TB

Taylor Bandy

Answers (6)

TB

Answered

Nina's employer offers a pension plan that is the product of the career average of her salaries while working there,the number of years of service,and a 1.75% multiplier.She calculates the average of her 17 years of salaries to be $54,000.What is her monthly pension?

On Jul 23, 2024

$1,338.75;54,000 × 17 × 0.0175 = 16,065;16,065 ÷ 12 = 1,338.75

TB

Answered

In the following,what is the meaning of t: t(58) = 5.015,p < 0.01?

A) test statistic

B) t value

C) degrees of freedom

D) significance level

A) test statistic

B) t value

C) degrees of freedom

D) significance level

On Jul 20, 2024

A

TB

Answered

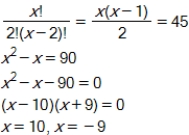

A market research firm was looking to form 45 different pairs of students from a group of students selected randomly.How many students were in that group?

On Jun 23, 2024

10;It is impossible to have a group of -9 students.

TB

Answered

A computer network manager wants to test the reliability of some new and very expensive fiber-optic Ethernet cables that the computer department just received.The computer department received 7 boxes containing 50 cables each.The manager does not have the time to test every cable in each box,so the manager assigns a subordinate to do a census.How many cables will be sampled if the subordinate does a census?

A) 50 cables

B) 350 cables

C) 10 cables

D) 7 cables

E) It will depend on the sampling of cables and the sampling of boxes (the sampling frame) .

A) 50 cables

B) 350 cables

C) 10 cables

D) 7 cables

E) It will depend on the sampling of cables and the sampling of boxes (the sampling frame) .

On Jun 20, 2024

B

TB

Answered

Nancy works at a health club.She notices that the clients who run on the track for a longer period of time go a longer distance.If this is a causal relationship,explain the explanatory and response variables.

On May 22, 2024

The explanatory variable is the time on the track,and the response variable is the distance traveled.

TB

Answered

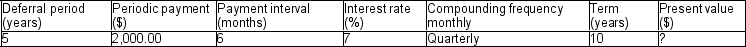

Determine the unknown value for the following deferred annuity. The annuity is understood to be an ordinary annuity after the period of deferral.

On May 21, 2024

$20,035.79