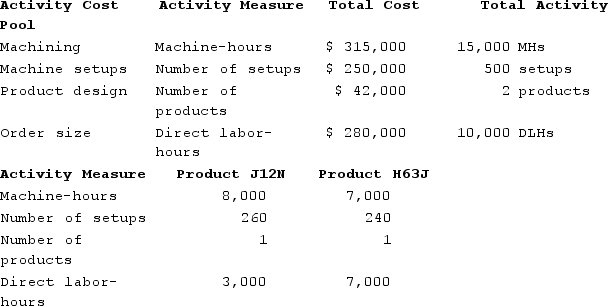

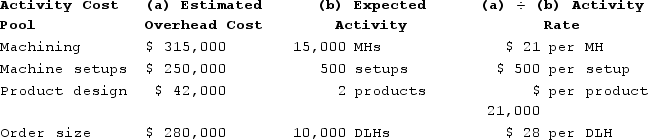

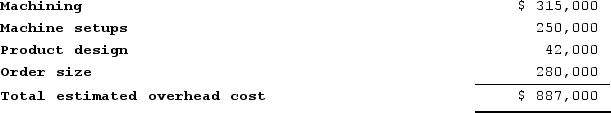

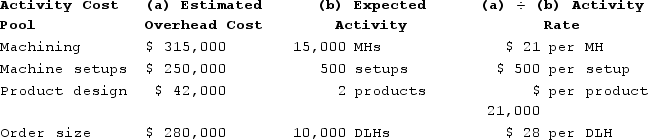

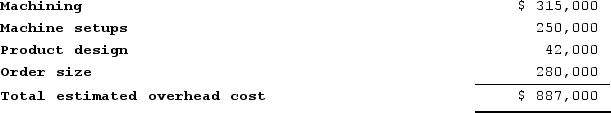

Ciulla Corporation manufactures two products: Product J12N and Product H63J. The company is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products J12N and H63J.

Required:a. Using theactivity-based costing system, how much total manufacturing overhead cost would be assigned to Product H63J?b. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product J12N?

Required:a. Using theactivity-based costing system, how much total manufacturing overhead cost would be assigned to Product H63J?b. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product J12N?

Required:a. Using theactivity-based costing system, how much total manufacturing overhead cost would be assigned to Product H63J?b. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product J12N?

Required:a. Using theactivity-based costing system, how much total manufacturing overhead cost would be assigned to Product H63J?b. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product J12N?On May 19, 2024

a.

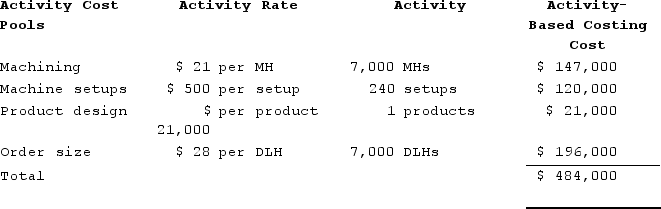

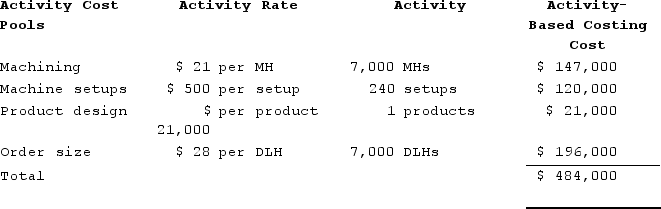

The overhead cost charged to Product H63J under the activity-based costing system is:

The overhead cost charged to Product H63J under the activity-based costing system is:

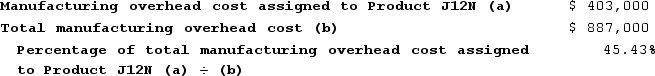

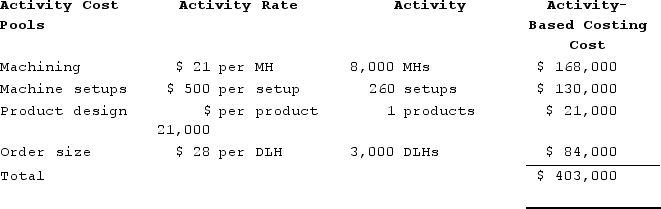

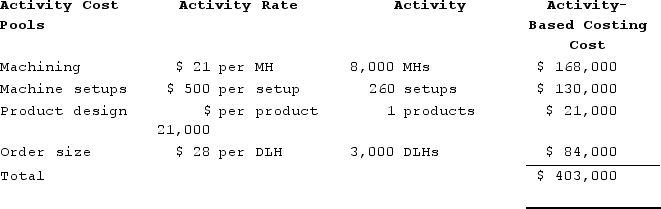

b. The overhead cost charged to Product J12N under the activity-based costing system is:

b. The overhead cost charged to Product J12N under the activity-based costing system is:

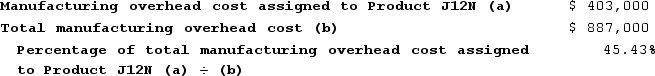

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product J12N is computed as follows:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product J12N is computed as follows:

The overhead cost charged to Product H63J under the activity-based costing system is:

The overhead cost charged to Product H63J under the activity-based costing system is: b. The overhead cost charged to Product J12N under the activity-based costing system is:

b. The overhead cost charged to Product J12N under the activity-based costing system is:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product J12N is computed as follows:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product J12N is computed as follows: