RK

Rakesh Kumar

Answers (6)

RK

Answered

On March 2, Conroy and Conrad Inc.obtained a loan for $120,000 for 5 years at 4%.Payments are $2,210 per month How much interest expense is recorded with the first instalment payment?

A) $400

B) $210

C) $2,400

D) $4,800

A) $400

B) $210

C) $2,400

D) $4,800

On Jul 07, 2024

A

RK

Answered

Ambrose's utility function is 4x1/21 x2.If the price of nuts (good 1) is $1, the price of berries (good 2) is $6, and his income is $198, how many units of berries will Ambrose choose?

A) 145

B) 9

C) 18

D) 8

E) 12

A) 145

B) 9

C) 18

D) 8

E) 12

On Jul 04, 2024

B

RK

Answered

In a city with a medium-sized population, the equilibrium price for a city bus ticket is $1.00, and the number of riders each day is 10,800. The short-run price elasticity of demand is -0.60, and the short-run elasticity of supply is 1.0.

a. Estimate the short run linear supply and demand curves for bus tickets.

b. If the demand for bus tickets increased by 10% because of a rise in the world price of oil, what would be the new equilibrium price of bus tickets?

c. If the city council refused to let the bus company raise the price of bus tickets after the demand for tickets increases (see (b) above), what daily shortage of tickets would be created?

d. Would the bus company have an incentive to increase the supply in the long run given the city council's decision in (c) above? Explain your answer.

a. Estimate the short run linear supply and demand curves for bus tickets.

b. If the demand for bus tickets increased by 10% because of a rise in the world price of oil, what would be the new equilibrium price of bus tickets?

c. If the city council refused to let the bus company raise the price of bus tickets after the demand for tickets increases (see (b) above), what daily shortage of tickets would be created?

d. Would the bus company have an incentive to increase the supply in the long run given the city council's decision in (c) above? Explain your answer.

On Jun 07, 2024

Given:

P* = $1.00 per ticket Q* = 10,800

Ed = -0.60 Es = 1.0

a.Demand: Qd = a0 + a1P Supply: Qs = b0 + b1P

Use: E = ×

×  to compute a1 and b1.

to compute a1 and b1.

Ed = a1 Es =

a1 Es =  b1

b1

-0.60 = a1 1.0 =

a1 1.0 =  b1

b1

a1 = -6,480 b1 = 10,800

10,800 = a0 - 6,480.00(1.0) 10,800 = b0 + 10,800.00(1.0)

10,800 = a0 - 6,480.00(1.0) 10,800 = b0 + 10,800.00(1.0)

a0 = 17,280 b0 = 0.0

Qd = 17,280 - 6,480P Qs = 0.0 + 10,800P

b.New demand = (1.10)Qd = (17,280 - 6,480P)(1.10)

Qd' = 19,008.00 - 7,128P

Equate Qd' to Qs to get new equilibrium price.19,008 - 7,128P = 0.0 + 10,800 P

P* = $1.06 per ticket

c.The shortage would be the quantity demanded at P = $1.00 minus the quantity supplied at P=$1.00.

Qd = 19,008 - 7,128($1.00) = 11,880

Qs = 0.0 + 10,800($1.00) = 10,800

Shortage = 11,800 - 10,800 = 1,080 rides per day

d.No. The bus company has no incentive to supply more than 10,800 rides per day, as long as the price is restricted at $1.00.

P* = $1.00 per ticket Q* = 10,800

Ed = -0.60 Es = 1.0

a.Demand: Qd = a0 + a1P Supply: Qs = b0 + b1P

Use: E =

×

×  to compute a1 and b1.

to compute a1 and b1.Ed =

a1 Es =

a1 Es =  b1

b1-0.60 =

a1 1.0 =

a1 1.0 =  b1

b1a1 = -6,480 b1 = 10,800

10,800 = a0 - 6,480.00(1.0) 10,800 = b0 + 10,800.00(1.0)

10,800 = a0 - 6,480.00(1.0) 10,800 = b0 + 10,800.00(1.0)a0 = 17,280 b0 = 0.0

Qd = 17,280 - 6,480P Qs = 0.0 + 10,800P

b.New demand = (1.10)Qd = (17,280 - 6,480P)(1.10)

Qd' = 19,008.00 - 7,128P

Equate Qd' to Qs to get new equilibrium price.19,008 - 7,128P = 0.0 + 10,800 P

P* = $1.06 per ticket

c.The shortage would be the quantity demanded at P = $1.00 minus the quantity supplied at P=$1.00.

