TN

Tayyaba Naqvi

Answers (7)

TN

Answered

Which of the following is true about fully justified texts?

A) Lines end in different places because words are of different lengths.

B) They have ragged right margins.

C) They are usually used for books.

D) They are common in current business usage.

A) Lines end in different places because words are of different lengths.

B) They have ragged right margins.

C) They are usually used for books.

D) They are common in current business usage.

On Jul 25, 2024

C

TN

Answered

There are three major types of business activities.________ activities are the means organizations use to pay for resources such as land,building,and equipment to carry out plans.

On Jun 28, 2024

Financing

TN

Answered

After many years,a small community builds a toll road but discovers that it is not used very much.If it wishes for the road to be used at the socially optimal level,the community should:

A) set the toll higher.

B) set the toll equal to $1.

C) set the toll lower.

D) build another toll road.

A) set the toll higher.

B) set the toll equal to $1.

C) set the toll lower.

D) build another toll road.

On Jun 25, 2024

C

TN

Answered

When you apply for a position but are rejected, employment experts recommend that you

A) send a rejection letter saying you believe the employer has made a hiring decision error in not choosing you.

B) phone the employer's personnel office to determine the reason why you were not selected.

C) send a rejection follow-up message indicating you are disappointed but will contact the company again in a month in case a job opens up.

D) do not apply at that company again for at least 12 months.

A) send a rejection letter saying you believe the employer has made a hiring decision error in not choosing you.

B) phone the employer's personnel office to determine the reason why you were not selected.

C) send a rejection follow-up message indicating you are disappointed but will contact the company again in a month in case a job opens up.

D) do not apply at that company again for at least 12 months.

On May 29, 2024

C

TN

Answered

In 2002, the United States placed higher tariffs on imports of steel. According to the open-economy macroeconomic model this policy reduced imports

A) into the United States and made U.S.net exports rise.

B) into the United States and made the net supply of dollars in the foreign exchange market shift right.

C) of steel into the United States, but reduced U.S.exports of other goods by an equal amount.

D) of steel into the United States and increased U.S.exports of other goods by an equal amount.

A) into the United States and made U.S.net exports rise.

B) into the United States and made the net supply of dollars in the foreign exchange market shift right.

C) of steel into the United States, but reduced U.S.exports of other goods by an equal amount.

D) of steel into the United States and increased U.S.exports of other goods by an equal amount.

On May 26, 2024

C

TN

Answered

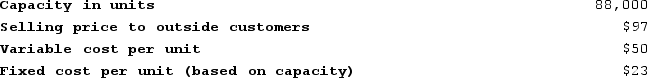

Vandermeer Products, Incorporated, has a Antennae Division that manufactures and sells a number of products, including a standard antennae. Data concerning that antennae appear below:

The company has a Aircraft Products Division that could use this antennae in one of its products. The Aircraft Products Division is currently purchasing 11,000 of these antennaes per year from an overseas supplier at a cost of $88 per antennae.

The company has a Aircraft Products Division that could use this antennae in one of its products. The Aircraft Products Division is currently purchasing 11,000 of these antennaes per year from an overseas supplier at a cost of $88 per antennae.

Required:

a. Assume that the Antennae Division is selling all of the antennaes it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?b. Assume again that the Antennae Division is selling all of the antennaes it can produce to outside customers. Also assume that $1 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What is the acceptable range, if any, for the transfer price between the two divisions?

The company has a Aircraft Products Division that could use this antennae in one of its products. The Aircraft Products Division is currently purchasing 11,000 of these antennaes per year from an overseas supplier at a cost of $88 per antennae.

The company has a Aircraft Products Division that could use this antennae in one of its products. The Aircraft Products Division is currently purchasing 11,000 of these antennaes per year from an overseas supplier at a cost of $88 per antennae.Required:

a. Assume that the Antennae Division is selling all of the antennaes it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?b. Assume again that the Antennae Division is selling all of the antennaes it can produce to outside customers. Also assume that $1 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What is the acceptable range, if any, for the transfer price between the two divisions?

On Apr 29, 2024

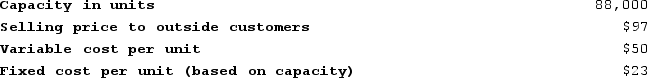

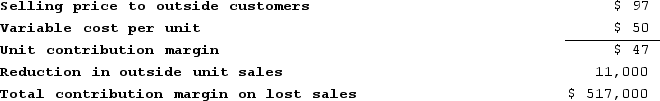

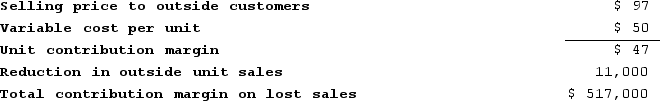

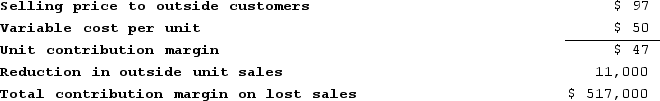

a. The total contribution margin on lost sales is computed as follows:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

Transfer price > Variable cost per unit + (Total contribution margin on lost sales ÷ Number of units transferred)

Transfer price > $50 per unit + ($517,000 ÷ 11,000 units) = $50 per unit + $47 per unit = $97 per unit

From the perspective of the purchasing division, the transfer is financially attractive if and only if:

Transfer price < Cost of buying from outside supplier

Transfer price < $88 per unit

No transfer will be made between the two divisions because the minimum price that the selling division is willing to accept is greater than the maximum price that the buying division is willing to pay.

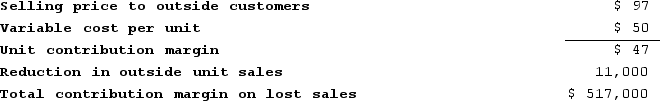

b. The total contribution margin on lost sales is computed as follows:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

Transfer price > Variable cost per unit + (Total contribution margin on lost sales ÷ Number of units transferred)

Transfer price > $49 per unit + ($517,000 ÷ 11,000 units) = $49 per unit + $47 per unit = $96 per unit

From the perspective of the purchasing division, the transfer is financially attractive if and only if:

Transfer price < Cost of buying from outside supplier

Transfer price < $88 per unit

No transfer will be made between the two divisions because the minimum price that the selling division is willing to accept is greater than the maximum price that the buying division is willing to pay.

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

Transfer price > Variable cost per unit + (Total contribution margin on lost sales ÷ Number of units transferred)

Transfer price > $50 per unit + ($517,000 ÷ 11,000 units) = $50 per unit + $47 per unit = $97 per unit

From the perspective of the purchasing division, the transfer is financially attractive if and only if:

Transfer price < Cost of buying from outside supplier

Transfer price < $88 per unit

No transfer will be made between the two divisions because the minimum price that the selling division is willing to accept is greater than the maximum price that the buying division is willing to pay.

b. The total contribution margin on lost sales is computed as follows:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:Transfer price > Variable cost per unit + (Total contribution margin on lost sales ÷ Number of units transferred)

Transfer price > $49 per unit + ($517,000 ÷ 11,000 units) = $49 per unit + $47 per unit = $96 per unit

From the perspective of the purchasing division, the transfer is financially attractive if and only if:

Transfer price < Cost of buying from outside supplier

Transfer price < $88 per unit

No transfer will be made between the two divisions because the minimum price that the selling division is willing to accept is greater than the maximum price that the buying division is willing to pay.

TN

Answered

Regardless of market conditions, most new products introduced in the marketplace are successful.

On Apr 26, 2024

False