SL

Sidney Lancaster

Answers (6)

SL

Answered

In an effort to simplify the multiple production department factory overhead rate method, the same rate can be used for all departments.

On Jul 19, 2024

False

SL

Answered

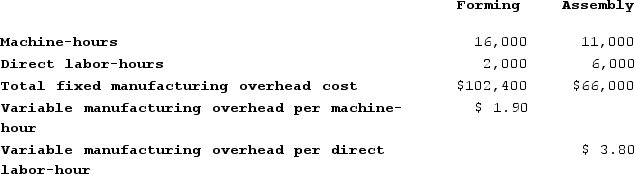

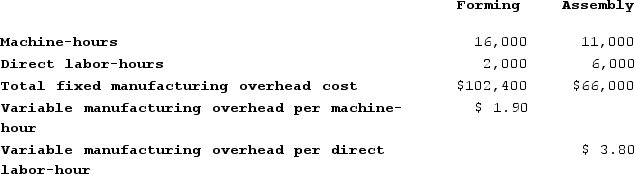

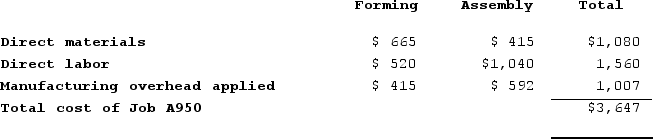

Amason Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

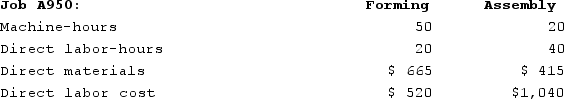

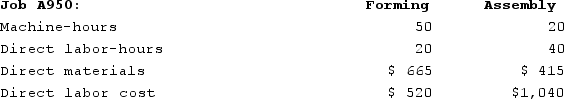

During the current month the company started and finished Job A950. The following data were recorded for this job:

During the current month the company started and finished Job A950. The following data were recorded for this job:

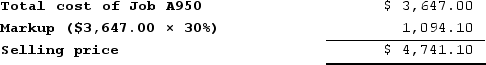

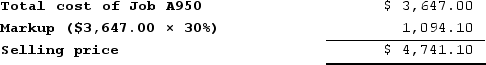

Required:Calculate the selling price for Job A950 if the company marks up its unit product costs by 30% to determine selling prices.

Required:Calculate the selling price for Job A950 if the company marks up its unit product costs by 30% to determine selling prices.

During the current month the company started and finished Job A950. The following data were recorded for this job:

During the current month the company started and finished Job A950. The following data were recorded for this job: Required:Calculate the selling price for Job A950 if the company marks up its unit product costs by 30% to determine selling prices.

Required:Calculate the selling price for Job A950 if the company marks up its unit product costs by 30% to determine selling prices.On Jul 16, 2024

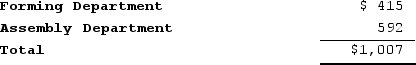

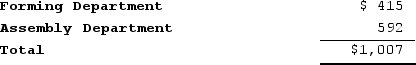

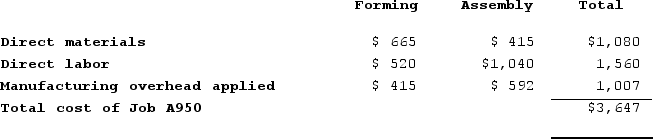

Forming Department:Forming Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per machine-hour × Total machine-hours in the department)= $102,400 + ($1.90 per machine-hour × 16,000 machine-hours)= $102,400 +$30,400 = $132,800Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $132,800 ÷ 16,000 machine-hours = $8.30 per machine-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $8.30 per machine-hour × 50 machine-hours = $415Assembly Department:Assembly Department overhead cost = Fixed manufacturing overhead cost + (Variable overhead cost per direct labor-hour × Total direct labor-hours in the department)= $66,000 + ($3.80 per direct labor-hour × 6,000 direct labor-hours)= $66,000 + $22,800 = $88,800Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the = $88,800 ÷6,000 direct labor-hours = $14.80 per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $14.80 per direct labor-hour × 40 direct labor-hours = $592

Overhead applied to Job A950

Overhead applied to Job A950

SL

Answered

An organization that creates many products with similar characteristics,using assembly lines would most likely be categorized as a(n) :

A) continuous manufacturing organization.

B) intermittent organization.

C) project organization.

D) contract manufacturing organization.

E) fixed-position organization.

A) continuous manufacturing organization.

B) intermittent organization.

C) project organization.

D) contract manufacturing organization.

E) fixed-position organization.

On Jun 19, 2024

A

SL

Answered

Which of the following is true regarding debits and credits?

A) Whether a debit or credit increases or decreases an account depends on the type of account.

B) Debits increase an account and credits decrease an account.

C) Credits increase an account and debits decrease an account.

D) There are some circumstances that allow for debits and credits to not equal.

A) Whether a debit or credit increases or decreases an account depends on the type of account.

B) Debits increase an account and credits decrease an account.

C) Credits increase an account and debits decrease an account.

D) There are some circumstances that allow for debits and credits to not equal.

On Jun 15, 2024

A

SL

Answered

List the requirements for agency by ratification, and then list the requirements that must be met for ratification to be effective.

On May 20, 2024

The requirements for agency by ratification are as follows:

1. An individual must misrepresent himself or herself as an agent for another party.

2. The principal accepts or ratifies the unauthorized act.

For ratification to be effective, the following requirements must be met:

1. The principal must have complete knowledge of all material facts regarding the contract.

2. The principal must ratify the entirety of the agent's act. The principal cannot accept certain parts of the agent's act and reject others.

1. An individual must misrepresent himself or herself as an agent for another party.

2. The principal accepts or ratifies the unauthorized act.

For ratification to be effective, the following requirements must be met:

1. The principal must have complete knowledge of all material facts regarding the contract.

2. The principal must ratify the entirety of the agent's act. The principal cannot accept certain parts of the agent's act and reject others.

SL

Answered

If the stock market is semistrong efficient,which of the following statements is correct?

A) All stocks should have the same expected returns; however, they may have different realized returns.

B) Investors can outperform the market if they have access to information that has not yet been publicly revealed.

C) In equilibrium, stocks and bonds should have the same expected returns.

D) All stocks should have the same expected return.

A) All stocks should have the same expected returns; however, they may have different realized returns.

B) Investors can outperform the market if they have access to information that has not yet been publicly revealed.

C) In equilibrium, stocks and bonds should have the same expected returns.

D) All stocks should have the same expected return.

On May 16, 2024

B