Qd = 19,008 - 7,128($1.00) = 11,880

Qs = 0.0 + 10,800($1.00) = 10,800

Shortage = 11,800 - 10,800 = 1,080 rides per day

d.No. The bus company has no incentive to supply more than 10,800 rides per day, as long as the price is restricted at $1.00.

RK

Answered

All of the following are important behavioral foundations for gaining integrative agreements EXCEPT:

A) the ability to separate the people from the problem in order to prevent emotional considerations from affecting the negotiations.

B) the ability to focus on positions rather than interests.

C) the ability to avoid making premature judgments.

D) the ability to keep the acts of alternative creation separate from their evaluation.

E) the ability to judge possible agreements on an objective set of criteria or standards.

A) the ability to separate the people from the problem in order to prevent emotional considerations from affecting the negotiations.

B) the ability to focus on positions rather than interests.

C) the ability to avoid making premature judgments.

D) the ability to keep the acts of alternative creation separate from their evaluation.

E) the ability to judge possible agreements on an objective set of criteria or standards.

On Jun 04, 2024

B

RK

Answered

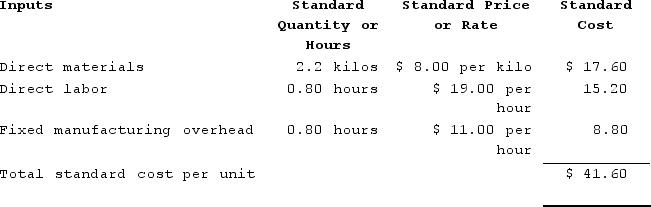

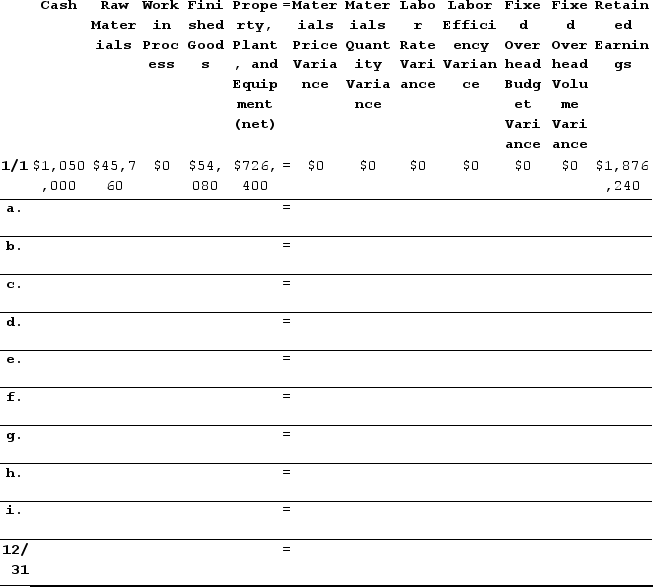

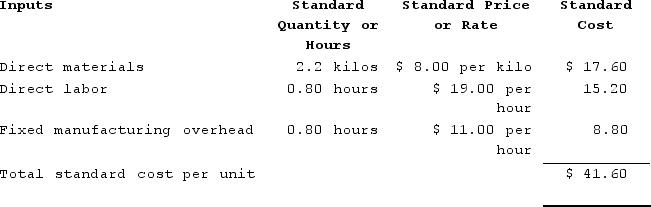

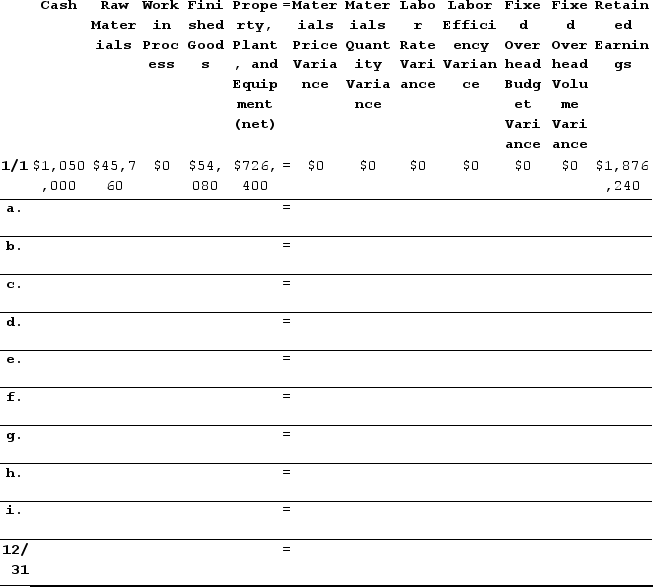

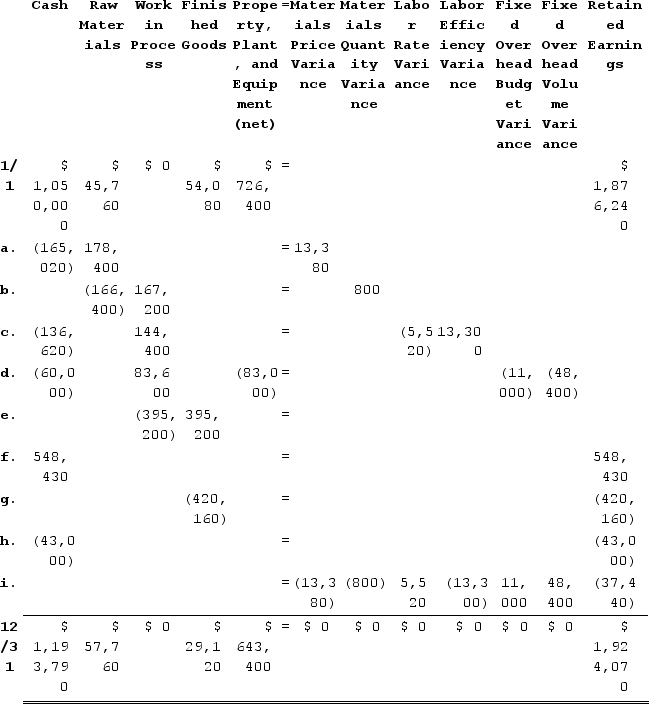

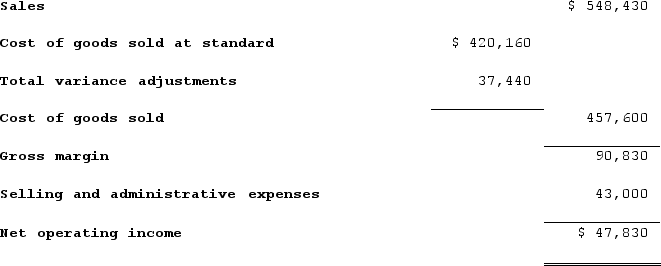

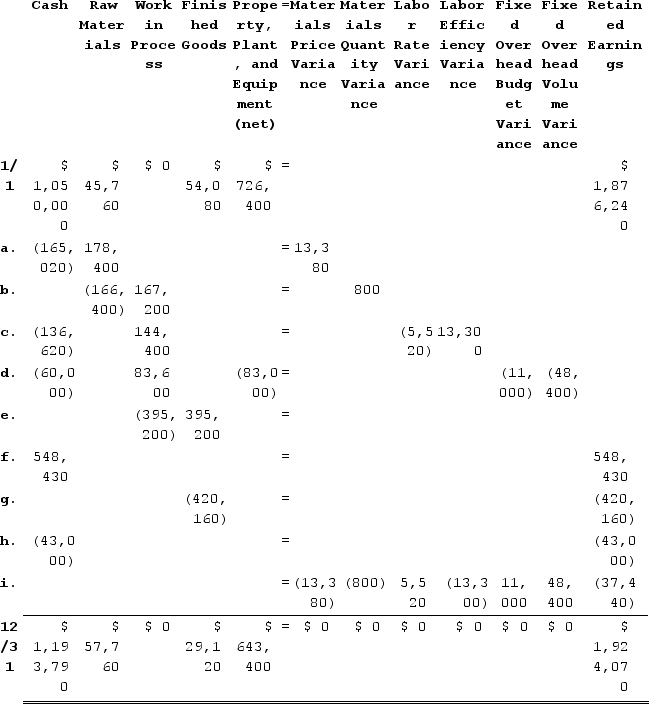

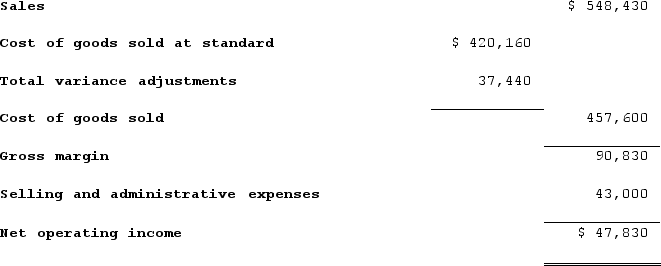

