SB

Sarah Belway

Answers (4)

SB

Answered

Judicial decisions are law even if the legislative branch should revoke them later by enacting new statutory law.

On Jun 05, 2024

False

SB

Answered

Shondra wants to develop a meal delivery service business and is working through the STP process. After establishing her objectives, describing potential market segments, and evaluating the attractiveness of each segment, Shondra now has to

A) differentiate his product line.

B) consider future customer loyalty.

C) create a perceptual map.

D) select a target market.

E) divide geographic segments into lifestyle groups.

A) differentiate his product line.

B) consider future customer loyalty.

C) create a perceptual map.

D) select a target market.

E) divide geographic segments into lifestyle groups.

On Jun 05, 2024

D

SB

Answered

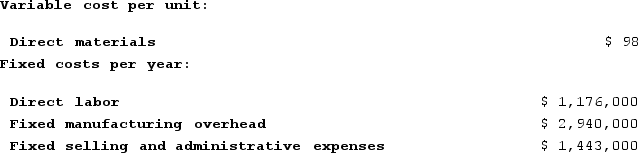

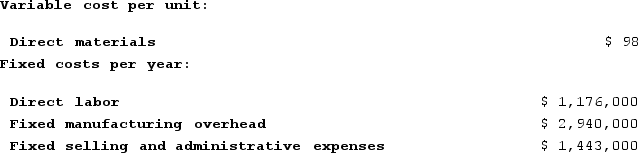

Shelko Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 37,000 units. The company's only product is sold for $272 per unit.Required:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 37,000 units. The company's only product is sold for $272 per unit.Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.b. Assume that the company uses an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.c. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 37,000 units. The company's only product is sold for $272 per unit.Required:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 37,000 units. The company's only product is sold for $272 per unit.Required:a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.b. Assume that the company uses an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.c. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

On May 08, 2024

a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement:

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_8699_bf83_f9763a0e3e94_TB8314_00.jpg) b.Absorption costing unit product cost:

b.Absorption costing unit product cost:

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_869a_bf83_5b0d8b07f83f_TB8314_00.jpg) Absorption costing income statement:

Absorption costing income statement:

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_869b_bf83_d1aae94ecbe8_TB8314_00.jpg) c.Reconciliation of super-variable costing and absorption costing net incomes:

c.Reconciliation of super-variable costing and absorption costing net incomes:

Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_adac_bf83_eb6419928f9a_TB8314_00.jpg)

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_8699_bf83_f9763a0e3e94_TB8314_00.jpg) b.Absorption costing unit product cost:

b.Absorption costing unit product cost:![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_869a_bf83_5b0d8b07f83f_TB8314_00.jpg) Absorption costing income statement:

Absorption costing income statement:![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_869b_bf83_d1aae94ecbe8_TB8314_00.jpg) c.Reconciliation of super-variable costing and absorption costing net incomes:

c.Reconciliation of super-variable costing and absorption costing net incomes:Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_adac_bf83_eb6419928f9a_TB8314_00.jpg)

SB

Answered

Raclette is a popular wintertime dish in Switzerland.It is essentially melted Raclette cheese over boiled new potatoes.If the price of Raclette cheese decreased,we would expect to see:

A) an increase in demand for Raclette cheese.

B) an increase in demand for new potatoes.

C) no effect on the demand for either of the Raclette ingredients since this is a traditional dish and its consumption does not depend on the prices of the ingredients.

D) an increase in demand for both Raclette cheese and new potatoes.

A) an increase in demand for Raclette cheese.

B) an increase in demand for new potatoes.

C) no effect on the demand for either of the Raclette ingredients since this is a traditional dish and its consumption does not depend on the prices of the ingredients.

D) an increase in demand for both Raclette cheese and new potatoes.

On May 06, 2024

B