Pioli Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $132,000 and budgeted activity of 12,000 hours.During the year, the company completed the following transactions:Purchased 22,300 kilos of raw material at a price of $7.40 per kilo.Used 20,800 kilos of the raw material to produce 9,500 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 6,900 hours at an average cost of $19.80 per hour.Applied fixed overhead to the 9,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $143,000. Of this total, $60,000 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $83,000 related to depreciation of manufacturing equipment.Transferred 9,500 units from work in process to finished goods.Sold for cash 10,100 units to customers at a price of $54.30 per unit.Completed and transferred the standard cost associated with the 10,100 units sold from finished goods to cost of goods sold.Paid $43,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $132,000 and budgeted activity of 12,000 hours.During the year, the company completed the following transactions:Purchased 22,300 kilos of raw material at a price of $7.40 per kilo.Used 20,800 kilos of the raw material to produce 9,500 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 6,900 hours at an average cost of $19.80 per hour.Applied fixed overhead to the 9,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $143,000. Of this total, $60,000 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $83,000 related to depreciation of manufacturing equipment.Transferred 9,500 units from work in process to finished goods.Sold for cash 10,100 units to customers at a price of $54.30 per unit.Completed and transferred the standard cost associated with the 10,100 units sold from finished goods to cost of goods sold.Paid $43,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $132,000 and budgeted activity of 12,000 hours.During the year, the company completed the following transactions:Purchased 22,300 kilos of raw material at a price of $7.40 per kilo.Used 20,800 kilos of the raw material to produce 9,500 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 6,900 hours at an average cost of $19.80 per hour.Applied fixed overhead to the 9,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $143,000. Of this total, $60,000 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $83,000 related to depreciation of manufacturing equipment.Transferred 9,500 units from work in process to finished goods.Sold for cash 10,100 units to customers at a price of $54.30 per unit.Completed and transferred the standard cost associated with the 10,100 units sold from finished goods to cost of goods sold.Paid $43,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $132,000 and budgeted activity of 12,000 hours.During the year, the company completed the following transactions:Purchased 22,300 kilos of raw material at a price of $7.40 per kilo.Used 20,800 kilos of the raw material to produce 9,500 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 6,900 hours at an average cost of $19.80 per hour.Applied fixed overhead to the 9,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $143,000. Of this total, $60,000 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $83,000 related to depreciation of manufacturing equipment.Transferred 9,500 units from work in process to finished goods.Sold for cash 10,100 units to customers at a price of $54.30 per unit.Completed and transferred the standard cost associated with the 10,100 units sold from finished goods to cost of goods sold.Paid $43,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net). 3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.On May 08, 2024

1.Materials price variance = Actual quantity × (Actual price − Standard price)= 22,300 kilos × ($7.40 per kilo − $8.00 per kilo)= 22,300 kilos × (−$0.60 per kilo)= $13,380 FavorableMaterials quantity variance:SQ = Actual output × Standard quantity = 9,500 units × 2.2 kilos per unit = 20,900 kilosMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= (20,800 kilos − 20,900 kilos) × $8.00 per kilo= (−100 kilos) × $8.00 per kilo= $800 FavorableLabor rate variance = Actual hour × (Actual rate − Standard rate)= 6,900 hours × ($19.80 per hour − $19.00 per hour)= 6,900 hours × ($0.80 per hour)= $5,520 UnfavorableLabor efficiency variance:Standard hours = Actual output × Standard quantity = 9,500 units × 0.80 hours per unit = 7,600 hoursLabor efficiency variance = (Actual hours − Standard hours) × Standard rate= (6,900 hours − 7,600 hours) × $19.00 per hour= (−700 hours) × $19.00 per hour= $13,300 FavorableBudget variance = Actual fixed overhead − Budgeted fixed overhead= $143,000 − $132,000= $11,000 UnfavorableVolume variance = Budgeted fixed overhead − Fixed overhead applied to work in process= $132,000 − (7,600 hours × $11.00 per hour)= $132,000 − ($83,600)= $48,400 Unfavorable2. and 3.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 22,300 kilos × $7.40 per kilo = $165,020. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 22,300 kilos × $8.00 per kilo = $178,400. The materials price variance is $13,380 Favorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 20,800 kilos × $8.00 per kilo = $166,400. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (9,500 units × 2.2 kilos per unit) × $8.00 per kilo = 20,900 kilos × $8.00 per kilo = $167,200. The difference is the Materials Quantity Variance which is $800 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 6,900 hours × $19.80 per hour = $136,620. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (9,500 units × 0.80 hours per unit) × $19.00 per hour = 7,600 hours × $19.00 per hour = $144,400. The difference consists of the Labor Rate Variance which is $5,520 Unfavorable and the Labor Efficiency Variance which is $13,300 Favorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $60,000. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (9,500 units × 0.80 hours per unit) × $11.00 per hour = 7,600 hours × $11.00 per hour = $83,600. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $83,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $11,000 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $48,400 Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 9,500 units × $41.60 per unit = $395,200. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 10,100 units × $54.30 per unit = $548,430. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 10,100 units × $41.60 per unit = $420,160. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $43,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings). 4.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 22,300 kilos × $7.40 per kilo = $165,020. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 22,300 kilos × $8.00 per kilo = $178,400. The materials price variance is $13,380 Favorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 20,800 kilos × $8.00 per kilo = $166,400. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (9,500 units × 2.2 kilos per unit) × $8.00 per kilo = 20,900 kilos × $8.00 per kilo = $167,200. The difference is the Materials Quantity Variance which is $800 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 6,900 hours × $19.80 per hour = $136,620. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (9,500 units × 0.80 hours per unit) × $19.00 per hour = 7,600 hours × $19.00 per hour = $144,400. The difference consists of the Labor Rate Variance which is $5,520 Unfavorable and the Labor Efficiency Variance which is $13,300 Favorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $60,000. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (9,500 units × 0.80 hours per unit) × $11.00 per hour = 7,600 hours × $11.00 per hour = $83,600. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $83,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $11,000 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $48,400 Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 9,500 units × $41.60 per unit = $395,200. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 10,100 units × $54.30 per unit = $548,430. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 10,100 units × $41.60 per unit = $420,160. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $43,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings). 4.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 22,300 kilos × $7.40 per kilo = $165,020. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 22,300 kilos × $8.00 per kilo = $178,400. The materials price variance is $13,380 Favorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 20,800 kilos × $8.00 per kilo = $166,400. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (9,500 units × 2.2 kilos per unit) × $8.00 per kilo = 20,900 kilos × $8.00 per kilo = $167,200. The difference is the Materials Quantity Variance which is $800 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 6,900 hours × $19.80 per hour = $136,620. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (9,500 units × 0.80 hours per unit) × $19.00 per hour = 7,600 hours × $19.00 per hour = $144,400. The difference consists of the Labor Rate Variance which is $5,520 Unfavorable and the Labor Efficiency Variance which is $13,300 Favorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $60,000. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (9,500 units × 0.80 hours per unit) × $11.00 per hour = 7,600 hours × $11.00 per hour = $83,600. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $83,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $11,000 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $48,400 Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 9,500 units × $41.60 per unit = $395,200. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 10,100 units × $54.30 per unit = $548,430. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 10,100 units × $41.60 per unit = $420,160. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $43,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings). 4.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 22,300 kilos × $7.40 per kilo = $165,020. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 22,300 kilos × $8.00 per kilo = $178,400. The materials price variance is $13,380 Favorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 20,800 kilos × $8.00 per kilo = $166,400. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (9,500 units × 2.2 kilos per unit) × $8.00 per kilo = 20,900 kilos × $8.00 per kilo = $167,200. The difference is the Materials Quantity Variance which is $800 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 6,900 hours × $19.80 per hour = $136,620. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (9,500 units × 0.80 hours per unit) × $19.00 per hour = 7,600 hours × $19.00 per hour = $144,400. The difference consists of the Labor Rate Variance which is $5,520 Unfavorable and the Labor Efficiency Variance which is $13,300 Favorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $60,000. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (9,500 units × 0.80 hours per unit) × $11.00 per hour = 7,600 hours × $11.00 per hour = $83,600. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $83,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $11,000 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $48,400 Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 9,500 units × $41.60 per unit = $395,200. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 10,100 units × $54.30 per unit = $548,430. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 10,100 units × $41.60 per unit = $420,160. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $43,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings). 4.

RK

Answered

Explain the difference between joint venture and direct investment market entry strategies. What are the advantages and disadvantages of each approach?

On May 05, 2024

When a foreign company and a local firm invest together to create a local business, it is called a joint venture. These two companies share ownership, control, and profits of the new company. The advantages are twofold: First, one company may not have the necessary financial, physical, or managerial resources to enter a foreign market alone. Second, a government may require or strongly encourage a joint venture before it allows a foreign company to enter its market. The disadvantages arise when companies disagree about policies or courses of action or when governmental bureaucracy bogs down the effort. Direct investment entails a domestic firm actually investing in and owning a foreign subsidiary or division. Advantages include cost savings, better understanding of local market conditions, and fewer local restrictions. Disadvantages include increased financial commitments and risks.